The Traders’ Week ahead Playbook

It’s another big week ahead on the markets with central banks tightening, the US500 making moves, and we review the Australian election results.

Thoughts and views to roll with into the new week

- The CHF was the star currency of the week – USDCHF fell 2.7%, printing a bearish engulfing and we look for follow-through selling early this week – I expect the CHF to remain supported, with rallies in USDCHF into 0.9775/0.9800 levels to fade

- EURCHF parity calls have resurfaced – a break below 1.0187 would certainly increase that probability. GBPCHF is one for the radar, given we’re pushing the lower bounds of its recent range

- The AUD and AUS200 reaction to the Labor victory in the Aussie election will be interesting – the result should be well priced, so shouldn’t cause any lasting reaction. The big factor is the rise of Teal Independents as a credible force with 7 rep’s in the Lower House and 12 in the Senate – the result should effect RBA thinking in any capacity

- The USD arrested 6 weeks of gains, closing -1.4% for the week. If the equity market is going to stage a short-term relief rally this week, then a weaker USD would be very helpful for that to play out, especially a lower USDCNH.

- The US500 has fallen for 7 straight weeks – the last time we saw 8 weeks in a row was in 2001 – the fact the index held 3858 on Friday suggests the bulls are prepared to support, but it’s hard to get excited until we break 4092 (double bottom neckline). In fact, if price does roll over and head lower it could get ugly – I expect the VIX to trade above 40 and possibly into 50 on a new leg lower – this would portray a greater degree of panic.

- Watching US credit markets this week – last week we saw US high yield credit spreads widen 33bp above US Treasuries – at 5.02%, should credit deteriorate then equities will head lower. I’d also be expecting rate cuts to start being priced in for 1H23 – use (CME:GEZ2022-100)-(CME:GEM2023-100) in TradingView

- Watching Crypto – Bitcoin is consolidating in a 31,200 to 28,500 range – clients are long and expecting a move higher, but I’m waiting for the market to show its hand before having any ST momentum bias

- We’re seeing good flows in our XAUUSD CFD – clients are long (60% of open positions are held long) – the technicals are unconvincing but favour a rise to 1880, which is the implied on the week (with a 68% degree of confidence)

- Crude looks supported on dips and a closing break of $114.50 would get the momentum traders going – not sure that will be seen as a positive for risk more broadly though.

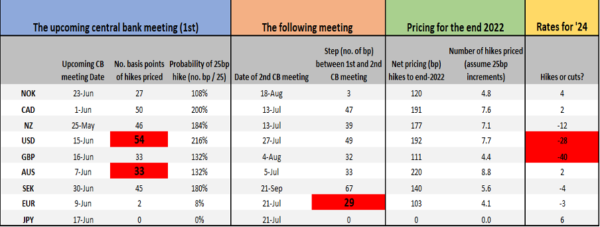

Interest rate matrix (using market pricing)

- What’s priced for the next meeting (increments of 25bp)

- The step (in basis points) up to the following meeting

- Priced (bp) for the full year

- Cuts or hikes priced for 2024.

Cells highlighted in red are of most interest.

On the radar this week – landmines to navigate

- AUS – RBA Kent speaks (Monday 09:05 AEST) – In a speech titled “From QE to QT”, this may offer some insights into the RBA’s plans to reduce the balance – one for the strategists out there, but unlikely to cause too many ripples in the AUD, given very strong relationship with USDCNH and S&P 500 futures.

(Source: Bloomberg – Past performance is not indicative of future performance.)

- Germany – IFO survey (Mon 18:00 AEST) – the market expects a modest decline across the three surveys (Business climate, Current assessment, Expectations) – on balance it’s the ‘Expectations’ survey traders will react to more intently and that is on a worrying trajectory, although that’s hardly a surprise. A read above 87 may breathe some life back into the GER40, which really needs a break of 14,270

- UK – manufacturing PMI (Tues 18:30 AEST) – the market expects the index to print 55.0 (from 55.8), so this will offer some insights into the growth debate. A number below 53.0 and GBP may take a hit – put GBPCHF on the radar where a closing break of 1.2100 should get some attention from the shorts

- Eurozone – manufacturing PMI (Tues 18:00 AEST) – the market expects 54.8 (55.5) – I’d be expecting a reasonable reaction in the EUR on a number below 52 and above 57, otherwise an inline print shouldn’t move the dial too intently

- Aus – RBA member Luci Ellis speaks (Wed 09:45 AEST) – Ellis has previous offered some hints of a more gradual approach to hiking, and with the markets delicately poised, pricing 33bp (a perfect split between 25bp vs 40bp), any intel that could see pricing skew towards one camp could impact the AUD

- NZ – RBNZ rates decision (Wed 12:00 AEST) – as you see in the rates matrix the market is pricing 46bp, so a 50bp hike is all but priced – the move in the NZD, therefore, comes if the RBNZ ‘only’ hike by 25bp. While 16/18 economist are calling 50bp, there could be a strong chance the bank does a dovish hike and offer a view that we’re getting closer to peak hawkishness. Risk is skewed to NZD shorts, although rather than trade vs the USD, the better play – NZDUSD looks like it might push to 0.6500

- US – FOMC minutes (Thursday 04:00 AEST) – Since the May FOMC meeting where they hiked by 50bp, we’ve heard from a raft of Fed members, so we may not learn much new from the minutes – recall the Fed we’re not “actively considering” 75bp hikes and this has anchored pricing for the June and July FOMC meeting to 50bp. Keep an eye on USD exposures, but less inclined to think it will be a volatility risk

- US – core PCE inflation (Friday 22:3 AEST) – The market looks for a 0.3% MoM change, which would the third monthly 0.3% lift in a row. The YoY pace in core PCE is expected to drop from 5.2% to 4.9%, while headline inflation is eyed at 6.2% (from 6.6%) – a welcome relief for the Fed, even if this is mostly base effects

- Aus – retail sales (Friday 11:30 AEST) – 0.9% (From 1.6%) – we’ve seen Westpac consumer confidence drop consistently from April 2021, but retail sales are yet to be truly impacted and +0.9% (if this proves to be correct) is in line with the 2-year average

- 4 Fed speakers – on the wires we hear from Bostic, George, Powell (Wed 02:20 AEST) and Brainard (Thurs 02:15 AEST) – hard to know what to expect from Powell or Brainard as the speeches may be short opening remarks

- BoE speeches – Bailey (Tues 00:15 AEST) and Tenreyro (Wed 03:30 AEST)

- 12 ECB speakers – we’ve heard from the ECB top brass of late and it seems the strong consensus we get an end to asset purchases in June and a lift in the deposit rate in July. Preference for EURCHF shorts, while EURUSD bulls will want a break of 1.0635.

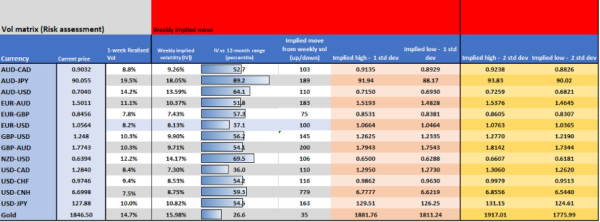

Implied volatility matrix

(Source: Pepperstone – Past performance is not indicative of future performance.)

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

-THE END-