Dollar Upside Breakout after Hawkish Fed, SNB, and BoE Next

The dollar broke out to the upside overnight following the hawkish Fed hike. At the same time, it’s closely trailed by the Swiss Franc for now, on geopolitical risks. Risk aversion is also keeping Yen afloat in crosses, despite strong rallies in treasury yields. For now, Kiwi is the worst performer for performer among the weak commodity currencies. But Euro is not too far behind as the Ukraine war could drag on further with Russia’s military mobilization.

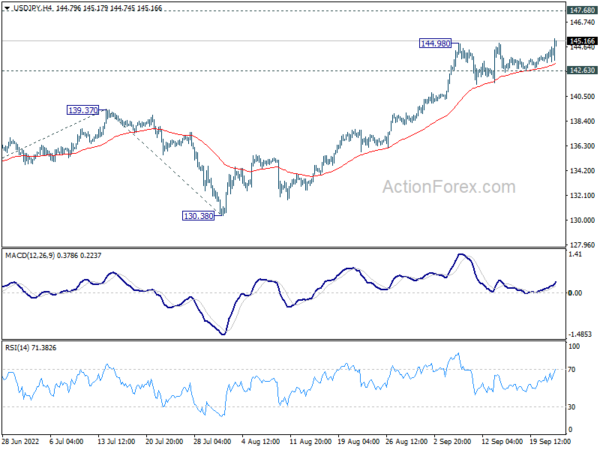

Technically, USD/JPY is resuming the recent up trend with a break of 144.98 resistance today, following the BoJ rate decision. The near-term outlook will stay bullish as long as 142.63 support holds. The next target is 1998 high at 147.68. Momentum towards the level and reactions from there is worth a watch, on hint at whether Japan is ready for taking actual actions on intervention.

In Asia, Nikkei closed down -0.53%. Hong Kong HSI is down -1.93%. China Shanghai SSE is down -0.34%. Singapore Strait Times is down -0.25%. Japan's 10-year JGB yield is down notably by -0.0256 at 0.236. Overnight, DOW dropped -by 1.70%. S&P 500 dropped -1.71%. NASDAQ dropped -1.79%. The 10-year yield rose dropped -0.061 to 3.510.

Fed hikes 75bps, rate to reach 4.4% by year-end

Fed raised interest rate by 75bps to 3.00-3.25% as widely expected, by unanimous vote. In the accompanying statement, Fed said job gains have been “robust” with the unemployment rate “remained low”. Inflation remains “elevated”. FOMC would be ” prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee’s goals.”

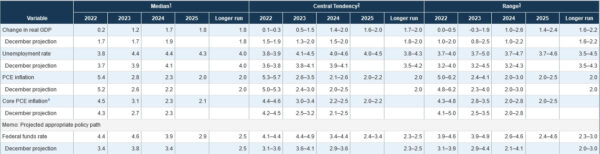

In the new economic projections, the Fed projects (median) interest rates to reach 4.4% in 2022, and 4.6% in 2023, before falling back to 3.9% in 2024, and then 2.9% in 2025. GDP growth is projected to be at 0.2% in 2022, 1.2% in 2023, 1.7% in 2024, and then 1.8% in 2025. The unemployment rate is projected to be at 3.8% in 2022, 4.4% in 2023, 4.4% in 2024, and then 4.3% in 2025. Core PCE inflation is projected to be at 4.5% in 2022, 3.1% in 2023, 2.3% in 2024, and then 2.1% in 2025.

More on FOMC:

- FOMC as Expected; Markets Extremely Volatile During Presser

- The Fed Fights On

- FOMC Hikes Policy Rate by 75 Basis Points, Signals Many More to Come

- FOMC press conference live stream

- (FED) Federal Reserve Issues FOMC Statement

DOW to break 30k soon on hawkish Fed

US stocks tumbled broadly after Fed raised the interest rate by 75bps overnight, and indicated that the rate could reach 4.4% by year-end. Chair Jerome Powell reiterated that pledge that “the FOMC is strongly resolved to bring inflation down to 2%, and we will keep at it until the job is done.” Meanwhile, against members’ expectations, “we have seen some supply side healing but inflation has not come down,” he noted.

DOW’s -1.70% decline indicates that the fall from 34281.36 is extending and a break of 30k handle would be seen soon. Such a fall is seen as part of the whole medium-term corrective pattern from 36952.65. The near-term outlook will stay bearish as long as the 31026.89 resistance holds. The next target is a retest of 29653.29 low. Firm break there will target 100% projection of 36952.65 to 29653.29 from 34281.36 at 26982.00. There’s where the correction would probably end.

BoJ stands part, the interest rate to remain at present or lower levels

BoJ kept monetary policy unchanged as widely expected. Under the yield curve control framework, the short-term policy interest rate is held at -0.10%. BoJ will continue to purchase Japanese government bonds, without setting an upper limit, to keep the 10-year JGB yield at around 0%. Also, BoJ will offer to purchase 10-year JGBs at 0.25% every business day through fixed-rate purchase operations, to cap the upside. These decisions were made by unanimous vote.

BoJ also pledges to continue with Quantitative and Qualitative Monetary Easing (QQE) with Yield Curve Control to achieve a 2% price target, “as long as it is necessary for stably maintaining that target”. The bank will not hesitate to take additional easing measures if necessary”. It expects short- and long-term policy interest rates to “remain at their present or lower levels”.

SNB and BoE next, GBP/CHF accelerating down

SNB and BoE rate decisions are the remaining focuses of the day. SNB is widely expected to rise the interest rate by 75bps to 0.50%, back in a positive region. There are some speculations of a larger hike, but it’s unlikely. The center would also repeat that appreciation of the Swiss Franc is welcome for now, as it helps curb imported inflation.

Meanwhile, BoE is expected to deliver another 50bps hike to 2.25%. The UK economy is stuck between a rock and a hard place. While inflation appeared to be slowing, “slightly”, it remained close to a multi-decade high. On the other hand, weakness has been seen in spending while the economy is already in recession. The voting of today’s decision could contain some surprises.

Some previews on SNB and BoE:

- SNB Could Surprise (Again) with a Larger than Expected Hike

- Will the SNB Rock the Swissie with a Huge 100 bps Rate Hike?

- BoE Preview: Pressure Mounts for a Jumbo Hike

- BoE Decision a Close Call to Speed Up Rate Hikes as Worries Mount

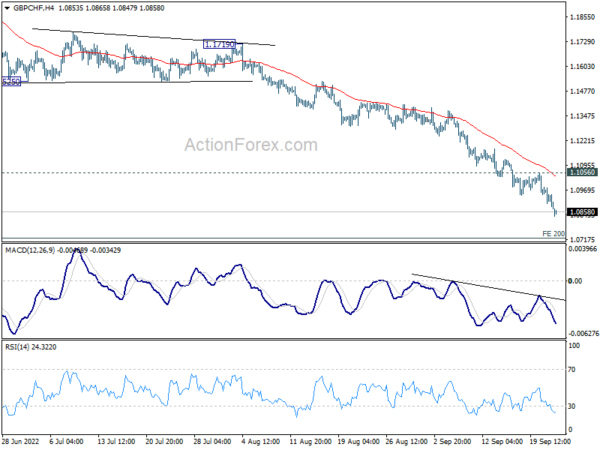

GBP/CHF broke through the pandemic low at 1.1107 earlier this month, and the downtrend is still in acceleration mode. The near-term outlook will stay bearish as long as the 1.1056 resistance holds. The next target is a 200% projection of 1.3070 to 1.2134 from 1.2598 at 1.0726.

There is a risk of further downside acceleration, either on dovish BoE or deterioration in geopolitical risks. In that case, the break of 1.0726 could pave the way to 1.0148.

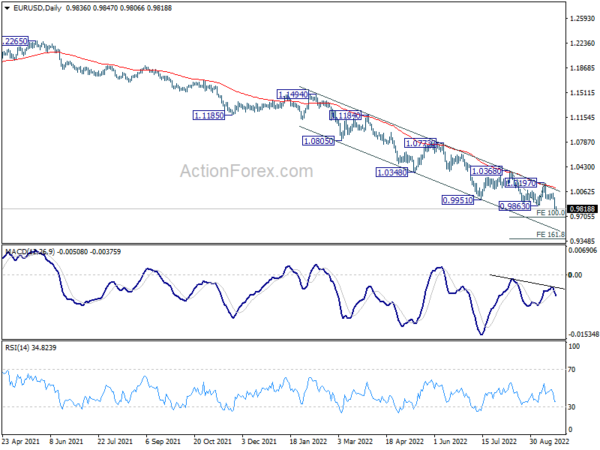

EUR/USD Daily Outlook

Daily Pivots: (S1) 0.9774; (P) 0.9876; (R1) 0.9940; More…

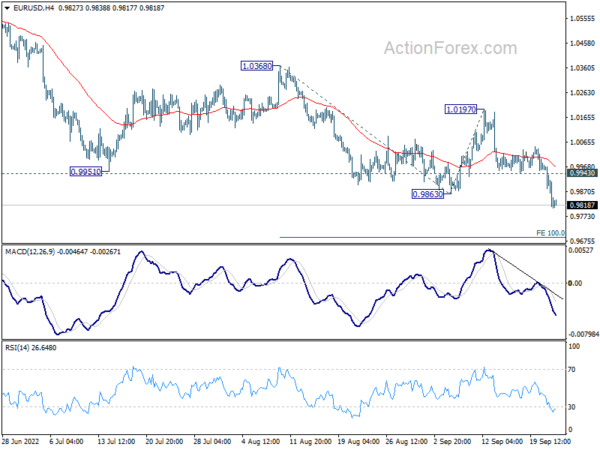

EUR/USD’s break of 0.9863 support confirms down trend resumption. Intraday bias is back on the downside for a 100% projection of 1.0368 to 0.9863 from 1.0197 at 0.9692. A firm break there could prompt downside acceleration and target a 161.8% projection at 0.9380. On the upside, above 0.9943 minor resistance will turn intraday bias neutral first. But the outlook will stay bearish as long as the 1.0197 resistance holds, in case of recovery.

In the bigger picture, the downtrend from 1.6039 (2008 high) is still in progress. The next target is a 100% projection of 1.3993 to 1.0339 from 1.2348 at 0.8694. In any case, the break of 1.0197 resistance is needed to be the first sign of medium-term bottoming. Otherwise, the outlook will stay bearish even with a strong rebound.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.