Inflation Is Running Hot!

JUN 16, 2021

Annual inflation at multi-year high.

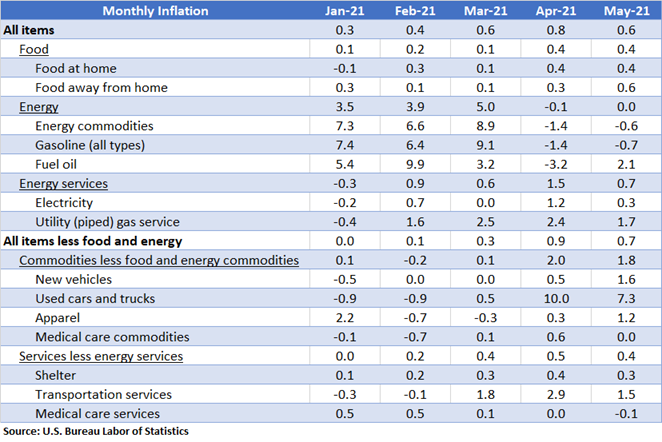

The U.S. Bureau of Labor Statistics (BLS) reported a sharp rise in consumer prices once again. Headline inflation was reported to have increased by 0.6% in May while core inflation increased by 0.7%. Over the last 12 months, headline inflation increased by 5.0%, the highest 12-month increase in 13 years, while core inflation rose by 3.8%, the largest 12-month increase in 29 years. For the second straight month, prices under the Used Cars and Trucks category continue to be the main driver of inflation, contributing to one-third of the inflation rise.

What’s pushing prices up?

Although jobs creation is starting to pick up this year, with a total of around 2.1 million jobs being added into the economy from January to May, the jobs market is still falling short from the pre-pandemic level by around 7 million jobs. That being said, we can expect a full recovery of the jobs market to take quite some time. As mentioned in the post U.S. Jobs Growth Accelerated But Fell Short Of Expectation, many firms reported difficulty in filling job vacancies with suitable candidates, resulting in a slowdown in jobs creation. As a result, firms have to compete among themselves for manpower by raising wages in an attempt to recover lost employment. This action undertaken by firms may lead to the “wage push inflation” effect which pushes inflation higher.

The wage push inflation effect happens when firms increase wages, leading to an increase in the operating cost of their businesses, eventually charging more for their products and/or services in order to cover the cost. Also, the increase in wages will lead to an increase in spending power of consumers, leading to an increase in demand of goods, which will eventually push the price of goods in the broader market higher.

Another factor that contributed to the rise in prices is the recent disruption of supply chain. This has led to a shortage of components for manufacturing and an increase in freight charges which pushes the prices of end products higher.

Is high inflation still transitory?

The FOMC is scheduled for a monetary policy meeting this week. It is likely that the central bank will maintain their view that inflation is transitory and will ease in the near future. Looking at the inflation data for this year, we see that the main drivers (Gasoline and Fuel Oil) for the increase in prices during the first quarter are oil-related. The increase in oil prices during the first quarter was mainly due to the 1 million barrels-per-day voluntary cut carried out by Saudi Arabia. However, as oil prices recovered to their pre-pandemic levels, the OPEC+ agreed to gradually increase oil production. Hence, we can see inflation under the Gasoline and Fuel Oil categories start to decline from April onwards.

So far in the second quarter, the main driver of inflation has been the prices of Used Cars and Trucks. The rise in demand of second-hand vehicles resulted from a decline in supply of new vehicles due to a shortage of computer chips required for manufacturing. Similar to the inflation caused by the rise in oil prices, second-hand vehicles prices will stagnate and eventually decline once the shortage of chips is resolved. To sum up, the two main contributors to the recent spike in inflation, oil and second-hand vehicles prices, have temporary effects and will be subdued in time to come. This will lead to a decline in overall inflation.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.