Yesterday the FOMC held intermeeting and announced to cut the policy rate 50bp from the current level. In a normal situation this action would imply to more liquidity will flow to capital market. However, looking at the price action of US market yesterday, it seems that investors assume that this easing action happened because the threat from COVID-19 outbreak may already hit or could be big impact in the future.

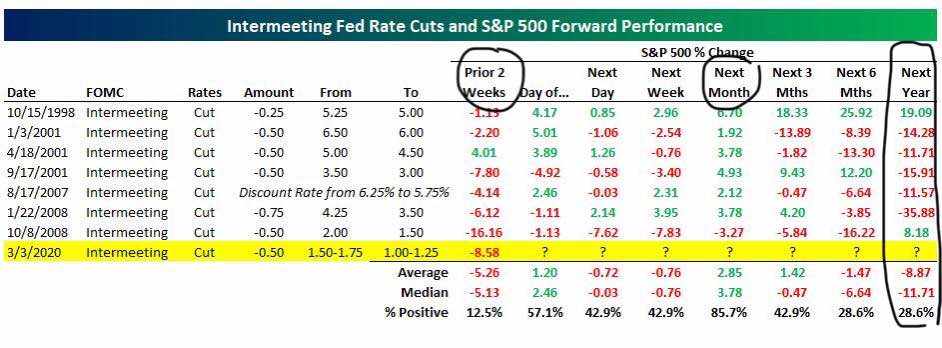

I have found this table from the internet. From the historical point of view it seems that the rate cut policies did not perform well as it was desired. As shown in the table, most of the time, 1 year return from annoucement date is negative. However, if we compare between return 2 week before rate cut and 1 month after the rate cut it show that the action was help as short term support for the market then the recovery tend to vanish after that.

Base on that historical trend, I think we should have a good time for buy side stock investor for a month then we prepare for more down side risk later.

风险提示:以上内容仅代表作者或嘉宾的观点,不代表 FOLLOWME 的任何观点及立场,且不代表 FOLLOWME 同意其说法或描述,也不构成任何投资建议。对于访问者根据 FOLLOWME 社区提供的信息所做出的一切行为,除非另有明确的书面承诺文件,否则本社区不承担任何形式的责任。

FOLLOWME 交易社区网址: www.followme.com

加载失败()