Conservative or aggressive? Three ways to help you find the best investment strategy for you!

As one of the major or most important items of passive income, investment can be regarded as the most known or even the most common one, and many people think that investments are for professionals and are beyond their capabilities.

This kind of mindset is also because that investment covers a wide range and involves loss. People may react differently to losses but for many, the reaction is to stay away from investment. Because if you stay away, it won’t be able to hurt you and you will not suffer from losses.

It is also because of the wide range of investment, a lot of people think it’s too compound and has an entrance barrier too high for them to enter, so they’d rather stay away from investment or leave it to the investment consultants who barely understand their situations. Let alone whether these consultants master financial and economic knowledge needed, a lot of them jump into selling products to customers without even fully understanding the products they’re selling. So, when it comes to the question of whether this product suits the customer, the answer is self-evident.

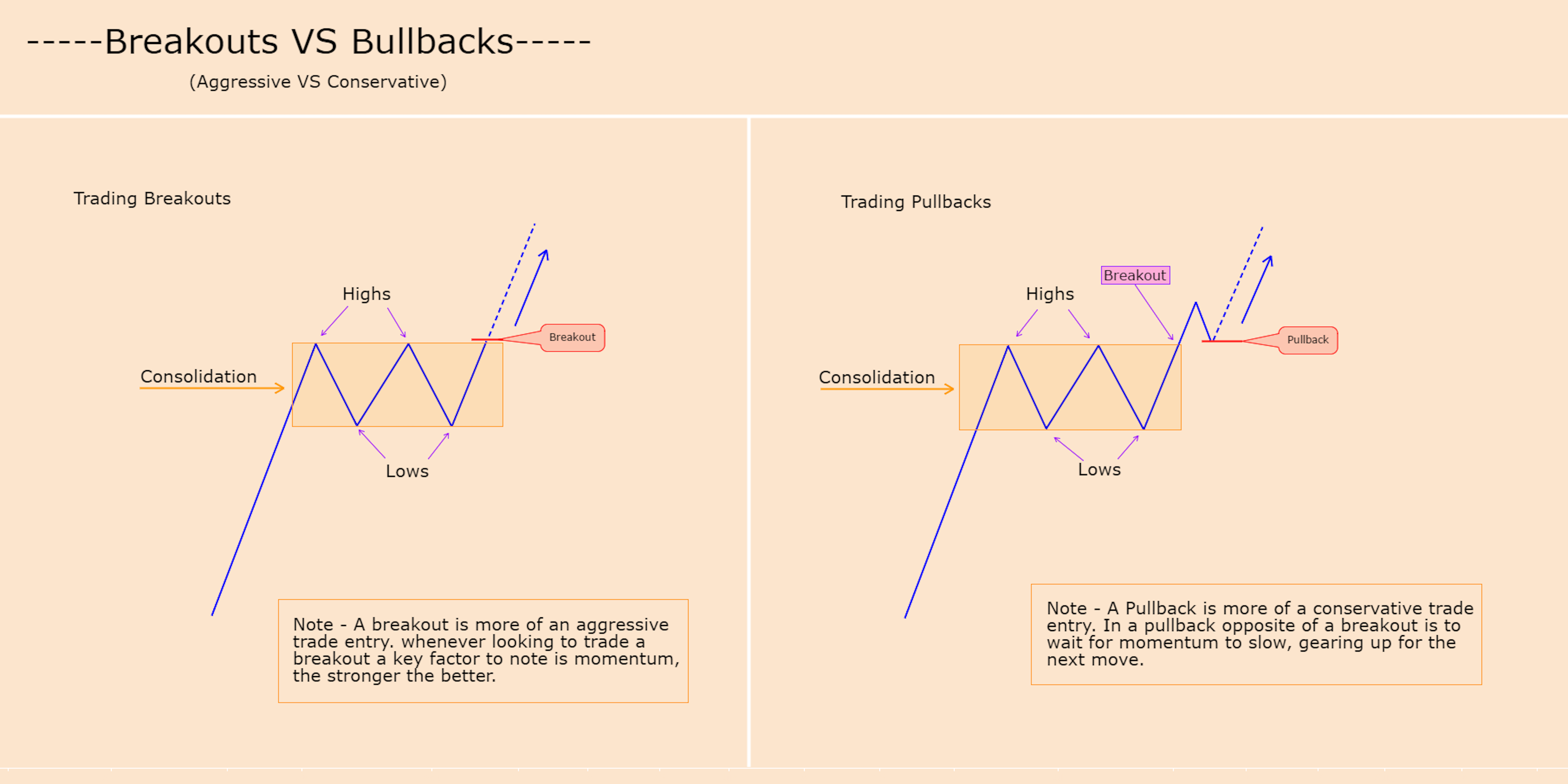

Investment strategies can be decided based on your own conditions. Basically, there are two kinds: one is a conservative investment strategy, another is an aggressive investment strategy. In addition to different payback of profit, they also involve different risks. Let’s take trading as an example to discuss which one should we lean towards when deciding our investment strategy.

Subjectively, the most important is to follow your heart. Some people are born gamblers, always dreaming of becoming rich overnight, then naturally they are more suitable for an aggressive investment strategy with at least high-enough odds. And for these people, even if you ask them to follow a conservative strategy, they won’t be able to hold themselves from operating more aggressively. In the end, they would go aggressive anyways, and the conservative strategy at the beginning won’t be followed well either.

Objectively, you have to think about the situation you are in. For example, is your cash flow is big enough? Can your monthly net income cover your daily expenses and leave some for contingency? And is there any money left in the income for investment? If the answer is yes, then objectively you can adopt an aggressive investment strategy.

Even if the account loses money every month, it can be replenished every month to prepare for the following investment. Normally from a wining ratio perspective, an aggressive strategy has a very big profit-loss ratio. Although it may easily cause you to lose money, if you continue to invest every month, you can increase the odds and secure the opportunities for bigger profit. But if the objective conditions I just mentioned cannot be met, I think it is better to choose a more conservative investment strategy.

In addition, in investing or trading, there might be some strategies that are handier for yourself. For example, a trader might not like aggressive strategies personally as s/he believes the risks are relatively high, and objectively s/he does not have enough money to replenish into the trading account or the investment account every month, so according to the foregoing, a conservative investment strategy is more suitable for him or her. Bit when s/he operates the account, s/he might find that the preferred trading strategy or the best trading strategy for him is actually aggressive, therefore it might be better for him to switch to a more aggressive approach.

This is because if a higher winning rate is possible with an aggressive strategy, then it makes up for the biggest shortcoming of the aggressive strategy to a greater extent, in other words the problem of low winning rate. So, the opportunities to profit are greatly increased while the odds remain unchanged. And if he adopts a conservative strategy, in the long run his returns may even be lower than that, because it is not an investment strategy that he is good at, so he will not be happy in the investment process. Imagine if you don’t like the person you live with, will you live a happy life? In addition to not being happy, you might in the end lose money, which clearly is not a good way to invest.

In conclusion, the adoption of investment strategies must take into consideration the preference of the investor himself/herself, the objective situations and also which one suits your own investment more. Choose after you have comprehensively weighed on the three factors above.

This is because there are many things to be considered when investing in an object, such as the market environment, the value of the object at that time, and market sentiment. Sometimes there are no strict standards to guide how to invest. This is also the case with investors choosing their investment strategies. It is necessary to take into account personal preferences, objective environmental conditions, and investment strategies that they are good at to make a comprehensive judgement and there is no strict standard to follow.

Most importantly, the first step for you is to find your own preference, figure out the environment and what are the strategies you’re good at before choosing one. Too many people start trading or investing before they figure out these three and in the long term, the result is not very good. Therefore, it’s better to take some time to think about that, and then make a final decision.

Edited 26 Mar 2020, 18:36

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.