GBP/USD Forecast: Sterling set to resist dollar storm on vaccine milestone, improving technicals

- GBP/USD has been recovering as the US yields retreat from their highs.

- Britain's covid vaccine achievements may allow the pound to extend its recovery.

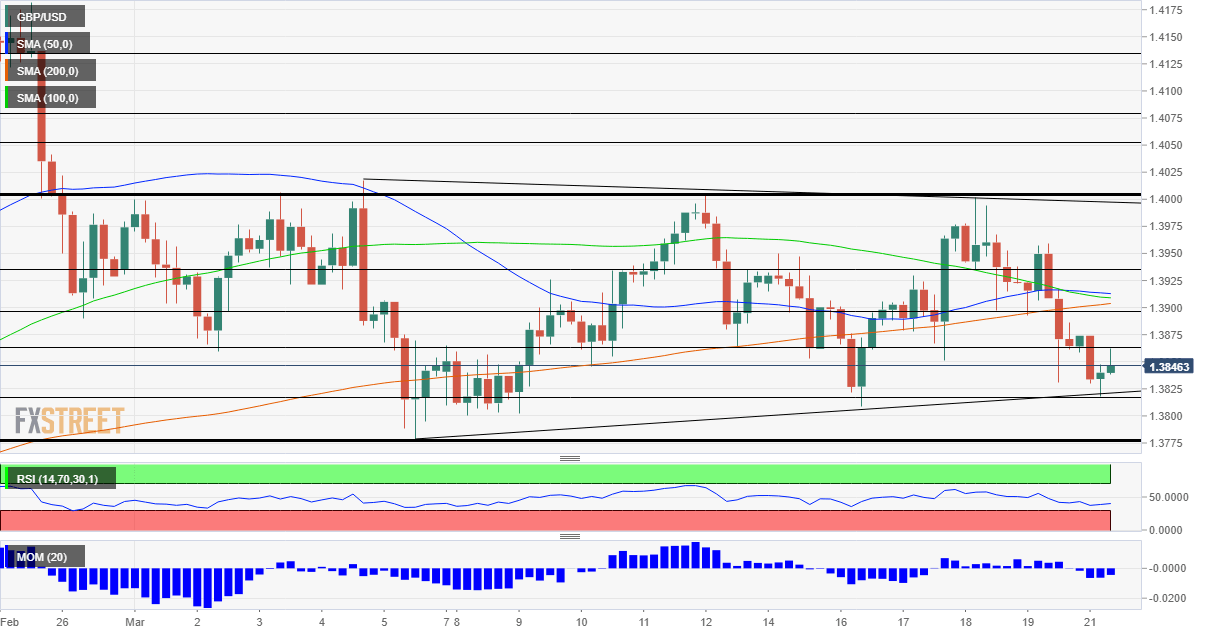

- Monday's four-hour chart is showing cable is setting higher highs.

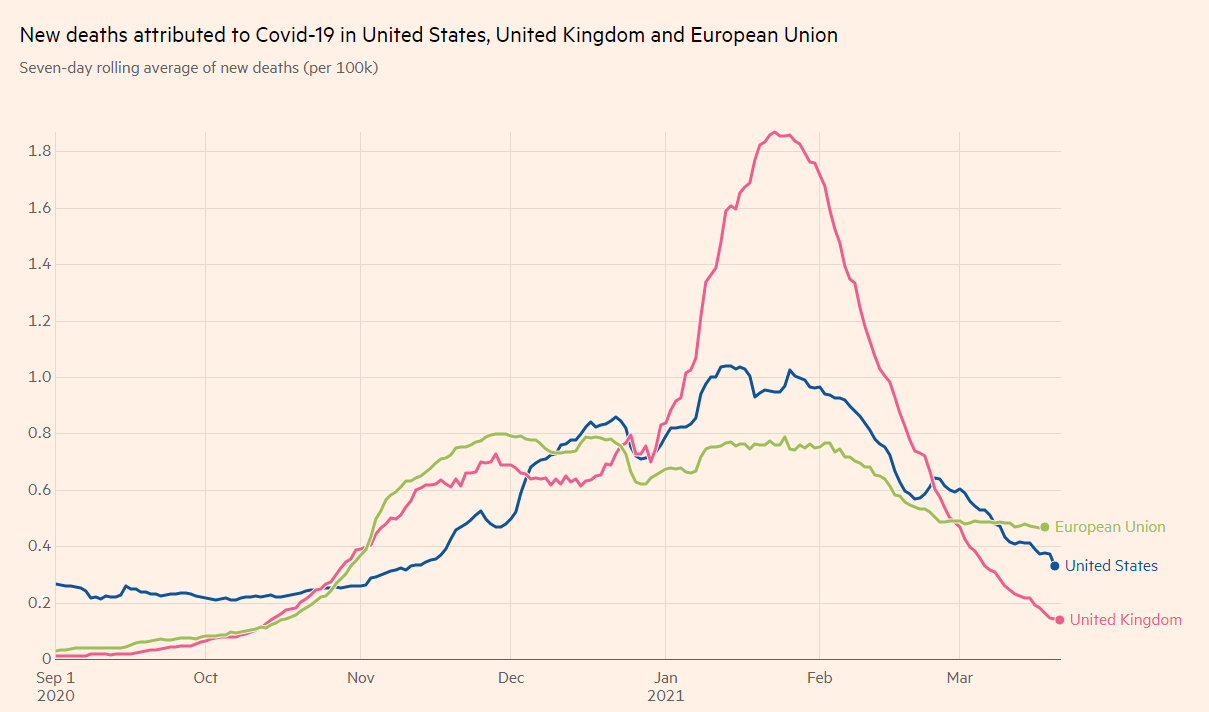

Nearly 27 jabs per second – that is on reflections of Britain's record day of vaccinations on Saturday, which concluded with over 873,000 injections. The UK's rapid immunization campaign is having a material effect in pushing death rates down, and sterling up, allowing it to weather dollar strength. Will it continue?

Vaccines allow Britain's gradual reopening to proceed with confidence, especially after the country reached 50% of all adults. The downside comes due to clashes with the EU over imports and exports of doses. The bloc is far behind the UK and is frustrated that AstraZeneca's inoculations made on EU territory are exported to Britain. Brussels has threatened to block shipments and UK Prime Minister Boris Johnson will reportedly call leaders on the continent to calm things down.

COVID-19-related deaths are falling in the UK:

The UK is already suffering from potential issues with vaccine supplies from India and may and another delay would postpone the administering of second doses. Nevertheless, the campaign may have reached a point of no return where a significant part of the population has enough immunity to prevent new lockdowns. Such optimism may continue supporting the pound.

In the US, returns on ten-year Treasuries have stabilized around 1.70% after storming higher late on Friday. The Federal Reserve announced it is letting the pandemic era SLR exemption to lapse – a move that forces commercial banks to reduce some of their bond holdings. After several jitters, investors concluded that the effect is limited.

The next moves for the greenback are also set to come from the Federal Reserve. Chair Jerome Powell will deliver a speech on Monday, the first out of three public appearances in which he will likely reiterate his message of ongoing support – and dismissal of inflation concerns. Bond auctions due out later in the week are also eyed.

Powell's second and third and speeches are before Congress, which recently approved President Joe Biden's $1.9 trillion covid relief program – and may be asked to debate additional measures. According to the media in Washington, the White House is planning a bill that includes infrastructure spending and tax hikes. Markets have yet to react.

All in all, while the dollar is set to remain strong, the sterling has a fair chair of putting up a fight.

GBP/USD Technical Analysis

The pound/dollar has been setting higher lows since it hit a low of 1.3775 in early March. This is a bullish sign that counters downside momentum on the four-hour chart. The cable is also trading under the 50, 100, and 200 Simple Moving Averages. While bears are in the lead, bulls are not giving up.

Resistance awaits at the daily high of 1.3860, followed by 1.39, which provided support last week. Further above, 1.3940 and 1.40 are eyed.

Support is at 1.3820, which is the daily low, followed by 1.3805 and 1.3775 mentioned earlier.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.