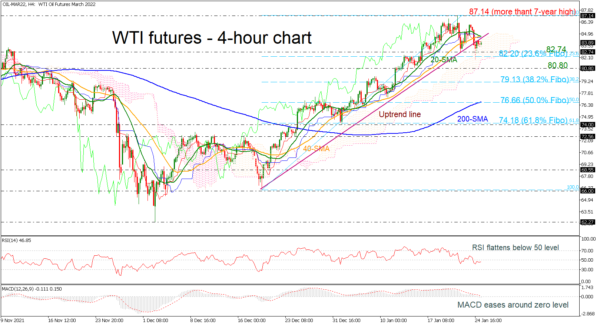

WTI Crude Oil Battle with Ascending Trend Line around 84.00

WTI futures have been trading slightly below the long-term ascending trend line over the last few sessions, remaining within the Ichimoku cloud. The RSI indicator is flattening beneath the 50 level, while the MACD oscillator is losing momentum below its trigger line in the short-term. The 20- and 40-period simple moving averages (SMAs) are creating a bearish crossover, confirming the latest down move.

If the price remains below the uptrend line, immediate support could come from the 82.74 barrier ahead of the 23.6% Fibonacci retracement level of the up leg from 66.00 to 87.14 at 82.20. Beneath these crucial levels, the 80.80 support and the 38.2% Fibonacci of 79.13 may act turning points.

On the flip side, a jump beyond the diagonal line and more importantly above the short-term SMAs, the next resistance could be the more-than-seven-year high of 87.14 before the rally continues until the 91.23 barrier.

Summarizing, WTI futures are battling with the long-term rising trend line and if the price continues to fall, the outlook will turn to neutral in the short-term.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.