Gold bulls will need to stay patient for a little while longer - 22/08/2023

Fundamentals, positioning, sentiment, and technical analysis all point to a further delay in gold’s big move upward, according to Chris Yates of Acheron Insights.

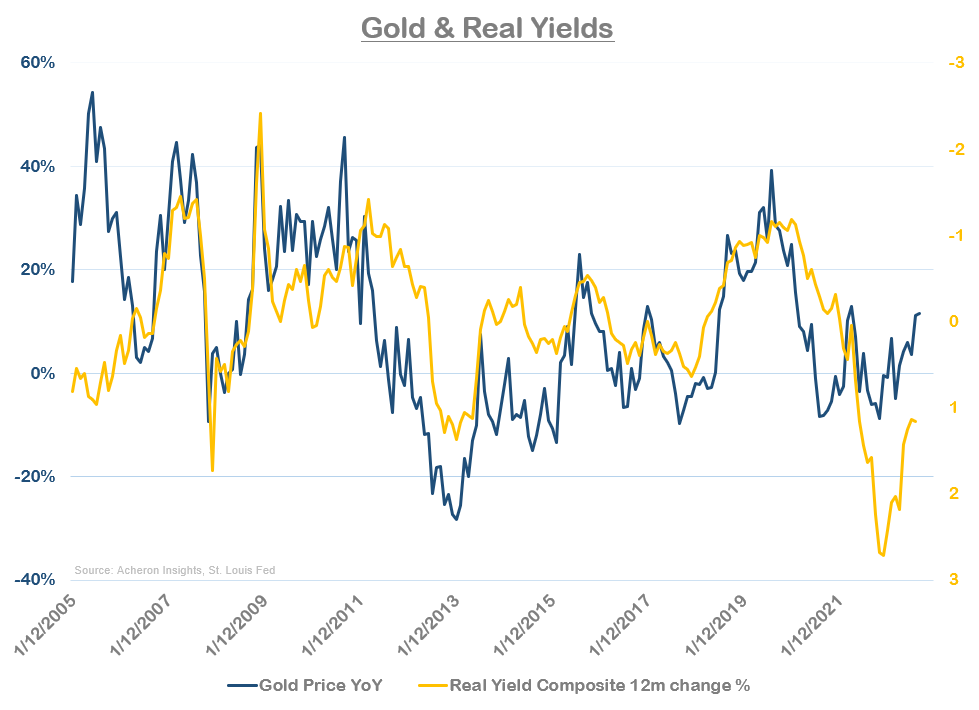

“For the short to medium-term fundamentals that influence the gold price - primarily the likes of real yields and the dollar - the outlook is still somewhat mixed for gold, after what has been a terrific year for the sector,” Yates wrote. “While it seems increasingly likely real yields are nearing their peak for this cycle, and although they are not likely to return to negative territory in the immediate future (that is more likely a story for 2024), the headwind from real yields that has kept a lid on the gold price for the last two-plus years is reaching its crescendo.”

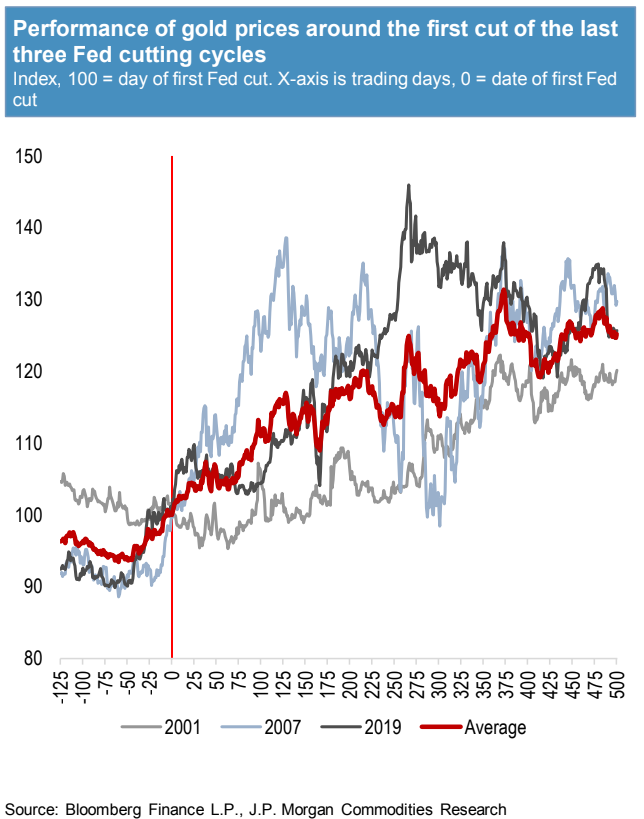

Yates said the fact that gold held up well despite “the biggest spike in real yields in decades” reaffirms his bullish long-term case. He said a rate cut before 2024 was “highly unlikely”, but pointed to gold’s historical positive performance once rate cuts begin.

He said the inverted yield curve is also supportive of “a significant move higher in precious metals” are slowly coming together, but the ideal conditions are not yet in place.

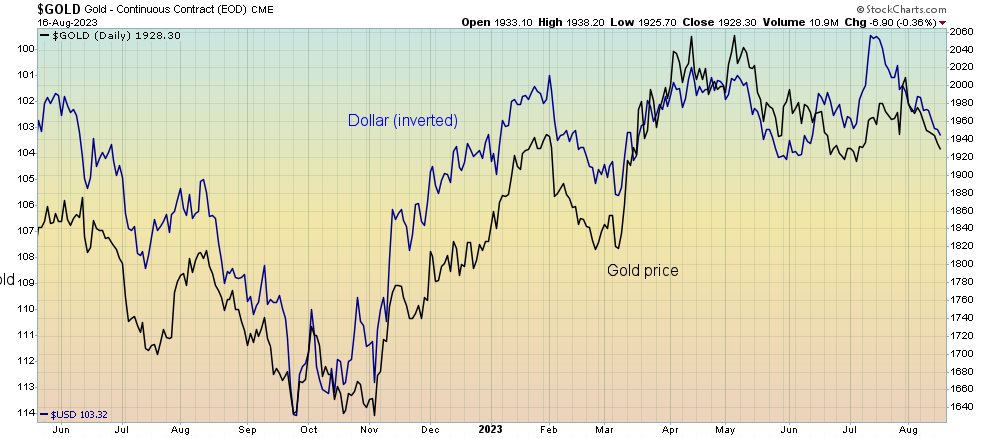

Yates said the U.S. dollar’s performance is one factor that makes him cautious about gold’s near-term upside. “I remain neutral to bullish the dollar over the next few quarters, and generally bearish on a cyclical perspective,” he said. “And, while they don’t always trade inversely, a spike in the dollar is most probably going to put pressure on the precious metals market. I think this remains a material risk for the time being.”

“As it stands, another move higher in the dollar could see the gold price continue this period of consolidation and/or correction for a little while longer,” he said. “But, when the dollar does roll over, I expect this bull market in precious metals to continue in earnest. A little more patience is required for gold bulls for the time being.”

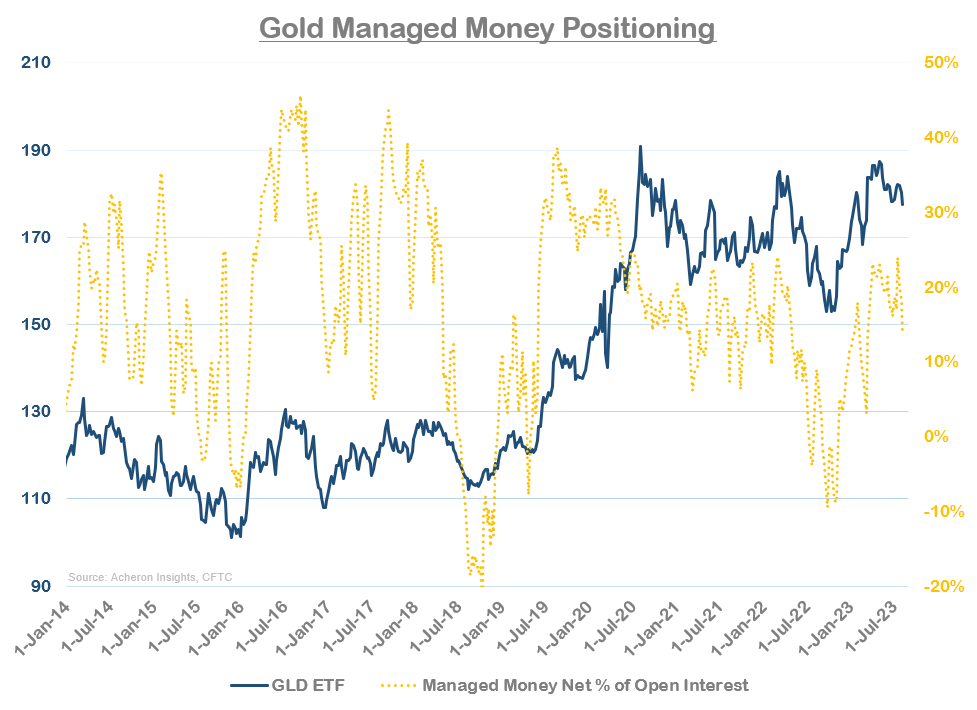

In terms of sentiment and positioning, Yates said that signals remain somewhat mixed. “Managed money positioning in gold futures currently lies in the middle of its recent historical range, suggesting speculative positioning is neither overly bullish nor overly bearish and, in the process, is giving no clear contrarian signals,” he said.

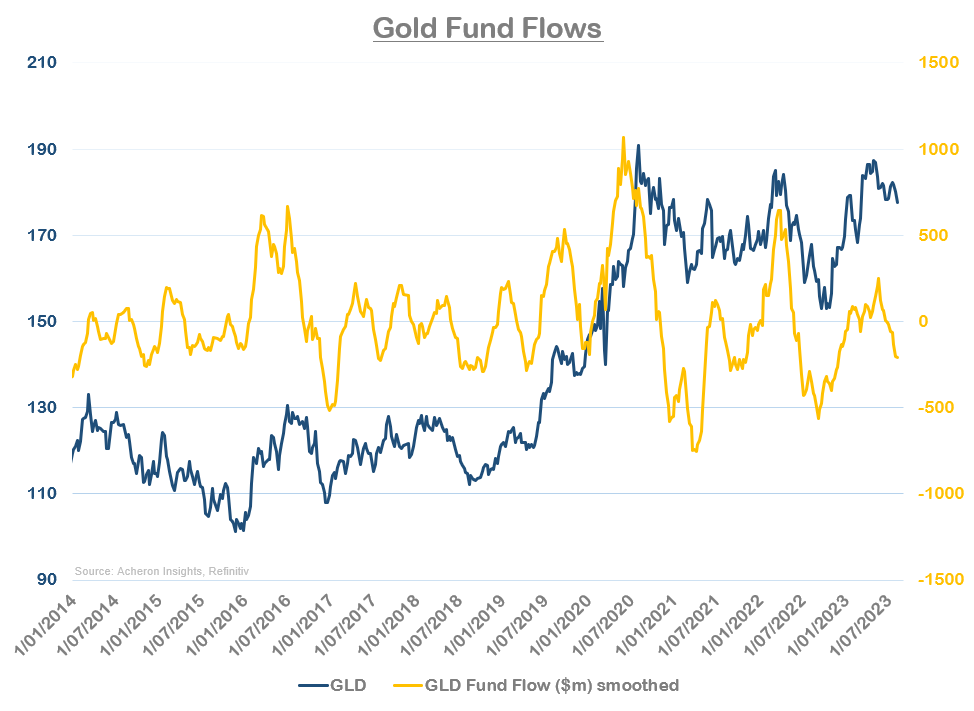

He said that sentiment is a bit more encouraging for the precious metal. “The fact that gold recently tested its all-time highs amid very little fanfare or media coverage is absolutely bullish,” Yates said. “Indeed, if we assess sentiment via such measures as flows into the GLD ETF, we can see how the recent highs were actually accompanied with only mediocre flows. This illustrates how the precious metals market is not anywhere close to exhibiting the kind of speculative furore evident at most market tops, while the fact that this correction has also seen meaningful outflows from gold ETFs is also of great encouragement to the medium-term outlook for the yellow rock.”

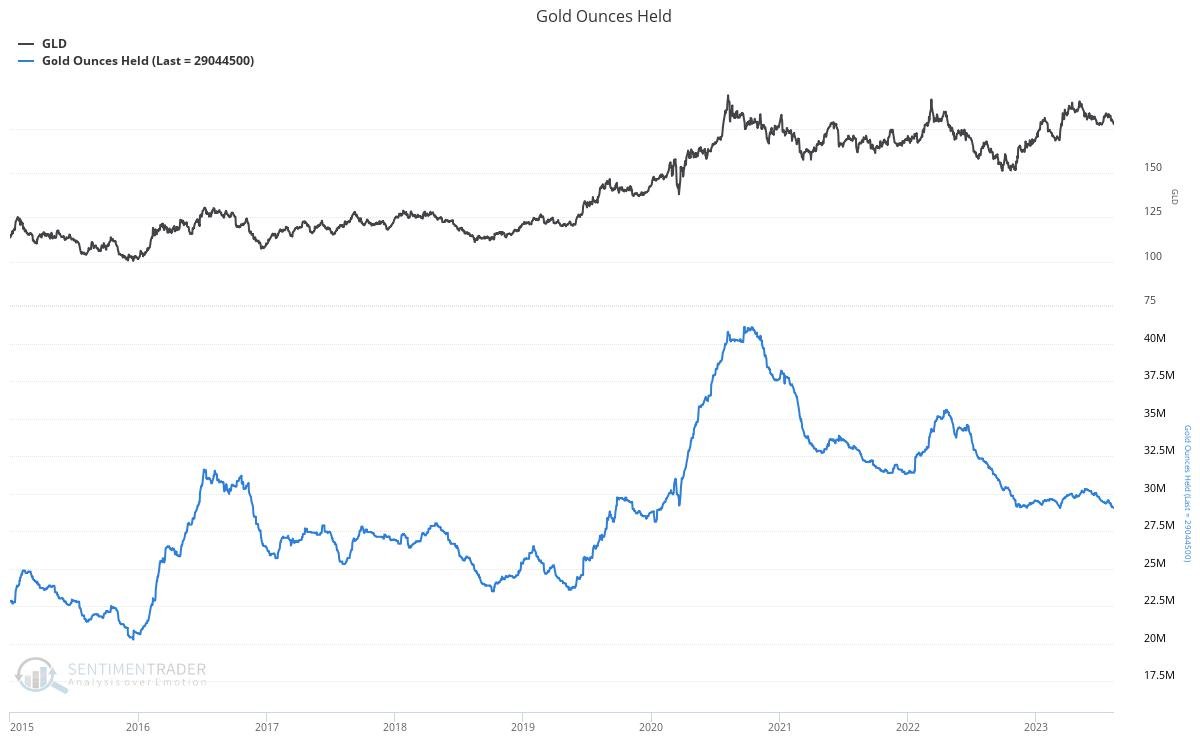

He said looking at the holdings of physical gold ETFs is also encouraging, as “despite the gold price flirting with all-time highs, physical gold held by ETFs is flirting with four-year lows.”

He also noted the ongoing buying by central bank as “one of the primary factors keeping a floor on the gold price” over the last two years. “The diversification of FX reserves into gold is, of course, one of the primary long-term fundamental reasons for owning gold, and it seems this trend continues to play out as all gold bulls have hoped.”

Turning to the technical perspective, Yates said higher highs and higher lows paint a favorable picture for the precious metal. “Whether this pull-back will see the gold price fall below the $1,940 support area remains a possibility, but I do believe any move lower toward $1,865 or even the $1,800 level should be considered an excellent buying opportunity for gold bulls,” he said.

Yates concluded by saying that the overall short to medium-term outlook for gold and the other precious metals remains mixed. “Although real yields are likely reaching their peak (though by all means could go higher over the short-term), continued hawkish Fed policy and the potential for a renewed rally in the dollar will likely put a cap on gold prices for the time being,” he said. “The conditions are still probably not yet in place for a significant upward move in gold, thus I can’t help but think the next big move may still be a story for 2024 rather than 2023, though the long-term outlook for the sector remains positive and any material dips should be bought by those bullish [on] the sector.”

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.