Research China: Top 5 questions for 2022 – and financial implications

- In this paper, we give a short overview of the key questions in China in 2022 and what we expect.

- Overall, we look for the Chinese economy to recover moderately, crackdowns to ease but not end and that China’s zero-tolerance policy on Covid is here to stay for most of 2022.

- We expect limited impact on the economic agenda of the 20th CPC National Congress, which is mostly a political event. We look for tensions around Taiwan to remain high but see a small probability of a military confrontation anytime soon.

- Based on this, we look for Chinese stock markets to move higher in 2022 and for the CNY to weaken moderately.

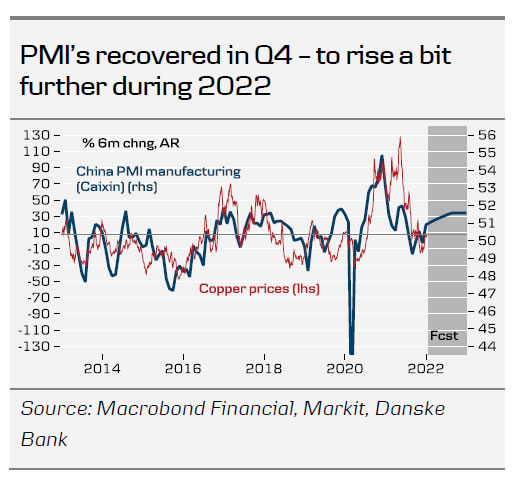

#1: Will China’s economy recover?

Short answer: Yes – we lift our growth forecast from 4.5% to 5.0% in 2022

As we argued in Research China – Stimulus picks up ahead of CPC Congress in ’22, 21 December 2021, a key policy goal this year is stability. Following a year of economic downturn and property crisis, Chinese polices aims at stabilisation and is already taking measures to steer the economy back towards the middle of the road. Given the latest improvement in data which came a quarter earlier than we expected, we revise up our GDP forecast for 2022 to 5% from 4.5%. Infrastructure projects are pushed forward and steps have been taken to stabilize the property markets via easing of mortgage lending, increasing bank loans to developers and loosening the ‘three red lines’ regulation that puts caps on developers’ debt levels. The latter will facilitate that troubled developers can raise liquidity by selling projects to more healthy developers. While the economy is set to recover, it is likely to be a moderate one. Headwinds continue from Covid outbreaks, which will likely become more frequent due to Omicron. And Chinese policy makers still very much focus on long term sustainability and financial risks. So stimulus will be measured.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

-THE END-