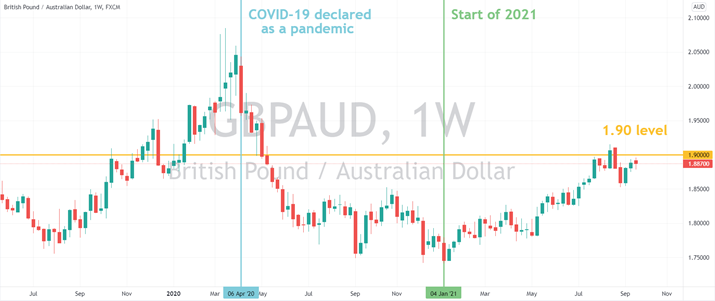

Will GBP/AUD Break Above 1.90?

ByJin Dao Tai

SEP 27, 2021

Since the start of this year, the British pound has been strengthening against the Australian dollar with the ending of the Brexit transition period on 31 December. At the moment, GBP/AUD has recovered close to half of its losses incurred since the COVID-19 pandemic. With the ongoing vaccination programme, the uncertainty caused by the pandemic is now lower than that of last year. Thus, the direction of GBP/AUD has started to become more reliant on the ongoing economic recovery as well as the central banks’ policy decision.

Optimism coming out from the BoE committee members.

During the August monetary policy meeting held by the Bank of England (BoE), half of the committee members including the central bank’s chief Andrew Bailey think that the minimum criteria for the BoE to consider an increase in interest rate has been met. Those members felt that there was obvious evidence that inflation in the UK has achieved the central bank’s 2% target sustainably and as such, an interest rate hike next year may be on the table. This is a progress made by the BoE in terms of policy tightening as they are one of the few central banks that has not done much ever since the pandemic started last year. Nonetheless, those members do not think that the criteria are sufficient to justify a rate hike at the moment due to the rise in COVID cases caused by the Delta variant.

9-year high inflation boosted BoE’s confidence on inflation sustainability.

The recent release of the UK CPI data further strengthened the BoE’s conviction on the sustainability of inflation. The UK Office of National Statistics (ONS) recently reported a 3.2% spike in annual headline inflation, a 9-year high level. The 1.2% rise in inflation was the highest month-to-month figure ever recorded. Although the ONS highlighted that the main driver behind the rise in prices is due to a base effect, one cannot deny that this will still push the BoE towards a potential quantitative easing (QE) tapering soon.

Dovish tapering from the RBA reflects concern on Delta variant.

When the Reserve Bank of Australia (RBA) announced in August to proceed with its September QE tapering plan set out during the July’s meeting, the market was taken aback by its decision given that COVID cases was on the rise during that period. Although the central bank admitted that the recent outbreak did disrupt the economic recovery, it is still confident that the economy will bounce back quickly based on previous experience. Moreover, RBA Governor Phillip Lowe explained during his testimony last month that “any additional bond purchases would have their maximum effect at that time and only a very small effect right now when the extra support is needed most.” Furthermore, he mentioned that fiscal policy would be more appropriate than monetary policy in terms of providing aid at the moment.

Come September’s meeting, the RBA announced officially the start of a new round of QE at a tapered rate of A$4 billion a week. However, the central bank revised the wording of the duration from “until at least mid November” to “until at least mid February 2022”, indicating that it does not have any intention to amend QE for the time being. The RBA explained that this decision stems from the delayed economic recovery caused by the recent COVID outbreak. As a result, the market responded to the central bank’s announcement with a sell-off in the Australian dollar across the board.

Dented Australian job market endorses RBA’s concern.

In an attempt to curb the rising COVID cases, lockdown restrictions were reimposed by the Australian government on parts of the country. As a result, the job market took a strong hit, losing 146,300 jobs in August, doubling the expected loss. Furthermore, there was a decline in the number of job seekers, leading to a slight fall in unemployment rate.

Plunging iron ore price.

Adding oil to fire, iron ore price plunged by 20% last week as Chinese steel mills are dumping and lowering the demand of iron ore. This is due to a production cut on steel by the Chinese government in an effort to curb CO2 emissions. Moreover, with an expected slowdown in construction activities in China in the near future, the demand of steel will further decline, leading to a lower demand of iron ore. With Australia being the largest exporter and China being the largest importer of iron ore, it comes as no surprise that the former’s revenue from exporting this raw material will be negatively impacted.

GBP/AUD is in good shape at the moment.

Fundamentally, GBP/AUD is making good progress in its recovery towards the pre-pandemic level. With the Bank of England scheduled to meet this Thursday, the market is expecting the central bank to deliver a hawkish note. Specifically, the BoE may be dropping hints on a potential QE tapering in the near future. Hence, we may be seeing GBP/AUD trading above the 1.90 level very soon.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.