Ongoing upbeat US figures battled rising coronavirus cases and deaths. More significant US economic indicators, the European Central Bank's meeting, a leaders' summit, US politics – and COVID-statistics are all in the mix in a busy week.

This week in EUR/USD: Chinese optimism, US coronavirus, mixed data

The initial positive impact on EUR/USD came from China – not from the underlying currencies. Authorities in the world's second-largest economy encouraged a bullish stock market, boosting searches for opening a stock account – and sending global shares higher. The safe-haven US dollar came under pressure and allowed the currency pair. It is unclear if this effect will last.

Investors were also encouraged by a temporary fall in US coronavirus cases. However, the dip was mostly related to the "weekend effect" – administrative work is slower on Saturday and Sunday, resulting in lower figures early in the week.

However, high positive test rates and reports about overwhelmed hospitals began weighing on sentiment and supporting the greenback. Toward the end of the week, the daily death toll neared 1,000 once again, and strains on testing joined those on hospitals.

President Donald Trump continued claiming America is winning in the battle against the virus while flaming tensions in back-to-back election rallies. The White House is pushing for schools to reopen. His strategy seemed to fail, with rival Joe Biden leading by nine points over the incumbent.

The Economist's model gives the Democrat a 90% chance of ousting Trump in November. Biden scared investors by saying that the era of shareholder capitalism needs to end.

US data remained positive. The ISM Non-Manufacturing Purchasing Managers' Index surging to 57.1 points. It is essential to note that the diffusion index still reflected a contraction in service sector hiring and refers to early in June – before the recent outbreak.

The upbeat JOLTs jobs report also exceeded estimates, yet it is for May. Jobless claims also beat expectations, but initial applications remain above one million and continuing ones top 18 million.

On the other side of the pond, data was mixed. German Factory Orders and Industrial Production disappointed in May, while retail sales for the eurozone rose more than expected. Various COVID-19 flareups seemed under control in the old continent.

Nevertheless, the European Commission downgraded its economic forecasts for the eurozone, showing an 8.7% contraction contrary to 7.7% in Brussels' previous update.

Eurozone events: ECB and leaders compete for attention

While local coronavirus flareups are seen around the old continent, there are no imminent risks of massive outbreaks triggering a lockdown, at least not now. Has business sentiment improved? The ZEW Economic Sentiment for July will likely show stability after the bounce seen beforehand.

The European Central Bank is set to leave its interest rate and bond-buying schemes unchanged on Thursday. The ECB boosted its Pandemic Emergency Purchase Program (PEPP) by €600 billion in June and does not publish new economic forecasts at this juncture.

Christine Lagarde, President of the European Central Bank, hinted at inaction and also cast doubt that EU leaders will make a decision on the EU recovery fund in their summit that begins on the following day. She may dedicate her press conference to nudging policymakers to approve the ambitious plan – which includes €500 billion in grants funded mutually by the EU Commission.

See European Central Bank Preview: EUR/USD depends on Lagarde's fearless nudging of the Frugal Four

Will Germany and France get their way? German Chancellor Angela Merkel urged fellow leaders – and especially the "Frugal Four" – to get behind the ambitious scheme. However, Austria, the Netherlands, Denmark, and Sweden are reluctant to award money to countries they see as profligate. Tensions are especially high between the Dutch and the Italians – at both ends of the north-south political divide.

Investors expect leaders to fudge an acceptable compromise in all-night discussions – something that has happened several times in the past. If the summit settles for a meager plan which mostly leans on loans rather than grants, the euro has room to fall. If Berlin and Paris get most of what they want, the common currency could advance.

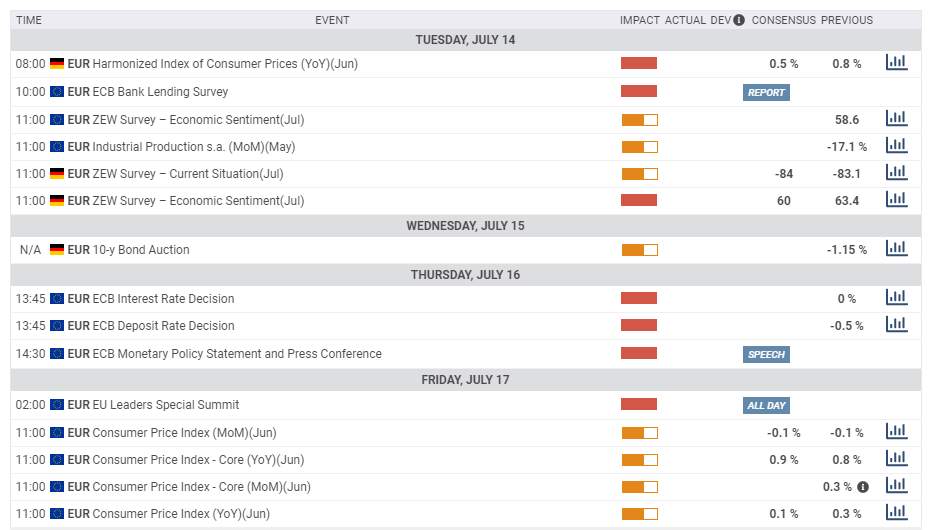

Here are the events lined up in the eurozone on the forex calendar:

US events: Coronavirus and the consumer

States' COVID-19 statistics will likely gain even more traction, as they impact consumer behavior and also trigger local lockdowns. Hospital capacity and deaths will likely replace the number of cases – which has been becoming constrained due to a lack of sufficient laboratories.

The longer Trump ignores the severity of the disease, the more likely he is to slip in opinion polls. Recent researches have shown that he is slipping amid senior citizens – which had previously supported him and are vulnerable to the disease.

Investors may pay more attention to politics as Biden's economic speech, saying that "Wall Street did not build America" draws a sharper contrast between him and the incumbent. The challenger has a stable nine-point lead over the current occupant of the White House.

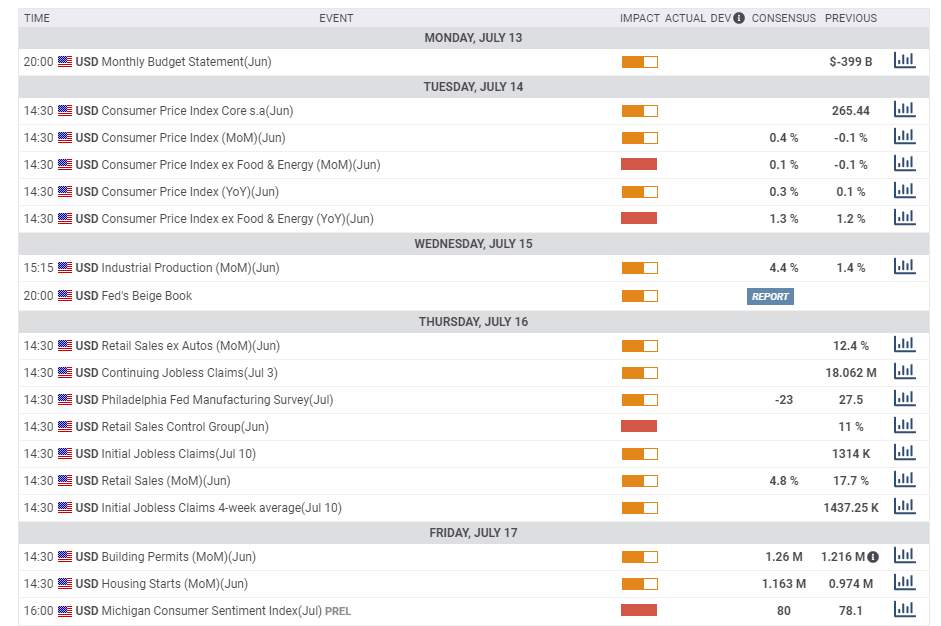

The economic calendar is busy, with inflation figures set to show a modest pickup from the lows in June.

See Consumer Price Index Preview: Prices slowly return to normal

Industrial output figures for June are also set to show an ongoing recovery from the lows, but the main dish awaits on Thursday – retail sales.

Has the American consumer continued compensating for lost expenditure? Shoppers sent sales up 17.7% in May – an impressive rebound in absolute terms but far from enough to make up for the downfall in April and March. Another increase is on the cards.

The early part of the month saw an ongoing recovery, but the second one already experienced a drop in consumption as the disease spread. Expenditure dropped even before governors reimposed restrictions or halted the reopening.

Jobless claims are also of interest and investors will want to see initial applications slip toward and potentially below one million. However, recent health deterioration may push it higher.

Friday's building permits and housing starts are projected to show a rebound. The sector is holding up. The last word of the week belongs to the University of Michigan's preliminary Consumer Sentiment figures for July. Once again, the question is – are shoppers worried about the health situation? A minor increase to 80 is on the cards, leaving it well below the near-100 level seen early in the year.

Here are the scheduled events in the US:

EUR/USD Technical Analysis

EUR/USD has been trading in a broad range between 1.1160 to 1.1415in the past month, and benefits from maintaining a safe distance from the 50, 100, and 200-day Simple Moving Averages. The currency pair also remains well above the uptrend support line that has accompanied it since the trough in March.

Momentum has all but disappeared and a new direction is yet to emerge. The currency pair has recently set a higher high, but that is only an initial, tentative sign of a potential bullish move.

Some resistance awaits at 1.13, the round level which capped it in early July. The monthly peak of 1.1370 is the next level to watch, and it is followed by 1.1415. Further above, 1.1495.

Some support is at 1.1250, a swing low in mid-July. It is followed by 1.1190, which cushioned it around the end of June. It is closely followed by 1.1160, the bottom of the recent range, and then by 1.1115, where the 50-day SMA hits the price.

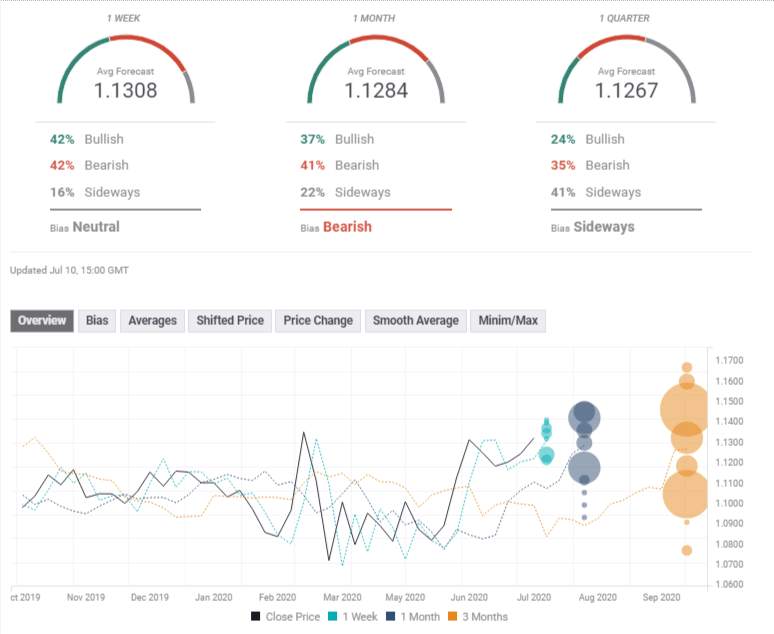

EUR/USD Sentiment

Europe leads the US on battling coronavirus and the ECB is doing everything it can. If EU leaders forge any kind of compromise, EUR/USD has room to rise – even if the US consumer and coronavirus weigh on sentiment.

The FXStreet Poll is showing that experts are foreseeing no significant moves in the short term and fall afterward. Average targets have been marginally upgraded in the past week.

Reprinted from Fxstreet,the copyright all reserved by the original author.

Disclaimer: The views expressed are solely those of the author and do not represent the official position of Followme. Followme does not take responsibility for the accuracy, completeness, or reliability of the information provided and is not liable for any actions taken based on the content, unless explicitly stated in writing.

Leave Your Message Now