EUR/USD: BUSINESS ACTIVITY IN EU ECONOMIC SECTORS IS DECLINING

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | SELL STOP |

| Entry Point | 1.0790 |

| Take Profit | 1.0630 |

| Stop Loss | 1.0900 |

| Key Levels | 1.0630, 1.0790, 1.0930, 1.1090 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY STOP |

| Entry Point | 1.0930 |

| Take Profit | 1.1090 |

| Stop Loss | 1.0850 |

| Key Levels | 1.0630, 1.0790, 1.0930, 1.1090 |

Current trend

After yesterday’s decline and renewing the lows of June 15, the EUR/USD pair is correcting at 1.0855.

The dynamics of the asset are developing against negative forecasts regarding the statistics on the August business activity of the leading EU countries, which will be published today. Thus, the German manufacturing PMI may reach 38.7 points, lower than 38.8 points earlier, the French manufacturing PMI – 45.0 points relative to 45.1 points, and the EU manufacturing PMI may drop from 42.7 points to 42.6 points. The German service PMI is expected to decrease from 52.3 points to 51.5 points, and the French service PMI may increase to 47.5 points from 47.1 points, changing the EU service PMI from 50.9 points to 50.5 points and putting additional pressure on the euro.

The US dollar is trading at 103.300 in the USD Index. Yesterday’s report on the real estate sector disappointed investors, but did not change the trend: July existing home sales fell to 4.07M from 4.16M, below the forecasted 4.15M, which was –2.2% compared to the previous month, continuing the negative trend since the beginning of the year.

Support and resistance

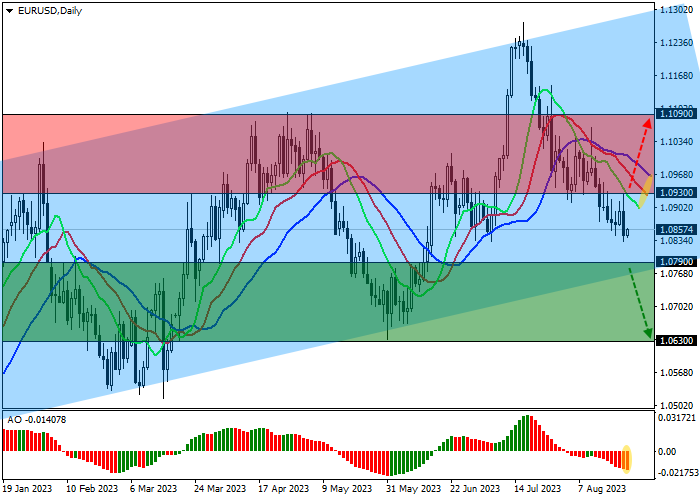

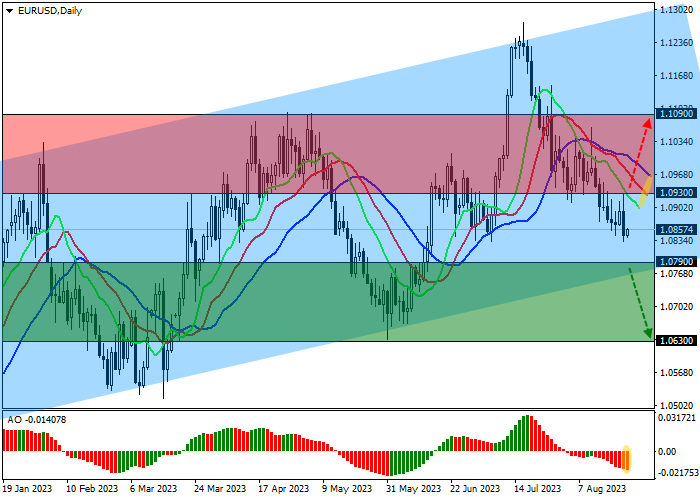

On the daily chart, the trading instrument continues its downward correction, approaching the lower border of the global ascending corridor with dynamic boundaries 1.1320–1.0760.

Technical indicators keep a sell signal: fast EMAs on the Alligator indicator are below the signal line, and the AO histogram forms downward bars, falling in the sell zone.

Resistance levels: 1.0930, 1.1090.

Support levels: 1.0790, 1.0630.

Trading tips

Short positions may be opened after the price drops and consolidates below 1.0790 with the target at 1.0630. Stop loss – 1.0900. Implementation period: 7 days or more.

Long positions may be opened after the price rises and consolidates above 1.0930 with the target at 1.1090. Stop loss – 1.0850.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.