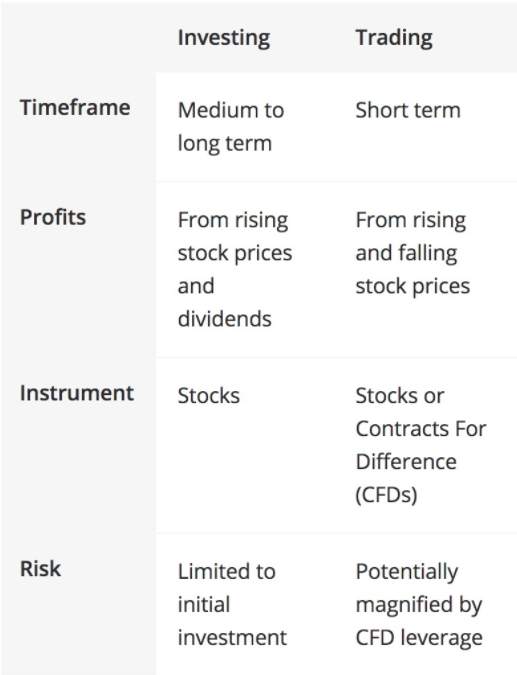

The terms ‘investing’ and ‘trading’ are often used interchangeably.

However, there are key differences between the two financial strategies. Here’s a look at how the two strategies differ.

Investing in stocks

The goal of investing in stocks is generally to build wealth over the long term.

Investors will often hold stocks for years, or even decades, with the aim of generating substantial profits from both rising stock prices and dividends over time.

Investors tend to ride out periods of underperformance, with the expectation that stocks will eventually rebound and any short-term losses will be recovered.

Trading stocks

The goal of stock trading is to generate short-term profits.

Traders hold stocks for a much shorter period of time than investors, often buying and selling within weeks, days, or even hours.

Instead of focusing on the company’s long-term prospects like investors do, traders focus on which direction the stock is likely to head in next and try to profit from that move.

Traders often use stop-loss orders to automatically close out losing trades at a predetermined price level in order to protect their capital.

Takeaway

Both investors and traders seek to profit from the stock market, however, they pursue this goal in different ways.

Investing is a ‘buy and hold’ long-term strategy, while trading is a ‘buy to sell’ short-term strategy.

Reprinted from eToro, the copyright all reserved by the original author.

Disclaimer: The views expressed are solely those of the author and do not represent the official position of Followme. Followme does not take responsibility for the accuracy, completeness, or reliability of the information provided and is not liable for any actions taken based on the content, unless explicitly stated in writing.

Leave Your Message Now