NASDAQ 100: THE BOND MARKET SEES A RAPID UPWARD MOMENTUM

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | SELL STOP |

| Entry Point | 14600.0 |

| Take Profit | 13900.0 |

| Stop Loss | 15000.0 |

| Key Levels | 13900.0, 14600.0, 15200.0, 15800.0 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY STOP |

| Entry Point | 15200.0 |

| Take Profit | 15800.0 |

| Stop Loss | 15000.0 |

| Key Levels | 13900.0, 14600.0, 15200.0, 15800.0 |

Current trend

The leading US index Nasdaq 100 shows corrective dynamics around 14887.0 after the end of the publication period of corporate reports and against growth in the bond market.

Thus, the American manufacturer and supplier of network equipment for large holdings and telecommunications companies Cisco Systems Inc. reported revenue of 15.20B dollars, which beat analysts’ expectations of 15.05B dollars, and earnings per share reached 1.14 dollars, up from 1.06 dollars. In turn, the management of the Chinese e-commerce platform JD.com Inc. posted revenue of 287.90B yuan, up from preliminary estimates of 279.92B yuan, while earnings per share were 5.39 yuan, compared to a forecast of 4.92 yuan.

Meanwhile, there is an upward trend in the domestic bond market: popular 10-year bonds are traded at a rate of 4.292%, having risen by 0.75% since the opening of trading, while conservative 20-year bonds add 0.60% and are around 4.570%.

The growth leaders in the index are Moderna Inc. ( 2.60%), Datadog Inc. ( 2.35%), Keurig Dr Pepper Inc. ( 1.14%), and Ross Stores Inc. ( 1.07%).

Among the decline leaders, stands out AMD Inc. (–3.74%), Intel Corp. (–3.57%), Atlassian Corp Plc. (–3.19%), and Tesla Inc. (–3.16%).

Support and resistance

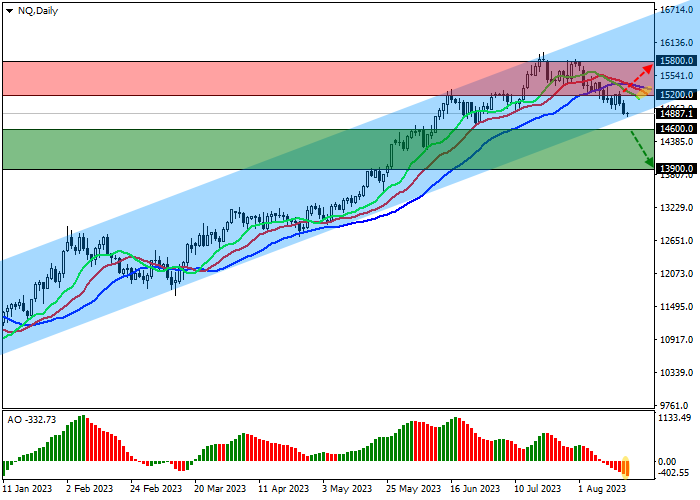

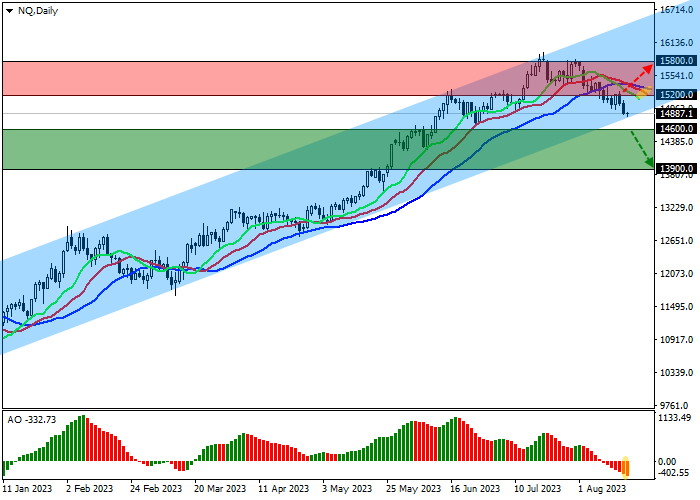

On the daily chart, the index trades within the global ascending corridor with the borders of 16500.0–14800.0, falling to the support line.

Technical indicators are holding the sell signal that was received at the end of last week: fast EMAs on the Alligator indicator are moving away from the signal line, and the AO oscillator histogram is forming new corrective bars, falling in the sell zone.

Support levels: 14600.0, 13900.0.

Resistance levels: 15200.0, 15800.0.

Trading tips

Short positions may be opened after the consolidation below the support level of 14600.0 with the target at 13900.0. Stop loss – 15000.0. Implementation period: 7 days or more.

Long positions may be opened after the consolidation above 15200.0 with the target at 15800.0. Stop loss – 15000.0.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.