NQ 100: STOCK MARKET CORRECTION CONTINUES

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | BUY STOP |

| Entry Point | 15700.5 |

| Take Profit | 16300.0 |

| Stop Loss | 15400.0 |

| Key Levels | 14700.0, 15300.0, 15700.0, 16300.0 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 15299.5 |

| Take Profit | 14700.0 |

| Stop Loss | 15600.0 |

| Key Levels | 14700.0, 15300.0, 15700.0, 16300.0 |

Current trend

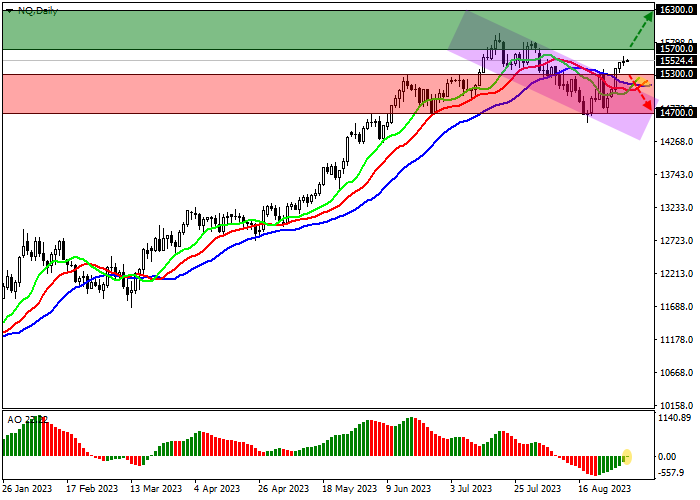

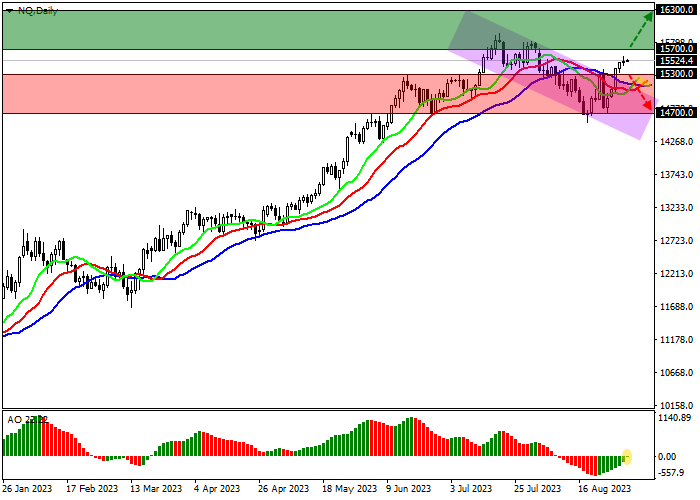

One of the leading US indices, the NQ 100, demonstrates corrective dynamics at the level of 15524.0 against the background of the expected preservation of the US Fed interest rate and a decline in the bond market.

NQ 100 quotes are gradually rising against the background of the expected preservation of the cost of borrowing at the level of 5.25%-5.50% at the September meeting of the US Fed. According to the Chicago Mercantile Exchange (CME) FedWatch Tool, the probability of maintaining the value at the same level is 89.0%, and its increase is only 11.0%. American technology companies are now at the start of the development of artificial intelligence technologies, and the availability of loans is very important, therefore, every change in the cost of borrowing will be reflected in the index quotes.

Additional support for the NQ 100 is provided by a correction in the US bond market: 10-year securities are traded at a rate of 4.110%, which is inferior to 4.310% shown in the middle of the month, the rate on 20-year bonds is 4.413%, which is lower than 4.413% recorded on August 21, and on 30-year ones – 4.222%, which also turned out to be below the peak values at 4,452% in the middle of the month.

The growth leaders in the index are Crowdstrike Holdings Inc. ( 9.28%), Zscaler Inc. ( 5.95%), Zoom Video Communications Inc. ( 3.44%), Broadcom Inc. ( 3.43%).

Among the leaders of the decline are Sirius XM Holding Inc. (-3.93%), Moderna Inc. (-3.04%), DexCom Inc. (-2.36%), JD.com Inc. ADR (-2.24%).

Support and resistance

On the daily chart, the index quotes are trading above the resistance line of the local descending channel, having broken it at 15300.0.

The technical indicators reversed again and issued a new buy signal: the fast EMAs on the alligator indicator crossed the signal line from the bottom up, and the AO histogram forms new ascending bars, rising in the buy zone.

Support levels: 15300.0, 14700.0.

Resistance levels: 15700.0, 16300.0.

Trading tips

If the asset continues local growth and consolidates above 15700.0, long positions with a target at 16300.0 will be relevant. Stop-loss – 15400.0. Implementation time: 7 days and more.

If the asset continues correctional decline and the price consolidates below the support level of 15300.0, short positions can be opened with a target at 14700.0. Stop-loss – 15600.0.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.