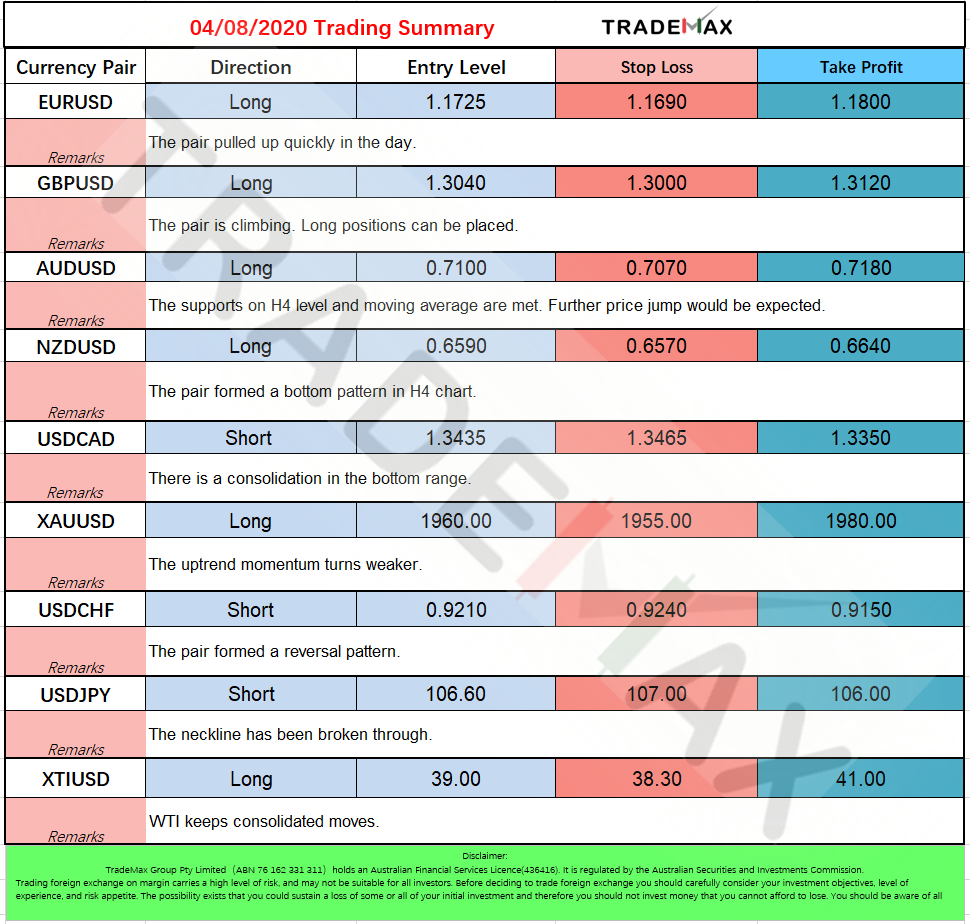

Market Insights 4 August 2020

Market Overview

EUR/USD’s pullback from Friday’s 26-month high of 1.1909 looks to have stalled with key data

reviving concerns about the health of the US job market. The European equities are likely to

track their Asian counterparts higher. That would further weaken the demand for the USD,

benefiting the spot.

With the US dollar selling back on the cards, Gold’s quest for the $2,000 level extends into

August, as it consolidates the rebound to near $1,980 region. The bulls continue to struggle at

higher levels, with a convincing break to the upside awaited.

EURUSD

If 1.19 is a short-term top, then we can expect to see a proper correction lower to unfold over

the coming weeks.

As analysts at Commerzbank have pointed out, EUR/USD last week sailed tough resistance at

1.1800 - 1.1815, this was a 50% Fibonacci retracement, a 12-year resistance line and the

September 2018 high.

GBPUSD

An ascending trend line from July 20, at 1.3030 now, restricts the pair’s immediate downside

ahead of 1.3000 threshold. Alternatively, bulls’ dominance past-1.3200 will have multiple

resistances to tackle before attacking the yearly top surrounding 1.3285.

USDJPY

The USD/JPY pair crossed 10-day SMA for the first time in over two weeks on Monday. The same

helps the quote to extend Friday’s recovery moves from the lowest since March 12 towards a

short-term descending resistance line.

Other than the 106.50 immediate upside barrier, comprising the said trend line, multiple highs

marked during the early June and July months, around 107.55 also questions the pair buyers.

Meanwhile, a daily closing below 10-day SMA level of 105.80 can take rest on 105.00 before

revisiting the five-month lows near 104.20.

AUDUSD

Unless the quote slips below 0.7065 support-zone, comprising June 10 high and July 24 low,

bulls are less likely to stop dreaming for 0.7200. Though there will be multiple resistances

beyond the July month’s top near 0.7230, also the highest since early-2019, to challenge the

bulls afterward.

XAUUSD

Gold’s next resistance is aligned at $1,981. The spot needs to take out a powerful hurdle at $1,985,

in order to revive the bullish bias. Alternatively, a failure to defend $1,960, the next cushion of

$1,945 will offer some respite to the bulls.

The gold moves in an ascending triangle in H4 chart. Further price breakout would be expected.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

-THE END-