Daily Market Report - 22th Jan 2021

Official Website: https://www.nooralmal.com/

EURUSD

The EUR/USD pair advanced to 1.2172, within the ECB monetary policy announcement, to stabilize around 1.2150. The shared currency surged on prevalent optimism, and as the European Central Bank maintained its current monetary policy while pledging to keep supporting the economy through the pandemic. President Christine Lagarde confirmed that the stimulus program will continue at least until March 2022, adding that current levels of facilities are good for now.

Data coming from the US was pretty encouraging, as Building Permits rose 4.5% in December, while Housing Starts were up by 5.8%. Initial Jobless Claims contracted to 900K in the week ended January 15, better than the 910K expected. Also, the Philadelphia Fed Manufacturing Survey printed at 26.5, improving from 9.1 and much better than the 12 expected.

This Friday, Markit will publish the preliminary estimates of its January PMIs for the EU and the US. Services output is expected to have fallen further into contraction in the Union, mainly due to the different coronavirus-related restrictions. The US will also publish December Home Sales.

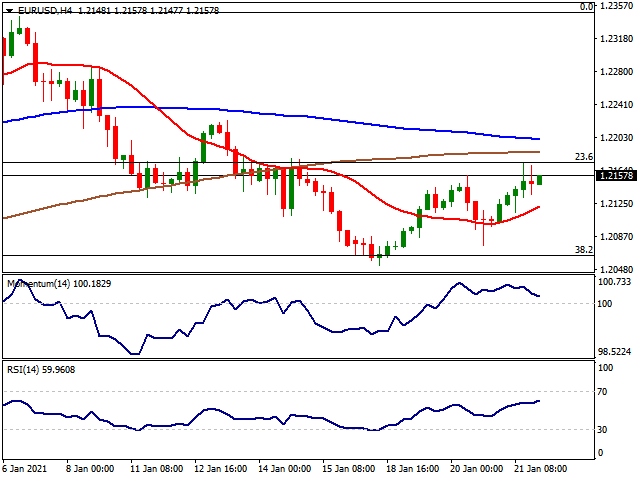

The EUR/USD pair topped at the 23.6% retracement of its November/January rally, holding on to modest intraday gains. The 4-hour chart shows that the pair is above a bullish 20 SMA, but below the larger ones, which are flat above the mentioned Fibonacci resistance level. The Momentum indicator retreated within positive levels, while the RSI is flat around 57, indicating limited selling interest. Bulls will have better chances on a break above the 1.2170 price zone.

Support levels: 1.2100 1.2060 1.2020

Resistance levels: 1.2170 1.2225 1.2260

USDJPY

The USD/JPY pair fell to 103.32, bouncing during US trading hours to settle in the 103.50 price zone. The pair traded alongside US Treasury yields, which eased in pre-opening trading but recovered during US trading hours. Nevertheless, the yield on the benchmark 10-year Treasury note settled at 1.10%, pretty much unchanged from its weekly opening level.

The Bank of Japan had a monetary policy. As widely expected, policymakers maintained the current policy unchanged. However, they downwardly reviewed this fiscal year’s growth to -5.6% from -5.5%. Governor Haruhiko Kuroda later said that it was too early to consider an exit from the ongoing “powerful” monetary stimulus. The country also published the December Merchandise Trade Balance, which posted a surplus of ¥751 billion, below expected but more than doubling the previous monthly reading. This Friday, Japan will publish December National inflation, and the January preliminary Jibun Bank Manufacturing PMI, foresee at 50.5 from 50 previously.

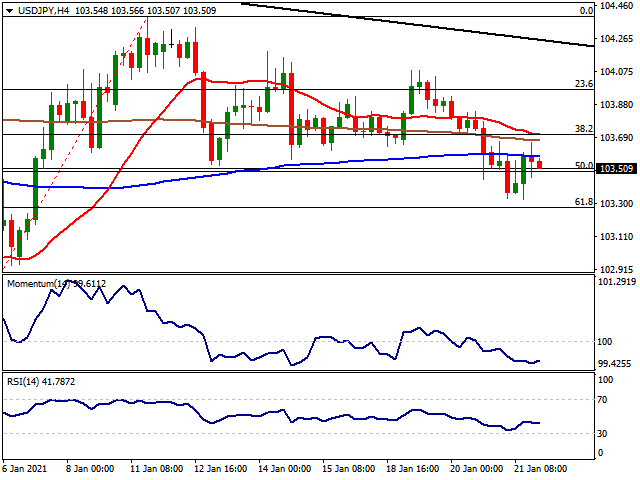

The USD/JPY pair retains its bearish stance in the near-term, despite bouncing from daily lows. The 4-hour chart shows that the pair remains below all of its moving averages, which anyway remain directionless and confined to a tight range. Technical indicators stand within negative levels, off their daily lows but without directional strength. A steeper decline could be expected on a break below 103.25, the 61.8% retracement of the January’s rally.

Support levels: 103.25 102.90 102.55

Resistance levels: 104.05 104.40 104.80

GBPUSD

The GBP/USD pair hit 1.3745, its highest since May 2018, ending Thursday with gains above the 1.3700 level. The pair was underpinned by the prevalent risk-appetite, which was more notorious during the European session. The positive sentiment eased as the day went by, with US indexes finishing the day mixed, but not far from their opening levels. Meanwhile, the number of new daily coronavirus contagions and deaths in the UK continues to retreat. Nevertheless, the government is considering extending restrictive measures while escalating vaccine-induced immunization.

The UK didn’t publish relevant macroeconomic data but will release this Friday, January GFK Consumer Confidence, foreseen at -29 from -26 in the previous month. Markit will release the preliminary estimate of the January Manufacturing PMI, expected at 54, and the Services index for the same month, foreseen at 45 from 49.4 in the previous month.

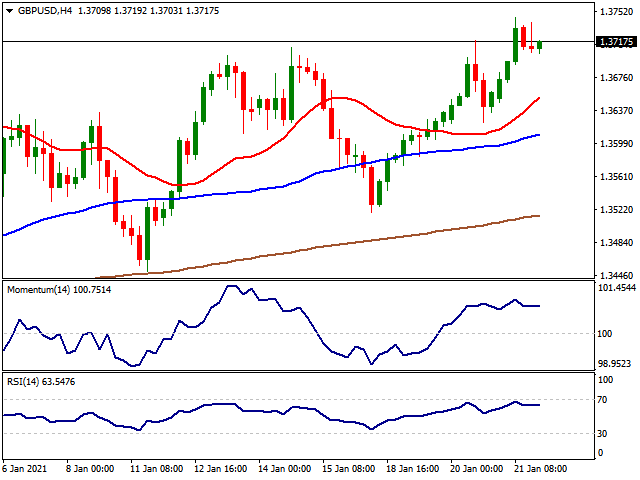

The GBP/USD pair is hovering a few pips above the 1.3700 threshold, neutral-to-bullish in the near-term. The 4-hour chart shows that technical indicators have lost bullish momentum but also that they remain within positive levels. Meanwhile, the pair keeps developing above all of its moving averages, with the 20 SMA accelerating north above the larger ones.

Support levels: 1.3670 1.3620 1.3585

Resistance levels: 1.3745 1.3790 1.3830

AUDUSD

The AUD/USD pair peaked at 0.7780 this Thursday, boosted by encouraging Australian employment data. The country added 50K new job positions as expected in December, 36.5K of them full-time positions. The unemployment rate came down to 6.6% from 6.8%, beating expectations of 6.7%. Consumer Inflation Expectations in the country stood at 3.4% in January, down from 3.5% in the previous month.

During the upcoming Asian session, Australia will publish the preliminary estimate of January Retail Sales, previously at 7.1%. The country will also release the Commonwealth Bank Services PMI, foreseen at 57.4 from 57 previously, and the Manufacturing PMI, expected at 55.9 from 55.7.

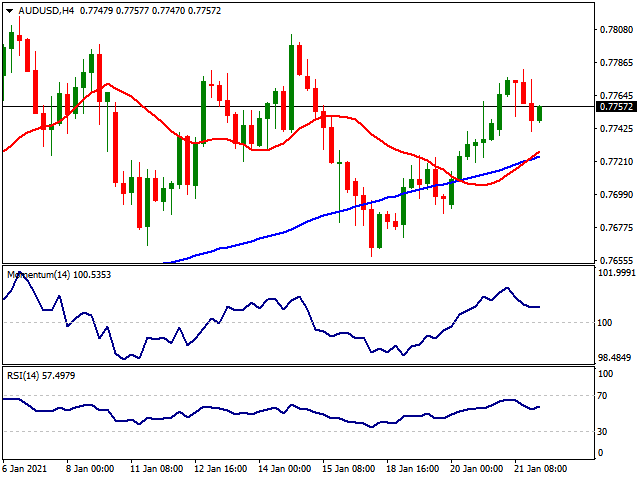

The AUD/USD pair is comfortable around 0.7750 little changed for the day. The 4-hour chart shows that it remains above bullish moving averages, with the 20 SMA and the 100 SMA converging around 0.7720, providing dynamic support. Technical indicators have eased from near overbought readings, but lost bearish strength within positive levels, indicating limited bearish interest.

Support levels: 0.7720 0.7690 0.7655

Resistance levels: 0.7770 0.7815 0.7850

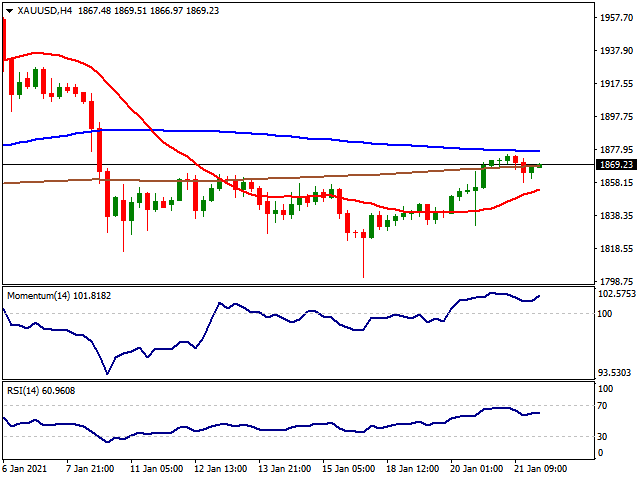

GOLD

Gold had an indecisive trading session on Thursday failing to end the day in the positive zone failing to capitalise the decline seen in the USD index DXY. Despite the decline seen in DXY, the index managed to hold over 90.00 levels while the US 10-year yield managed to re-gain 1.10% which pressured Gold. Apart from the extreme liquidity, higher inflation expectations should support Gold generally. However the activity in the benchmark bond yield is limiting the expected rally in precious metals. On the other hand, near-zero rates are also helping non-yielding Gold. Under normal conditions, the Fed should start to tighten its monetary policy as soon as economic activity picks-up pace in the post-pandemic era. However, the current debt-pile of the US might delay the increase in the rates even if the economy is normalised.

Gold is expected to keep its current range between $1,800 and $1,900 for the coming term. From the technical point of view, below the $1,860 level, the supports can be followed at $1,800, $1,763 ($1,451-$2,075 61.80%) and $1,700 levels. Over the $1,860 level, the resistances can be followed at $1,900 with $1,956 ($1,451-$2,075 38.20%) and $2,000 levels.

Support Levels: $1,800 $1,763 $1,700

Resistance Levels: $1,900 $1,956 $2,000

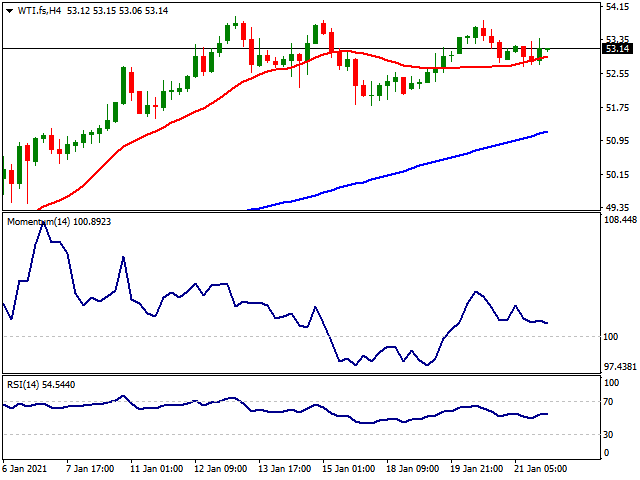

CRUDE WTI

As the stockpiles grew bigger in the US, WTI faced some selling pressure on Wednesday finding resistance at the $53.80 zone once again. As per the latest Crude Oil Stock report from the American Petroleum Institute (API), 2.562 million barrels of oil were added to the inventories versus the previous depletion of 5.821 million. WTI had a solid rally which started in last November as the first news hit the markets about the coronavirus vaccine. After that, OPEC+ supply adjustments with Saudi Arabia’s voluntary production cut gave WTI additional boost lifting the black gold to its pre-pandemic levels. However, despite the positive developments, the current situation in the pandemic is far from ideal. Therefore, WTI needs a new catalyst to keep its bull run.

If WTI keeps its position below $52.00 level, $51.03 (October 2019 low), $50.60 (June/August 2019 support) and $50.00 levels can be followed as new targets. Over the $53.00 level, the resistances might be followed at $53.93 ($63.33-$51.03 %23.60), $55.73 ($63.33-$51.03 %38.20) and $57.13 ($63.33-$51.03 %50.00).

Support Levels: $51.03 $50.60 $50.00

Resistance Levels: $53.00 $53.93 $55.73

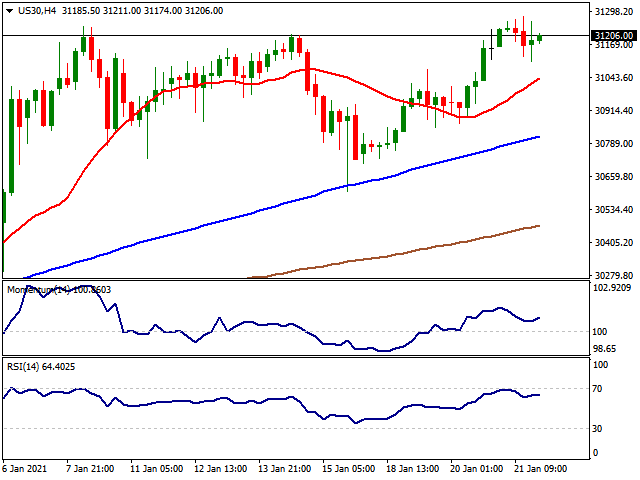

DOW JONES

The risk appetite continues to dominant the US equity markets as Dow Jones is inching higher its all-time highs day by day. Reflecting the risk appetite, the US index DXY continued its decline through the 90.00 level after having a correction from its current lows. s President Biden is expected to be supported by Treasury Secretary nominee Janet Yellen in keeping fiscal policy accommodative to prop up the economy. The new administration has also bolstered expectations for a faster containment of the COVID-19 pandemic, which is likely to undermine economic growth in the fourth quarter. On the data side, Initial jobless claims fell to 900,000 during the week ended Jan.16 from the previous week's 926,000, beating expectations for a decline to 910,000, according to the US Labor Department and data compiled by Trading Economics. At this point, Biden administration’s fiscal stimulus plan approval will play a crucial role for the US indexes to keep their bull-run.

From the technical point of view, if the index stays over 31,000, 32,000 and 32,500 levels can be followed as new targets high while below the 31,000 level, 30,000 and 29,500 levels can be followed as supports.

Support Levels: 31,000 30,000 29,500

Resistance Levels: 32,000 32,500 33,000

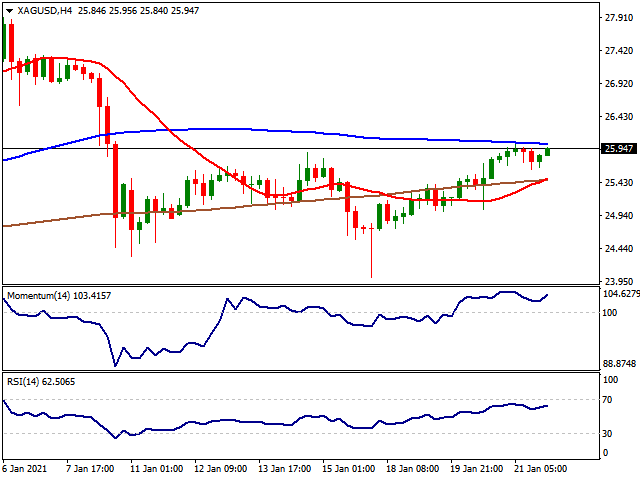

SIVLVVVERR

Despite the negative-undecisive session seen in Gold, Silver had a better session on Thursday pushing Gold to Silver ratio to 72.00 level. While both silver and Gold are good hedge against inflation, Gold is facing headwinds lately because of the rally seen in the US 10-year yields. On the other hand, Silver looks stronger than Gold against the inflation. Break-even inflation expectations rallied on Wednesday, with 10-year break-evens at one point rising as high as 2.1% from 2.09% on Tuesday and 30-year break-even rising back towards multi-year highs around 2.12% from under 2.10% on Tuesday. As Silver outperformed Gold clearly in terms of annual gains, it is highly expected that the same scenario will be valid for 2021 especially with the expected normalisation in manufacturing sectors.

If Silver manages to stay over $27.00, next targets upside might be followed at $29.28 (March 2013 resistance) and $30.00 levels. Below the $27.00 level, the supports might be followed at $25.00, $24.00 and $23.38 levels.

Support Levels: $25.00 $24.00 $23.38

Resistance Levels: $27.00 $29.28 $30.00

MACROECONOMIC EVENTS

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.