Risk Management Techniques for Active Traders

How a trade is implemented is more important than the trade idea itself” – Colm O’shea, Market Wizard.

Too many aspiring traders search for a “one size fits all” solution. Typically, aspiring traders think that there is a “best way” to be consistently profitable in the markets; they think that there is a “best way” to enter, manage and exit positions, and a “best way” to establish risk limits.

Unfortunately, nothing could be further from the truth. There are actually many different profitable ways to approach the markets, each with their own objectives. Note the keyword: Objectives.

“An investor without investment objectives is like a traveller without a destination”. – Ralph Seger.

- Your objectives determine the “right” approach to entries.

- Your objectives determine the “right” approach to exits.

- Your objectives determine the “right” approach to position sizing.

- Your objectives determine the “right approach” to trade management.

Objective: High Trade Frequency

If you are an active trader, exploiting an edge that offers one or more opportunities each day on the same instrument or multiple opportunities across various instruments, then risk management will be an overriding concern.

Active traders attempt to maximize their profits by pushing the limits of their edge.

Mathematically:

Expected profit per trade = (number of wins/total trades) x average winner – (number of losses/total trades) x average loser

Profit forecast per week = expected profit per trade x average number of trades per week

Evidently, if you have established conditions that offer you an edge (which can be as simple as trading an evident trend using pullbacks or breakouts), then you can attempt to jump on board every setup that presents itself—so long as the odds of success remain the same. Stated otherwise, when trading more actively, attacking every setup that presents itself can enhance your profit forecast only if the quality of your trades remains equally high.

The worst thing that an aspiring trader can do is “seek action” by entering into multiple positions without properly filtering and assessing the quality of each trade idea. Let us explore the possible implications of seeking multiple trades per day.

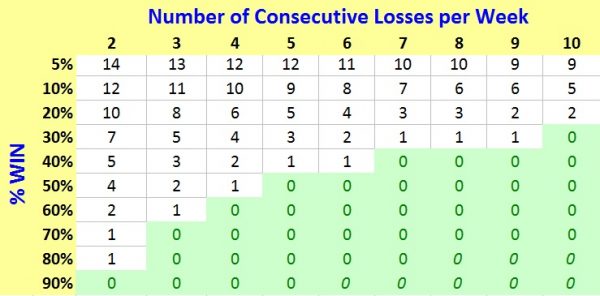

Number of Consecutive Losses based on Average Win Rate – proprietary calculations.

The chart above is calculated based an active trader having three trades per day, so 15 per week on average. This translates into the following monthly figures (60 trades per month):

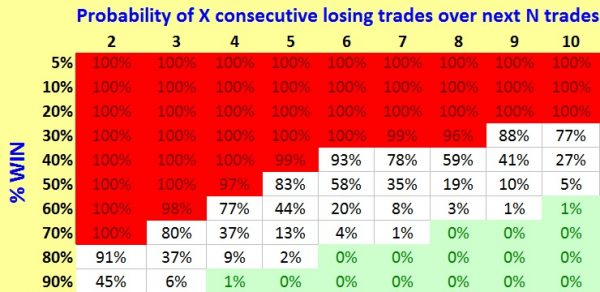

Number of Consecutive Losses based on Average Win Rate – proprietary calculations.

So, even if you have a 50% strike rate, you’re still looking at ten potential double whammy situations. If you have a 70% strike rate, you’re still looking at five potential double whammy situations. If you have a 60% strike rate, you’re still looking at one potential streak of five losses in a row.

In general, you can calculate the probability of having X number of consecutive losses within the next N trades, with the following formula in Excel:

= 1 – binomdist(0, A – B + 1, C^B, false)

Where:

A = n° of trades to consider (60 in our example).

B = n° of consecutive losses to evaluate.

C = Probability of loss in a single trial = 1 – %win.

And you end up with a chart like this:

Probability of X consecutive losing trades over N trades

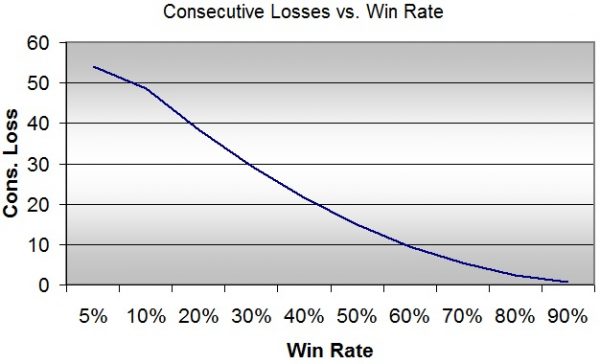

Very few traders consider the implications of trading too frequently. Evidently, the more you trade, the more likely you will encounter a string of losses. Independently from the quality of your system, multiple losses will occur.

Stated in a different way:

This essentially means that the quality of trades is much more important than the quantity of trades.

This brings us to a necessary ingredient: a solid risk management vehicle, which is made up of:

a) Position sizing (what size to allocate to each trade).

b) Risk limits (how many trades to allow on any given day/week).

The objective of the risk management vehicle is:

a) To size your positions in a way that allows you a large degree of flexibility (so you can take 3-4 trades per day, which is 15-20 per week) without ever putting your account in danger.

b) To have stop losses that complement your method and are far enough away to not get hit by random moves, yet are not too far away that they dilute profit potential.

Let us run through an example.

If you have 15 trades per week, and on average you win 60% of them and get stopped out on the remaining 40%, considering a very conservative Risk:Reward ratio of 1:1 (where entry-exit = entry-stop distance), you end out with nine winners (+9R) and six losers (-6R). Your expected profit per week is 3R (which is handsome, by all means). We are keeping the numbers realistic, in this example, because it is not realistic to expect an 80-90% win rate.

Now, we have already said that having a lot of trades does stress our risk limits. Remaining realistic, on any given week you shouldn’t expose your account to more than a 1.5% drawdown, because active trading always tends to stress these risk limits from the start, and drawdown figures are often exceeded. By aiming for a 1.5% MaxDD per week, you are setting the bar very low, so even when you exceed the limit, your account will be very much alive and well.

Going back to the math, your expected -6R of losses should be equal to 1.5%, which gives us a position size of 0.3% per trade. To stay on the conservative side, make that 0.2% per trade.

This means that each day you will have around 0.8% of the total account at risk—which is about right (3-4 trades per day). And theoretically, given our established performance figures, you should be able to trade this system without jeopardizing the account.

So, once again, here are some suggestions if you want to pursue the high frequency objective:

a) Use a position size calculator. You should keep your risk very low (in our example, 0.2% of your consolidated equity on each trade), so that consecutive losses will not jeopardize your account.

b) Fit that 0.2% of equity into the number of pips you require as a stop loss (so you will have larger position sizes when your stop loss is small, and smaller position sizes when your stop loss is large). Try to aim for a profit potential that is larger than the stop loss. That takes pressure off your hit rate.

High frequency trading requires the trader to run a tight ship. This is why professional active traders are usually active—not because they are opening a myriad of positions, but because they are attempting to maximize the return of their few quality trades. Which is a much more solid objective.

Objective: Getting the Most from your Trades

This is the crux of how you, as a retail trader with a limited amount of risk capital, can aim to grow a small account into a big one. By implementing risk management techniques that let you build a large position, while minimising risk, you have the opportunity for large profits.

These techniques involve:

- Scaling in and out of a position.

- Trading against (jobbing) a core position.

With the objective of building a risk-free position.

When you enter into a position, plan ahead on how you are going to generate the most profit you can from it. Ask yourself these key questions:

- What is the current market type and how can you best build a position in this market type? Do you need to scale into the position quickly, as you expect it to get away from you? Or can you take your time to build the position?

- Are there any points along the way to your profit objective where you want to take profit and then re-enter?

- Where are the likely opportunities to trade against, or job your core position?

Range Environment

In range-bound markets, traders will most likely need to build up their position size quickly, using smaller time frames than their primary time frame. Here is an example:

The market has alerted us to the fact that 0.7700 (round number) and 0.7800 (round number) have been rejected strongly in the recent past. So, if we are attempting to gauge where the uptick in AUD/USD is likely to encounter resistance, those are the levels to watch. Now, we need to drop down a couple of time frames, in order to wait for the reaction and build our positions.

You will finally see a trend emerge. And your work is by no means completed. When evident trends emerge, as in the situation above, your job is to add to the position on either breakouts or pullbacks, maximizing these great runs.

Of course, risk limits apply to multiple entry scenarios as well.

“You have to trade at a size such that if you are not exactly right in your timing, you won’t be blown out of your position. My approach is to build a larger size as the market is going my way. I don’t put on a trade by saying, “my god this is the level; the market is taking off right from here.” I am definitely a scale-in type of trader. I do the same thing getting out of positions. I don’t say, “fine I’ve made enough money. This is it I’m out”. Instead, I start to lighten up as I see the price action or fundamental changing.” – Bill Lipschutz, Market Wizard.

If you are scaling into a position, then decide ahead of time what your maximum risk on the total trade should be. Ideally, this should be less or equal to 2% of your consolidated equity. Then, you can decide how much to deploy initially, depending on the number of additional entries you foresee.

As a rule of thumb, range-bound scenarios will offer less chances to enter into a full-scale position and the entries will be quite close together. Vice-versa, trends can last for a long time (even months), so you should be prepared to add to a trending market more often, although the entries will most likely be further away from one another.

Contrast multiple entries with a single position approach:

- If you take a full-sized position and lose, then you will have lost the maximum amount.

- If you take all your profits in one go, and the market continues in your direction, you have broken one of the cardinal rules of trading, and cut your profits short.

It’s not about 50-50 odds, “all-in/all-out” scenarios. It’s about maximizing the odds in any given situation. Most traders have a preoccupation with being “right” on their entry. Instead, veteran traders know the entry is not so important; rather, it is about how the trade is managed.

Most of the time markets don’t go in a straight line. Instead, they chop around, so you can use this choppiness to your advantage and:

- Build your position.

- Reduce your risk.

Jobbing a position

Trading contrary to your core position is defined as “jobbing” in dealer jargon. The objective is once again to maximize the efficiency of a trade. However, jobbing (i.e. trading against the current market direction) is also a risky business and should not be taken lightly.

In the example above, we were selling the Australian Dollar from a potential resistance. Jobbing our open trades would require buying into weakness. Here are some rules of thumb to adhere to, when considering jobbing a core position independently from the setup you use:

- Try to enter into position when the market has “pushed too far” on any given day or week. The more it exaggerates a move, the higher the odds of a retracement.

- Jobbing is meant to trade retracements. Do not confuse this with your core objective for a trade.

- Jobbing requires being nimble. Do not do this unless you have significant time to devote to the markets.

- Most importantly, jobbing should be done only once you have established a decent core position that is in profit. Otherwise, you risk having a double whammy if the market chops around.

Examples of Where and How to Consider Jobbing a Core Position

In the charts below, we will explore some higher odds situations for jobbing (i.e. counter-trend trading) a core position. It must be very clear, however, that you should have a healthy profit in place (so, at least a day’s worth of movement in your favour) before considering this tactic. It is advanced and requires you to be nimble.

We have had two very real/very possible setups for jobbing CADJPY longs after the US elections.

They have some elements in common: they are both executed around key levels (US Election Day high in the first case; 80.00 Big Round Number in the second case) and they both happen after a significant move in the direction of the prevailing trend.

Since we are effectively “fading” a trend, the tactics these examples use are:

- Potential exhaustion of available intraday space.

- Evident resistance to rebound from.

In a strong trend, do not expect counter-trend trades to last very long. When jobbing, do not linger in the market, expecting large profits. Attempt to get rewards that are larger than the risk outlay, but don’t expect multiple-R runs. The objective is simply to pay higher-odds reversals that help “make some quick pips” and thus give you a better average entry price on your trending position.

Jobbing is, after all, a defensive play.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.