CISCO SYSTEMS INC.: ANALYSTS DON'T SEE BIG PROSPECTS FOR STOCK GROWTH

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | BUY STOP |

| Entry Point | 56.25 |

| Take Profit | 58.50 |

| Stop Loss | 55.50 |

| Key Levels | 51.70, 54.30, 56.20, 58.50 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 54.25 |

| Take Profit | 51.70 |

| Stop Loss | 56.00 |

| Key Levels | 51.70, 54.30, 56.20, 58.50 |

Current trend

The stocks of the largest manufacturer and supplier of network equipment for large holdings and telecommunications companies Cisco Systems Inc. are correcting at 55.00.

After the publication of the report for Q4 and the whole year, it became known that analysts at Bank of America Corp. left the forecast for the issuer's shares at the "neutral" level with a target price of 56.0 dollars per share. Experts note that the company's calculation for the growth of orders in 2024 due to the demand for artificial intelligence technologies may not be justified. The same opinion is shared by representatives of financial holding KeyBanc Capital Markets Inc., who maintained their assessment at the level of "neutral". Analysts see prospects for revenue growth for Cisco Systems Inc., but given the average figures for the last three years, they do not dare to change the rating to "buy".

As for the financial report itself, EPS earnings per share amounted to 1.14 dollars, which is higher than the initial estimates of 1.06 dollars, and revenue – to 15.2B dollars, which also exceeds the estimated 15.05B dollars. Next year, Cisco Systems Inc. expects Q1 earnings per share of 1.02–1.04 dollars, and revenue in the range of 14.5–14.7B dollars, which confirms the restrained forecasts of analysts.

Support and resistance

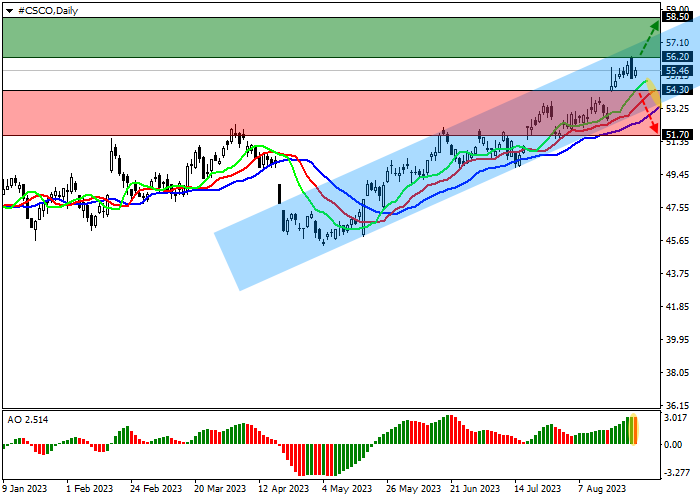

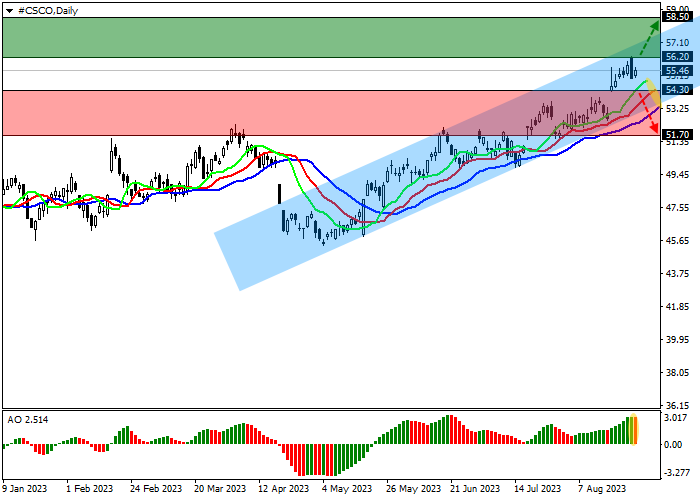

On the daily chart, the price continues to trade in a corrective trend, being near the resistance line of the ascending channel with the boundaries of 53.00–57.00.

Technical indicators, after a short slowdown, began to strengthen the global buy signal again: the range of EMA fluctuations of the alligator indicator continues to actively expand, and the AO histogram forms correction bars, while being above the transition level.

Support levels: 54.30, 51.70

Resistance levels: 56.20, 58.50.

Trading tips

If the asset continues growing and the price consolidates above the local resistance level of 56.20, long positions will be relevant with a target at 58.50. Stop-loss – 55.50. Implementation time: 7 days and more.

If the asset continues to decline and the price consolidates below the local support level at 54.30, short positions can be opened with a target at 51.70. Stop-loss – 56.00.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.