Written by@老张逼逼逼 click to check the original article

We came to this market to make money, but in the end, it seems that everyone has become a philosopher. We must think about how to grab wealth in the market, and we must also think about the foundation of our own life, that is, your profit comes from what? This is a difficult question for every trader. In fact, thinking about trading behavior from a philosophical point of view is the way that every trader should go through.

For example, most traders in the market hope that their profit curve presents a fixed angle (such as 30 degrees or 45 degrees), a continuous and stable rise, and this kind of curve trading pattern is most likely the martingale trading method.

However, such a curve will experience a large-scale drawdown sooner or later. If there is not enough capital or reasonable risk control methods, the system will not always perform perfectly. If you do not recognize the source of the profit of this system from a philosophical point of view, you will be holding the position in a wrong way until a strong enough trend takes away all your profits and money.

This case shows clearly that at the "technical" level, you have been able to make a profit; but at a deeper level, when you do not have a deep understanding of the underlying logic to make money, you will eventually be swallowed by the black hole of the market.

Throughout the past and present, the vast majority of Chinese and Western philosophical schools are idealistic, and a few are materialistic.

1. Using the empirical philosophy of materialism to look at the market will lead to the conclusion that trading is not profitable.

Empirical philosophy speaks of the law of causality. With such mentality, it leads you to vainly try to use the result of price movement to derive the law of price movement. In trading, we can see the results of price movements and use this to speculate on the reasons leading to the price results. In fact, such speculation is inaccurate in most cases, and sometimes the deduced conclusion is quite different from the real reason.

In the real market, there are infinite factors that affect the behavior of institutions and retail investors, such as emotions, sudden large orders, wars and even natural disasters. Empiricist philosophy believes that there must be an effect if there is a cause. Whether it is Eliot's wave theory or Buddhism , it is believed that the market operates accurately under a predetermined law. However, the reality is not the same.

Since market move cannot be precisely defined, we will eventually conclude that the market is unpredictable. Therefore, in the view of materialistic empirical philosophy, trading cannot be profitable. In this case, how do we find our profit model in the market?

2. Since the empirical philosophy of materialism is not working, I have to go to the philosophical schools of idealism to find the answer.

Among many Western idealistic philosophical thoughts such as Hegel, Nietzsche and Kant, Kant's transcendental philosophical thought is particularly prominent, and it has promoted the progress of modern science. Whether it is Newton's universal gravitation or Einstein's theory of relativity, they follow the thinking of transcendental philosophy. They are either scientists, philosophers, or theologians.

The transcendental philosophy perfectly fits the strategy formulation method in trading. Under the guidance of this ideology, people have to legislate for the trading market, that is, assuming a model to define market move, and follow the model to carry out trading behavior. If the behavior is ultimately profitable, the hypothesis is proved to be correct, otherwise it will be falsified.

For example, trend-following traders admit that volatility and trends are unpredictable, but the trend is bound to come with inertia. They use the trend market after the shock period to grab profits and cover the losses during the volatile period to achieve overall profitability. In fact, the trend-following trading method can be traced back to the era of Jesse Livermore, or even earlier. There are still a large number of people using this method to make profits in trading, which is enough to prove the validity of this method, that is, the hypothesis is established.

Let us return to the nature of trading--to profit, so as to prove the effectiveness of your trading strategy. No matter which method is used to trade, the core to be profitable is a formula, namely:

Win rate × profit/loss ratio> 50%

This is how you judge whether you can make a profit. There are so many kinds of trading methods, but they actually share the same core, and only if they meet the above formula can they be profitable. We try to use a priori philosophy, or you could say trading beliefs, to analyze several conventional trading models.

(1) Trend trading

Assuming that the market is trending, after the volatility, the trend is bound to come, and there is inertia in the trend, the profit brought by the trend market will cover the loss caused by the volatile market.

(2) Swing trading (guess the top and find the bottom)

Assuming that the top and bottom of the market have traces to follow, look for top and bottom patterns (such as butterfly patterns, shadows, waves, etc.) through candle charts, Elliott waves, entanglement theory, and harmony patterns, and sell high and buy low to gain profits.

(3) Martingale (grid)

Assuming that the rise and fall are not achieved overnight, there will always be retracements in the upward or downward process. With enough capital, enter the market when you lose. When the market bounce back, you gain profit and leave.

(4) Scalping

Assuming that there are always resistance and support levels in the process of rising and falling in the volatile market, use the advantage of the winning rate of resistance and support to gain profits.

The trading methods mentioned above are all hypothetical models based on a priori philosophy. Only when the system gains profits can the hypothesis be established and the model effective. It can be said that the adherents of each trading system have their own beliefs, and the corresponding price must be paid in order to verify the effectiveness of the model.

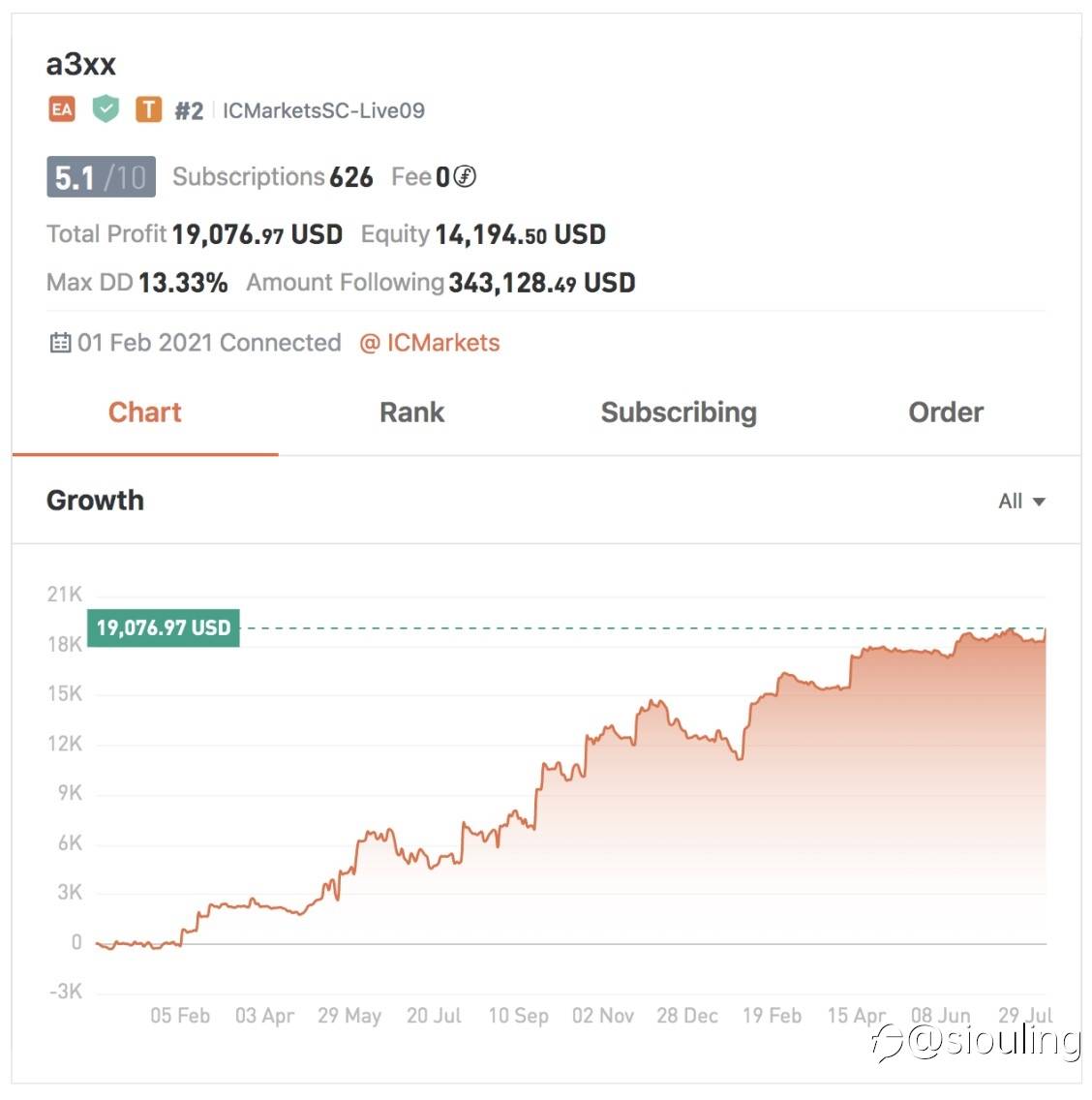

As the old saying goes, "Smart though, it is better to take advantage of the trend." Trend-following traders are usually regarded as the most orthodox traders. In the long process of waiting for the trend, the account may wear out due to constant losses, which is very challenging, so there are very few trend traders in the FOLLOWME trading community. The community signal @a3xx has a maximum weakening period of more than 70 days, and many copiers will close the signal during the weakening period, resulting in unable to keep up with profitable orders; and the trend trading of @jason1818 , holding positions for about 500 days, makes ordinary traders impossible to copy.

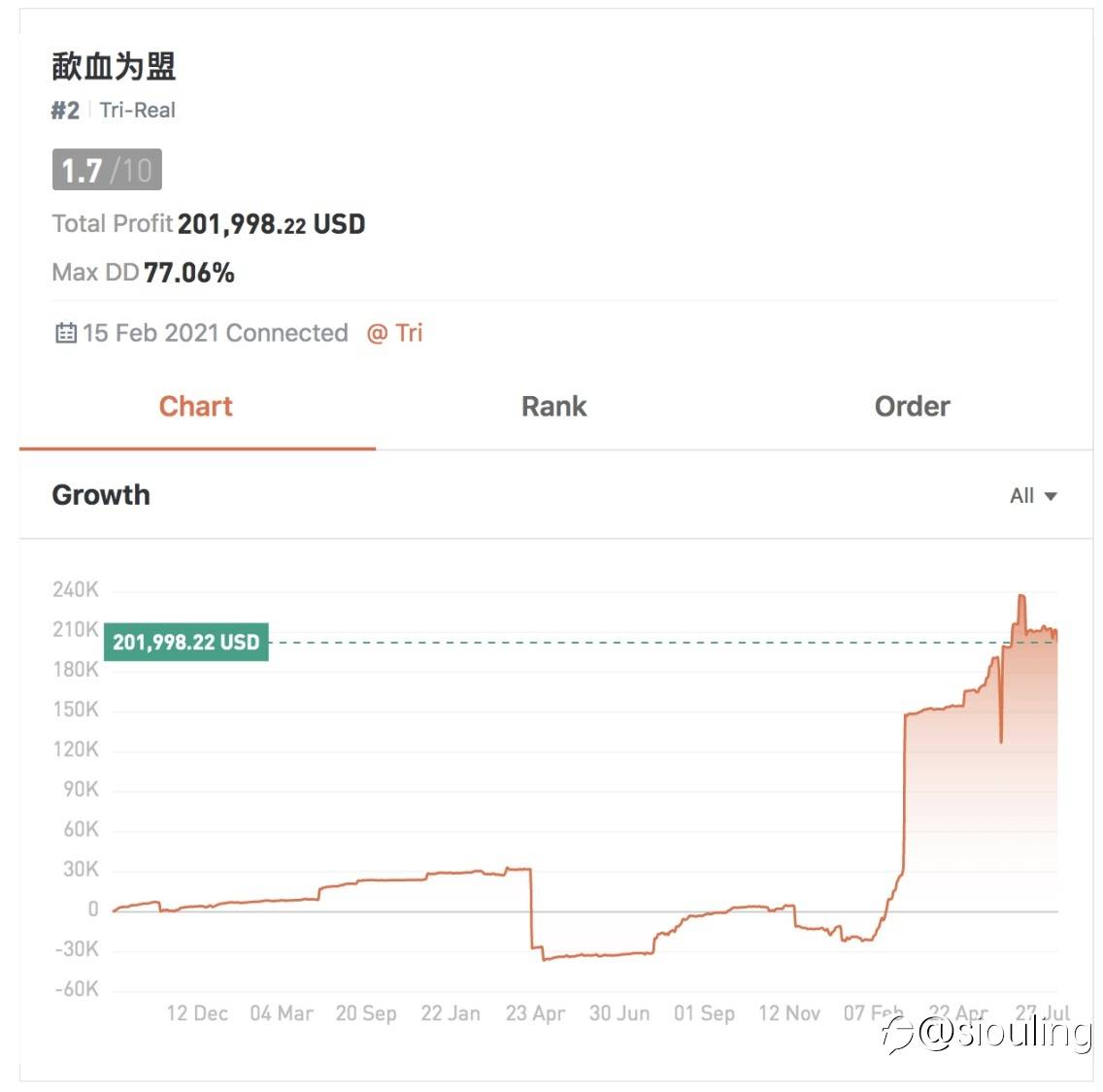

Swing trading is a test of validity of the market shape. For a certain period of time, if the guessing method is accurate, the system will work, and huge profits can be obtained. For example, one of the most famous community trader @歃血为盟 , who makes huge profit orders, but once the system fails, it’s very challenging to stick to it. Take @期市J神 as an example, his account has gone through a period of decline for more than a year, and he waited, and finally soaring to the sky.

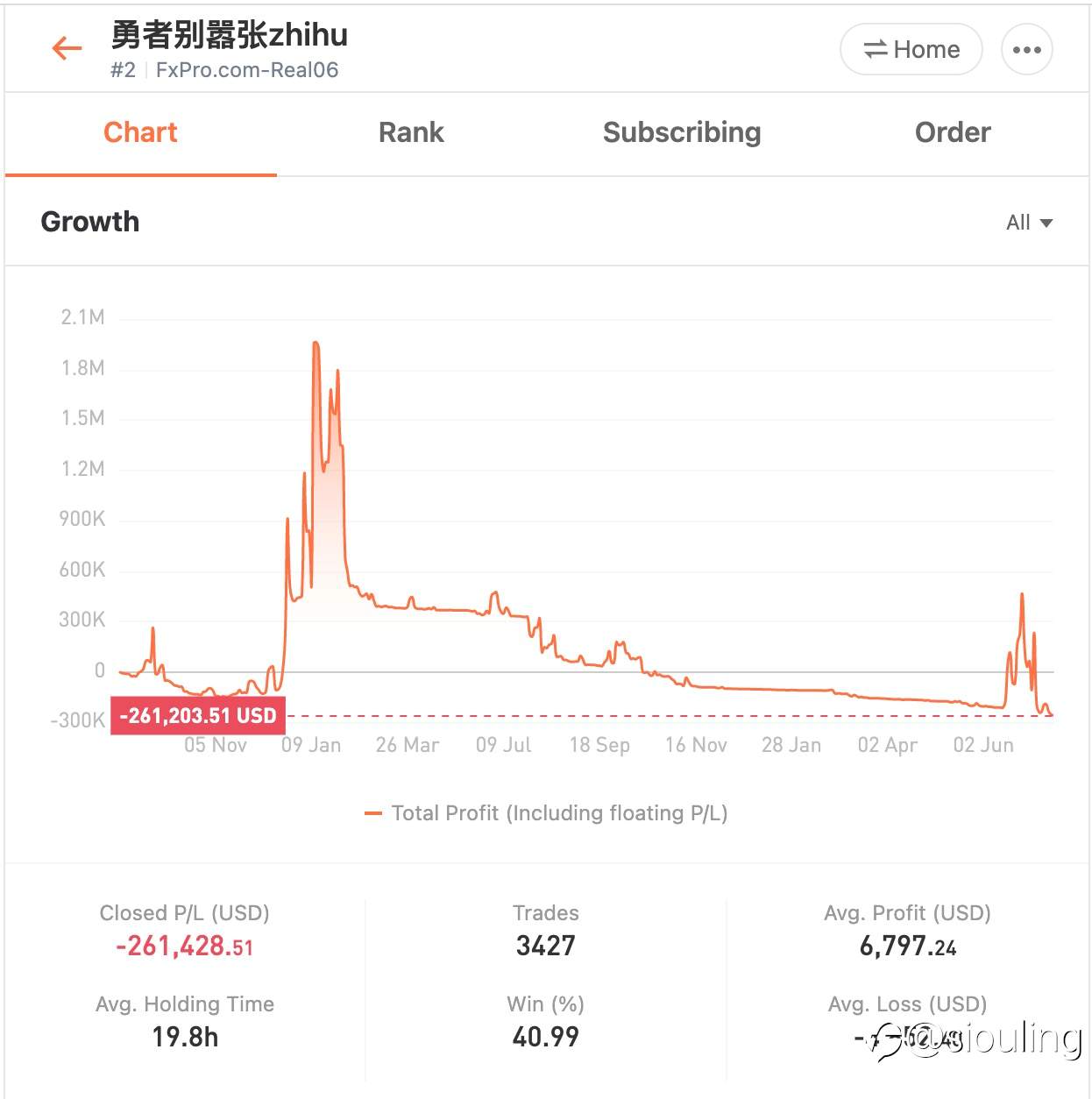

Another example is @勇者别嚣张zhihu , a firm follower of Elliott’s wave theory, and a practitioner of “all in”. He once gained 2 million (RMB) profits in a single month, and for a long time since then, his account has been losing money. The market just quite recently starts to fit his trading model. It can be said that the whole process is very draining and challenging to him.

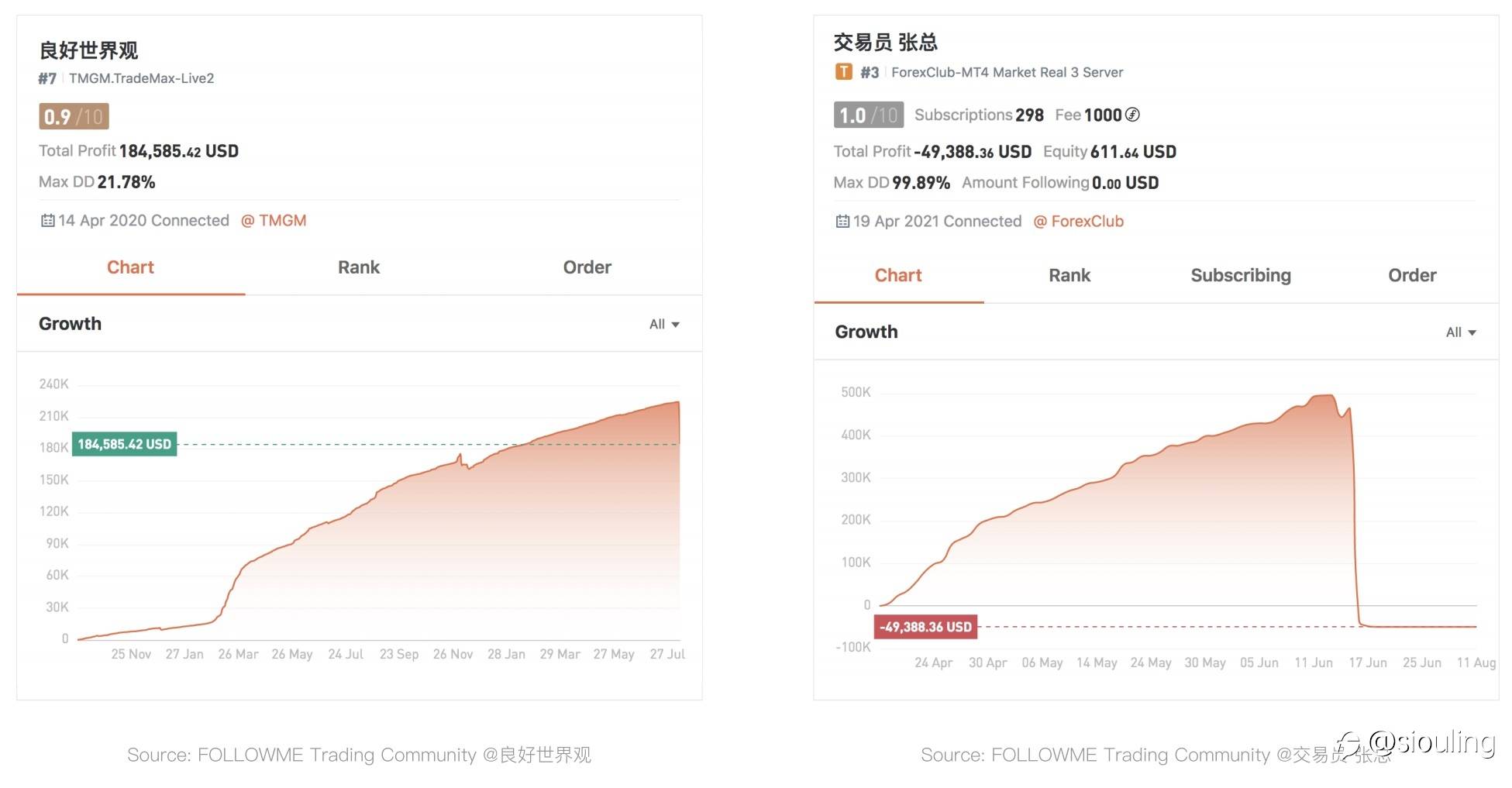

Practitioners of Martin strategy, they hope that the market will be in volatility for a long time, even though the market is very compatible with them most of the time, but the devil has always existed, and the market is constantly falling or rising slowly, which often terminates a Martin strategy. Without a strong heart and timely risk control to stop losses, the account may be swallowed.

A well-known Chinese trader Qingze once said, "To say the market has no rules, that’s not true. It indeed has some vague rule." It is this seemingly irregular pattern that constantly tests the mentality of traders and make them constantly doubt themselves in the volatile market. So how do we dispel the doubts and find our beliefs?

3. In the idealism of ancient China, one of the main arguments of the "Book of Changes" explained by Laozi's philosophy and Confucianism is that "moving the opposite way", which can provide a fulcrum to balance the trading mentality.

The opposite of Taoism refers that the development of a certain thing must first starts from its opposite. This is also why Chinese nation rises at its darkest time, that’s because they believe that darkness will pass and light will come. With such confidence and belief, we know how to act. If we want to be strong, we must start from the weakest. If we want excess profits, we must start from accepting losses.

To put it simply, things must be counterproductive. When we apply such a thinking to trading, we will inevitably find a balance of mentality, that is, the market will not always meet your profit model, each profit model can be verified, but the market is reflexive.

Trend and volatility are opposite. Trend traders have to admit that the volatility lasts longer than the trend. Traders must try and make mistakes during the oscillating period to ensure that they don’t miss the market. They must be brave enough to stay long when the trend comes to ensure profits. Then in a painful period of weakness, they must firmly believe that the cycle of making money is coming. Swing traders must admit that the market is unpredictable and that there is no accurate prediction. What you do is just to make profits and stop losses, and to make money bravely when the market conforms to the model, and resolutely stop losses when the model fails. Martingale and scalp traders should also realize that the trend of unilateral market will inevitably come, regardless of the size of the funds, an appropriate risk control line should be set, and the stop loss must be set and it will be triggered.

#Tradingpsychology# #SwingTrading# #ElliottWaves# #Scalping#

Disclaimer: The views expressed are solely those of the author and do not represent the official position of Followme. Followme does not take responsibility for the accuracy, completeness, or reliability of the information provided and is not liable for any actions taken based on the content, unless explicitly stated in writing.

Leave Your Message Now