GBP/USD: BRITISH LENDING CONTINUES TO DECLINE

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | SELL STOP |

| Entry Point | 1.2565 |

| Take Profit | 1.2310 |

| Stop Loss | 1.2620 |

| Key Levels | 1.2310, 1.2570, 1.2820, 1.3130 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY STOP |

| Entry Point | 1.2825 |

| Take Profit | 1.3130 |

| Stop Loss | 1.2750 |

| Key Levels | 1.2310, 1.2570, 1.2820, 1.3130 |

Current trend

Against the growth of the US dollar, the GBP/USD pair is correcting at 1.2663.

The negative dynamics are developing against poor macroeconomic statistics: thus, the volume of consumer lending of the Bank of England decreased from 1.637B pounds to 1.191B pounds compared to forecasts of 1.300B pounds, and the number of approved mortgage loans decreased from 54.61K to 49.44K as a result of the ongoing increase in the interest rate of the regulator, which now stands at 5.25% and may increase again in September.

The US dollar is trading at 103.500 in the USD Index. Investors assessed the data on the labor market neutrally: initial jobless claims decreased from 232.0K last week to 228.0K, which led to an increase in the total number of citizens receiving assistance from the state, from 1.697M to 1.725M. The average number of applications over the past four weeks has not changed much and amounted to 237.50K compared to 237.25K earlier. Also, the benchmark price index for personal consumption expenditure increased by 0.2% in July, correcting from 4.1% to 4.2% YoY.

Support and resistance

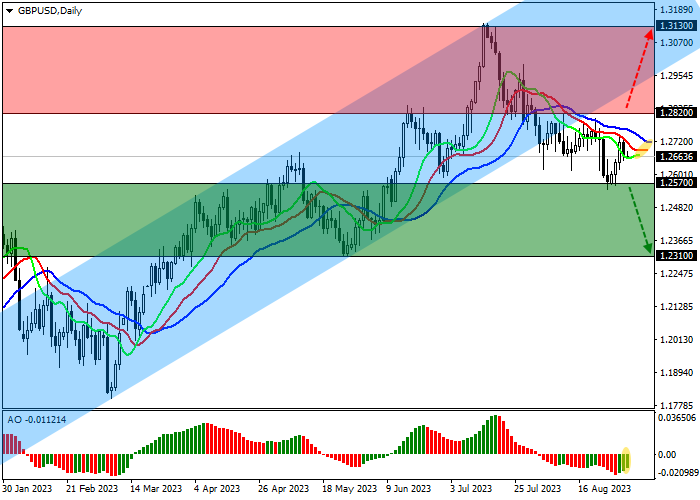

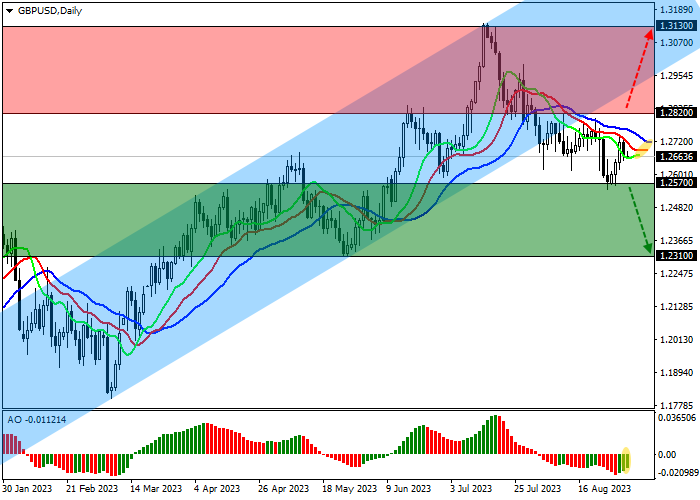

On the daily chart, the trading instrument is developing a downward trend and is below the support line of the global ascending channel, preparing for a new low at 1.2570.

Technical indicators hold a sell signal: fast EMAs on the Alligator indicator widen the oscillation range, and the AO histogram forms down bars, falling in the sell zone.

Resistance levels: 1.2820, 1.3130.

Support levels: 1.2570, 1.2310.

Trading tips

Short positions may be opened after a reversal, reduction, and consolidation of the price below 1.2570 with the target at 1.2310. Stop loss – 1.2620. Implementation period: 7 days or more.

Long positions may be opened after the price rises and consolidates above 1.2820 with the target at 1.3130. Stop loss – 1.2750.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.