How to Stop Loss

Generated naturally not intentionally during foreign exchange transactions, stop loss is an instinctive reaction as well as an important method for investors to protect themselves in forex, aiming at preserving strength, improving capital utilization and efficiency, and avoiding mistakes that may lead to a total washout. Although it is not able to avoid risks, it is helpful to hedge against greater accidents.

Successful investors may trade in different ways, but stop loss is a common feature that guarantees their success, the importance of which is often illustrated with Alligator Principle by professionals. In foreign exchange market, Alligator Principle is: you have to stop loss immediately without delay or taking chances when finding your transaction deviates from the direction of the market.

Function of Stop Loss

The main function of stop loss is risk management.

Lots of investors trade in a model of high-risk equaling to low-profit, which is the most serious money-losing habit. First, let’s talk about behavior and mentality of hold-up. Generally, investors who are unwilling to accept losses will stick to the idea of hold-up once the foreign exchange they bought began to lose money, and when it rises to the cost price after a long-term hold, they will be eager to sell.

Thus, it is quite possible to make a big loss by accident. There is no big profit but a big loss if the foreign exchange is sold once gets back to the cost price.

Therefore, it may lead to a bad result that the longer you trade in forex, the more you will lose! How to avoid being stuck in this vicious circle? In short, it is about managing risks (set a stop-loss price) and accepting risks (cut loss). How to carry out a stop loss?

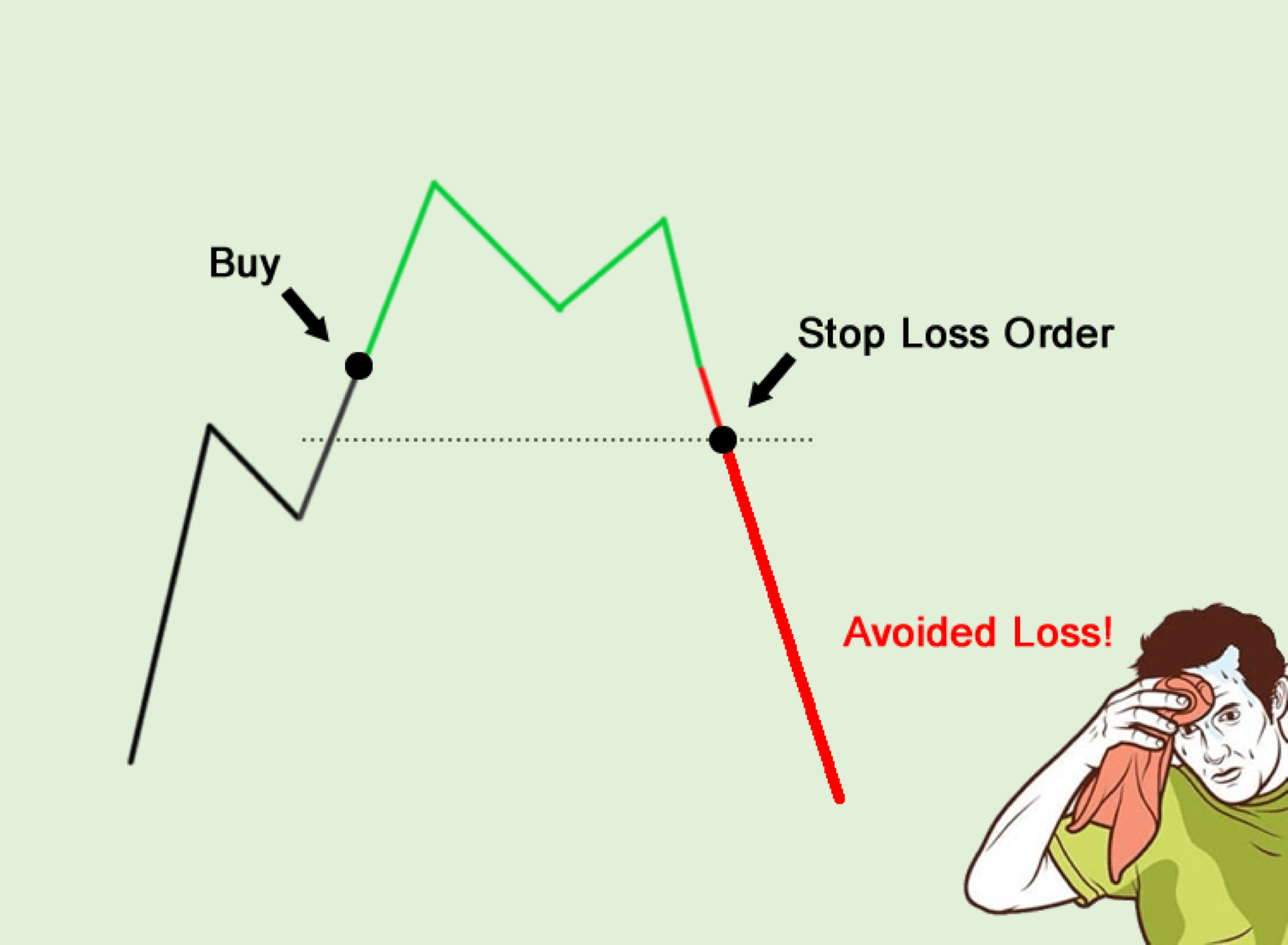

In fact, stop loss has two functions: one is to control loss and reduce loss immediately when there is reversal; the other is to maintain the earned profit.

All in all, it can control the risk and keep the loss in control, which is where the importance lies.

The Experience of Trading Without Stop Loss

Investors who do not prefer stop loss often share some unpleasant experience of losing money:

a. Hold-up with Ostrich Mentality. Like the saying goes, out of sight, out of mind. Investors with this mentality usually ignore the unpleasant situation and leave the loss increasing. It can be imagined that they must be depressed, afraid and nonplussed, waiting until they cannot bear anymore, and quit negatively with no resort.

b. The regret mentality of "reaching Treasure Island but returning empty-handed". Some investors have no idea of stop loss when they gain considerable profits, and may even increase investment, forgetting to protect the capital or keep the minimum profit measures. Once the market reverses, unluckily, they only have to lose all the profits with regret.

c. The remorse of "reaching Treasure Island only taking something valueless". Some investors rush to make a small profit without stop-loss techniques to expand the profits when the market is in a great situation, therefor lost a chance to make a fortune. The only thing they can do is watching the market rise day by day, filled with self-accusation and regret.

Three key points of the importance of stop loss

The importance of stop loss mainly includes the following key points:

a. The operational situation of placing a stop loss order will naturally lead traders out of trouble without any worries, when the trading strategy is basically wrong.

b. In a profitable situation, only by placing a stop loss properly can the traders avoid being forced to give up the opportunity to make a big profit.

c. The most important thing is to realize that stop loss is absolutely an indispensable tool in fund management and risk management, as well as an essential method to help a successful trader to maintain a good and stable fund management system and risk management system.

Is it a good idea that some mature traders with strong self-control will immediately quit when the market is gloomy, rather than set a stop loss on the market in advance? I think there is nothing wrong, but the potential crisis should be noticed. For example:

- A moment of hesitation may lead to a blunder when a trader sometimes changes his/her mood and cannot keep his/her own restraint.

- The loss risk is also a price to pay when the trader has to leave and can't keep an eye on the market, or he/ she encounters an unexpected situation.

- Worst of all is stock market disaster like the one happened in American in October, 1987. When the market gets gloomy, the processing timing of traders will be far worse than that of traders who have already placed stop losses on the market, due to the fast collapsing of market.

From above all, we can see the advantages of stop loss:

a.You can trade without keeping an eye on the market all the time.

b. It won't let you miss any time to go out.

c. Help you develop the good habit of trading.

How to set a reasonable stop loss price?

To set a reasonable stop loss price calls for both correct mentality and absolutely right approach. Based on the chart of stock market, the price should be set on at the key level where the chart reverses, and that is the right thing to do for the following reasons:

a. When the set price is touched by the market, it will immediately stop, which means there will be a reverse and the transaction should be ended immediately.

b. When the market cannot touch the set price, traders should go in full swing to expand profits.

There are also some average mistakes that traders may make.

- Determine the stop loss price by the number of points or a fixed loss limit, which is more short-sighted and preferred by short-term traders. Traders use this method are often fooled and swept out cause the stop loss level is not in the key position. Thus, even though there is risk control and investment direction is correct, they are still out depressively. It will easily make traders believe that stop loss is unreliable if this happens all the time. What a pity!

- Thinking about setting stop loss without carrying out. Some traders are reluctant to place a stop because they are worried about being deliberately ripped off by major investors. They repeatedly hesitate to set stop loss or constantly adjust the ideal stop price until they are forced to sell out, which is possibly caused by their own unwillingness to accept the loss

If major investors are wolves, then traders with the above two wrong behaviors are like fresh meat which will be swallow anytime. Both inappropriate stop loss and no stop loss are the result of human frailty, a false state of mind, which should be avoided. All in all, stop loss is necessary as one of the fundamental approach to be invincible in market.

How to set effective and correct stop loss?

The implement of effective and correct stop loss is based on a completely correct mentality. The proper practices and precautions include:

a. Stop loss should be set before trading.

b. The stop loss price should be determined at the position where the market is reversed, and away from everyone's stop loss point, so as to avoid being wipe out at the same time.

c. The number of trades should be allocated after the stop price is set.

d. Stop loss should not be canceled.

e. Do not adjust the setting of stop-loss in an unfavorable situation.

f. With the expansion of profits, the arrangement of stop losses should be adjusted in order to gradually improve and ensure profits.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.