Daily Market Report - 25th Nov 2020

NCM Investment - The Festival of GOLD

OPEN ACCOUNT AND GET A CHANCE TO WIN GOLD

For more details: https://www.nooralmal.com/gold...

Official Website: https://www.nooralmal.com/

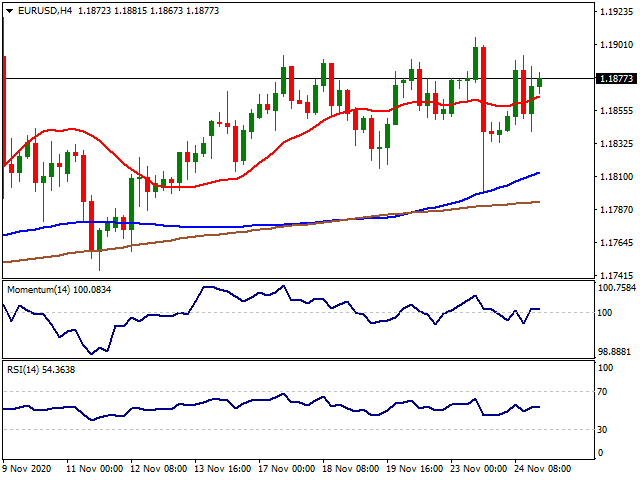

EURUSD

The EUR/USD pair seesawed between gains and losses this Tuesday, ending the day with gains near a daily high at 1.1893. The EUR found support on local data, as the German Q3 GDP was upwardly revised to 8.5%, while the November IFO survey on Business Climate met expectations with 90.7. The assessment of the current situation beat expectations, although expectations contracted by more than anticipated.

The greenback recovered ahead of Wall Street’s opening but fell under selling pressure after US Consumer Confidence fell in November to 96.1 from 101.4 in the previous month, according to the Conference Board. Meanwhile, news that US President Trump has agreed with the transition process with Joe Biden and vaccine hopes lifted the market’s mood.

Wednesday will be quite a busy day in the US, as the country will publish October Durable Goods Orders and the second estimate of Q3 GDP. Given the shortened week due to the Thanksgiving holiday, the country will also publish Initial Jobless Claims and the final version of the November Michigan Consumer Sentiment Index.

The EUR/USD pair retains its neutral technical stance in the near term, trading around 1.1880 ahead of the Asian opening. The 4-hour chart shows that the pair is trading a few pips above a directionless 20 SMA, after meeting buyers around the 100 SMA on Monday. Technical indicators are stuck to their midlines, lacking directional strength. The pair needs to clear the 1.1920 resistance area to actually turn bullish, while the risk will turn to the downside on a break below 1.1810.

Support levels: 1.1860 1.1810 1.1770

Resistance levels: 1.1920 1.1960 1.2010

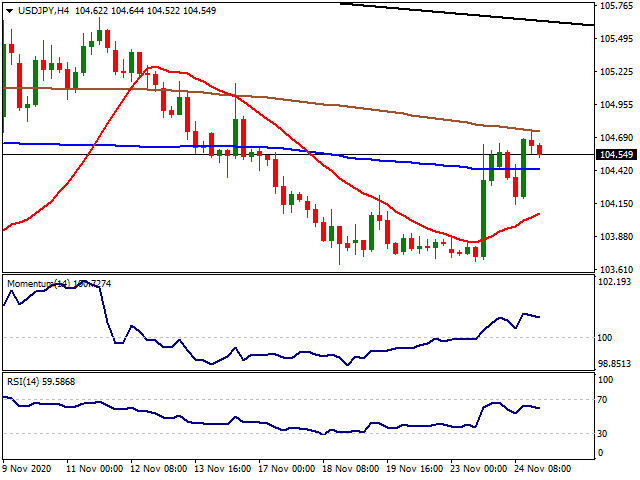

USDJPY

The USD/JPY pair reached a fresh weekly high of 104.75 during the American session, following Wall Street´s lead and as the Dow Jones Industrial Average surpassed the 30,000 threshold for the first time ever. Cooling US political tensions, vaccine hopes and encouraging US data released earlier this week boosted high-yielding assets. Also, US Treasury yields advanced, with the yield on the benchmark 10-year note hitting 0.89%.

Japan has had a light macroeconomic week so far, without releasing relevant data. This Wednesday, the country will publish October Corporate Service Price Index, foreseen at 1.2% YoY, down from the previous 1.3%.

The USD/JPY pair holds on to most of its daily gains, trading around 104.60, lacking bullish momentum. The 4-hour chart shows that it’s trading below a bullish 20 SMA and a flat 100 SMA, but also that it met sellers around the 200 SMA. In the meantime, technical indicators turned flat within positive levels, maintaining the risk skewed to the upside.

Support levels: 104.30 103.95 103.50

Resistance levels: 105.00 105.40 105.80

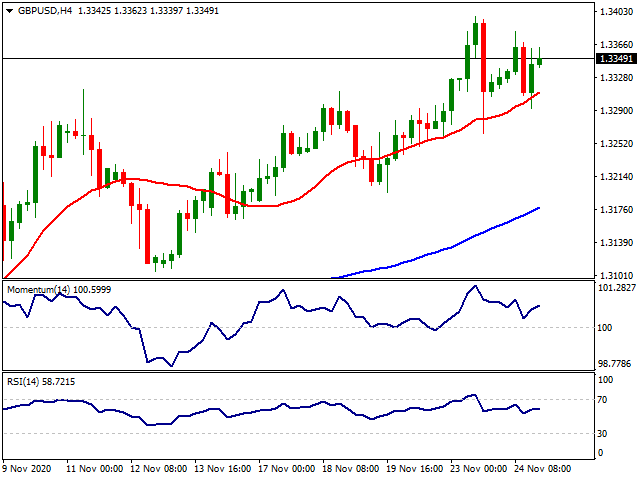

GBPUSD

The GBP/USD pair has advanced for a third consecutive day as broad optimism, and Brexit hopes continue to underpin the sterling, although it´s ending the day with modest gains. Trade talks between the EU and the UK extended into this week, and while weekend news suggested progress, nothing has been confirmed yet.

BOE’s Jonathan Haskel was on the wires this Tuesday and referred to Brexit and the coronavirus pandemic, indicating that both could affect the central bank’s outlook for 2021. He added that policymakers “have plenty” to do in terms of policy firepower. The UK won’t publish macroeconomic data this Wednesday.

The GBP/USD pair is biased higher, but the bullish momentum is limited by a cautious stance ahead of Brexit clarity. The 4-hour chart shows that the pair has bounced from a bullish 20 SMA, which led the way higher ever since the week started. The larger moving averages are accelerating their advance below the shorter one. Technical indicators remain within positive levels but lack strength enough to confirm an advance coming.

Support levels: 1.3310 1.3265 1.3210

Resistance levels: 1.3365 1.3410 1.3460

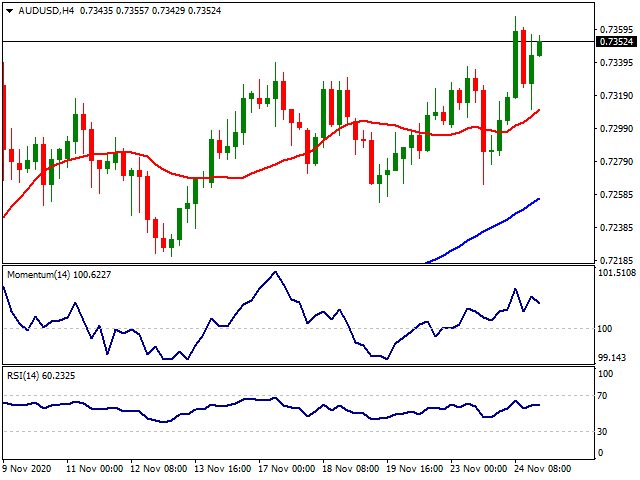

AUDUSD

The AUD/USD pair hit a fresh 2-month high of 0.7367, holding on to most of its daily gains as the US session comes to an end. The pair rallied despite discouraging Australian data, as the trade surplus in October resulted at 4840M, down from 5630M in the previous month. Imports rose 8% in the month, while exports were up by 6%. Rallying equities provided support to the pair during US trading hours. This Wednesday, Australia will publish Construction Work Done, seen declining by 2% in the three months to September, after falling by 0.7% in the second quarter of the year.

The AUD/USD pair is trading in the 0.7350 price zone, poised to extend its advance. The 4-hour chart shows that a mildly bullish 20 SMA provided intraday support, currently at 0.7310. The 100 SMA has accelerated north below the shorter one. Technical indicators, on the other hand, lack directional strength but remain within positive levels. The next relevant resistance and the bullish target is 0.7413, the year high achieved last September.

Support levels: 0.7335 0.7290 0.7250

Resistance levels: 0.7370 0.7415 0.7540

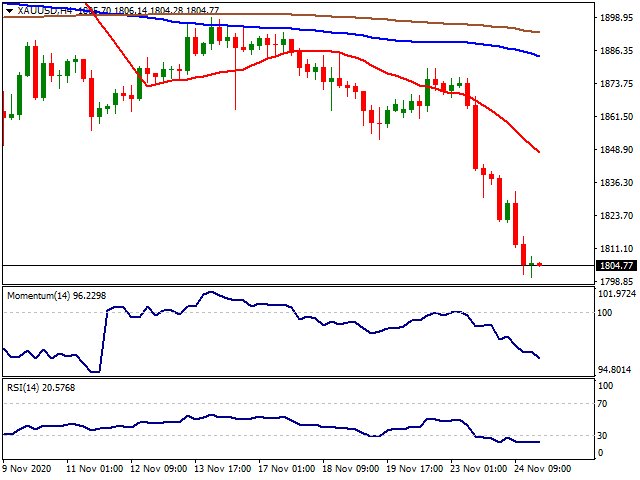

GOLD

Vaccine news combined with the transition of the White House continued to push Gold lower on Tuesday. As Biden is getting ready to take over the White House, markets are cheering up one less uncertainty. On the other hand, despite the current gloomy look of the pandemic, traders are willing to price the vaccine news that might end the pandemic way before it is expected. Despite the small retracement seen in the USD index DXY, Gold slashed almost $40 on Tuesday testing an important support level at $1,800 while the US indexes rallied to new highs. As the election results are resolved and vaccine news creates massive optimism, markets are gearing up to year-end trading to maximize their annual gains.

From the technical point of view, below the $1,860 level, the supports can be followed at $1,800, $1,763 ($1,451-$2,075 61.80%) and $1,700 levels. Over the $1,860 level, the resistances can be followed at $1,900 with $1,956 ($1,451-$2,075 38.20%) and $2,000 levels.

Support Levels: $1,800 $1,763 $1,700

Resistance Levels: $1,900 $1,956 $2,000

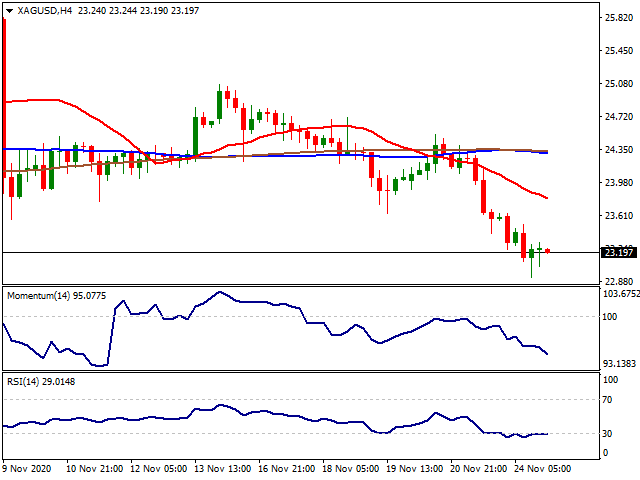

SILVER

As the precious metals faced a massive sell-off on Tuesday with the improved risk appetite, Silver tested a key support level at $22.90. Vaccine news started to create a bet against the much expected Fed stimulus combined with the better than expected macro-data readings lately. The stimulus deal was the only hope for the precious metals due to its impact on the USD as an extreme amount of liquidity was expected to be injected into the markets.

Below the $22.90 level ($11.63-$29.86 38.20%), the supports can be followed at $20.75 ($11.63-$29.86 50.00%) and $18.42 ($11.63-$29.86 61.80%). Over the $22.90 level, the target's up can be followed at $25.21 ($11.63-$29.86 23.60%), $26.00 (August-September support), $27.00 and $28.00 levels.

Support Levels: $22.90 $20.75 $18.42

Resistance Levels: $25.21 $26.00 $27.00

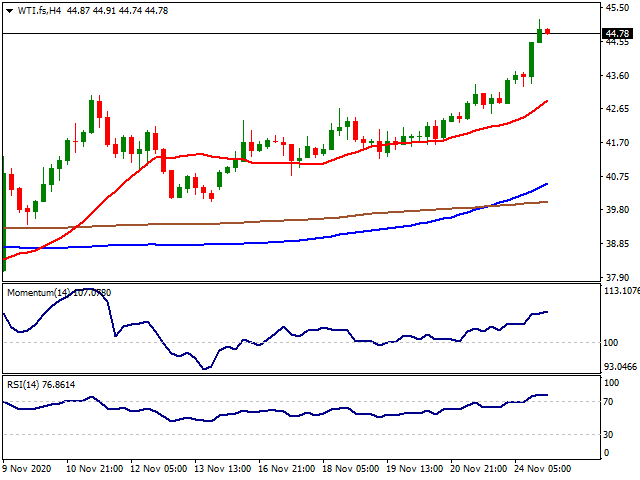

CRUDE WTI

Improved market sentiment boosted WTI to its highest level since March testing over $45.00 on Tuesday. As the clouds over the US election fades, the risk appetite intensified carrying the US indexes to new all-time highs. Also, the expectation of an increase in the oil demand continued to support WTI combined with the latest stock data set in the US. On the geopolitical side, Yemen’s Houthi rebel group attacked a Saudi Aramco distribution station in the Saudi Arabian city of Jeddah and a fire reportedly broke out. However, Aramco's said its supply of fuel to customers was not affected.

If WTI manages to hold over $42.00, next targets upside can be followed at $44.00 (February 2020 low), $48.64 (March 2020 high) and $50.00. Below the $42.00 level, supports can be followed at $41.00 and $40.00 consolidation zone.

Support Levels: $42.00 $41.00 $40.00

Resistance Levels: $44.00 $48.64 $50.00

DOW Jones

Dow Jones renewed its all-time high at 30,116 level on Tuesday as The General Services Administration (GSA) acknowledged President-elect Biden as the winner and will release the necessary resources and services that will allow his team to be prepared for national security threats and coordinate with Trump officials over several matters, including the coronavirus pandemic response. Vaccine news combined with better than expected US macro-data set with a more clear picture on the US election results boosted the risk appetite as the markets are heading through year-end trading. With the help of the vaccines, markets are pricing a faster re-opening of the economies at least in 2021 Q2 at the moment. Also, vaccine developments might delay or even cancel the second stimulus programme. Wednesday will be packed with the US macro-data readings as the markets in the US will be closed due to Thanksgiving holiday on Thursday.

From the technical point of view, if the index stays over 29,000, 29,500 and 30,000 levels can be followed as new targets high while below the 28,400 level, 28,000 and 27,770 can be followed as supports.

Support Levels: 28,400 28,000 27,770

Resistance Levels: 29,500 30,000 30,500

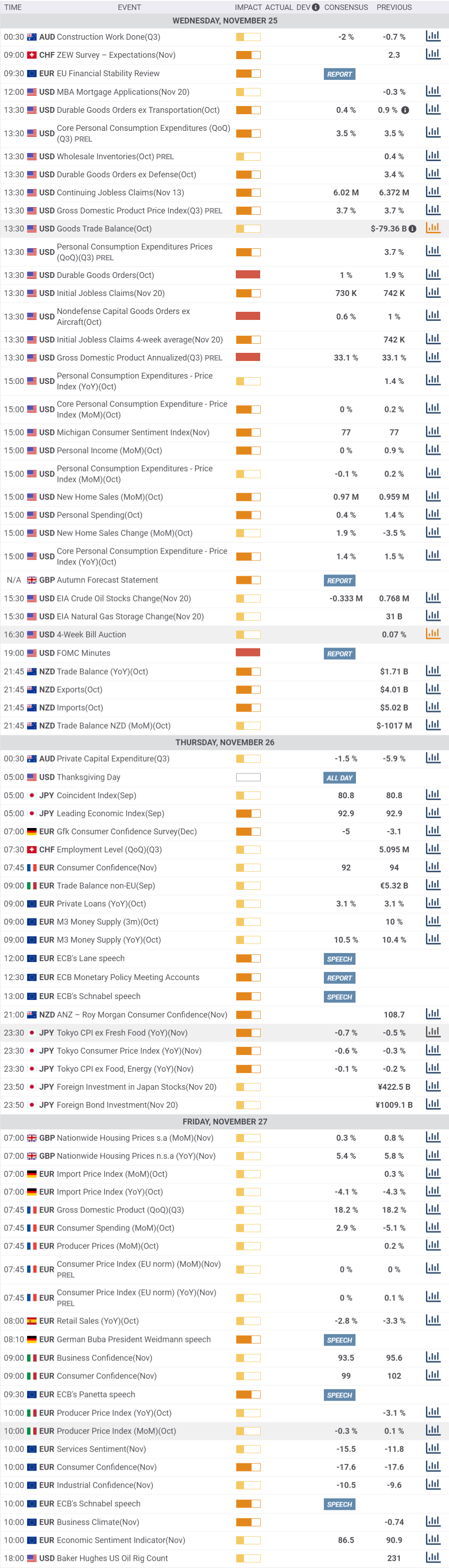

MACROECONOMIC EVENTS

MACROECONOMIC EVENTS

* All the Moving Average support and resistance levels are dynamic by nature. Means when the price approaches the Moving averages, slight variation occurs in the forecasted Moving Average support and resistance levels. Previous few days’ intraday levels are also signicant while trading the current day as the price tend to hover around these levels for some time. Levels in red indicate strong, critical or vital.

Please remember that trading financial markets carry a high degree of risk to your capital. It is possible to lose more than your initial stake. Leveraged products may not be suitable for all investors, therefore please ensure you fully understand the risks involved and seek independent advice if necessary.

All Rights Reserved © Noor Al Mal

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.