The rally in the EURUSD will peak in the short term.

Currencies have a positive correlation with expected future interest rates. Bonds yields on the short end of the curve are primarily driven by interest rates expectations which means that short-term bond yields embed expected future interest rates. Currency pairs represent two nations so it’s imperative to compare two nations bonds yields.

Interest rate differential

Interest rates differential which acts as a leading indicator for exchange rate movement signal that the rally on the EURUSD is close to a pause.

g

Positioning

Bullish Speculative bets on leveraged funds are approaching all times high of 2021. As leveraged funds takes profits on those positions Euro will experience a downward pressure.

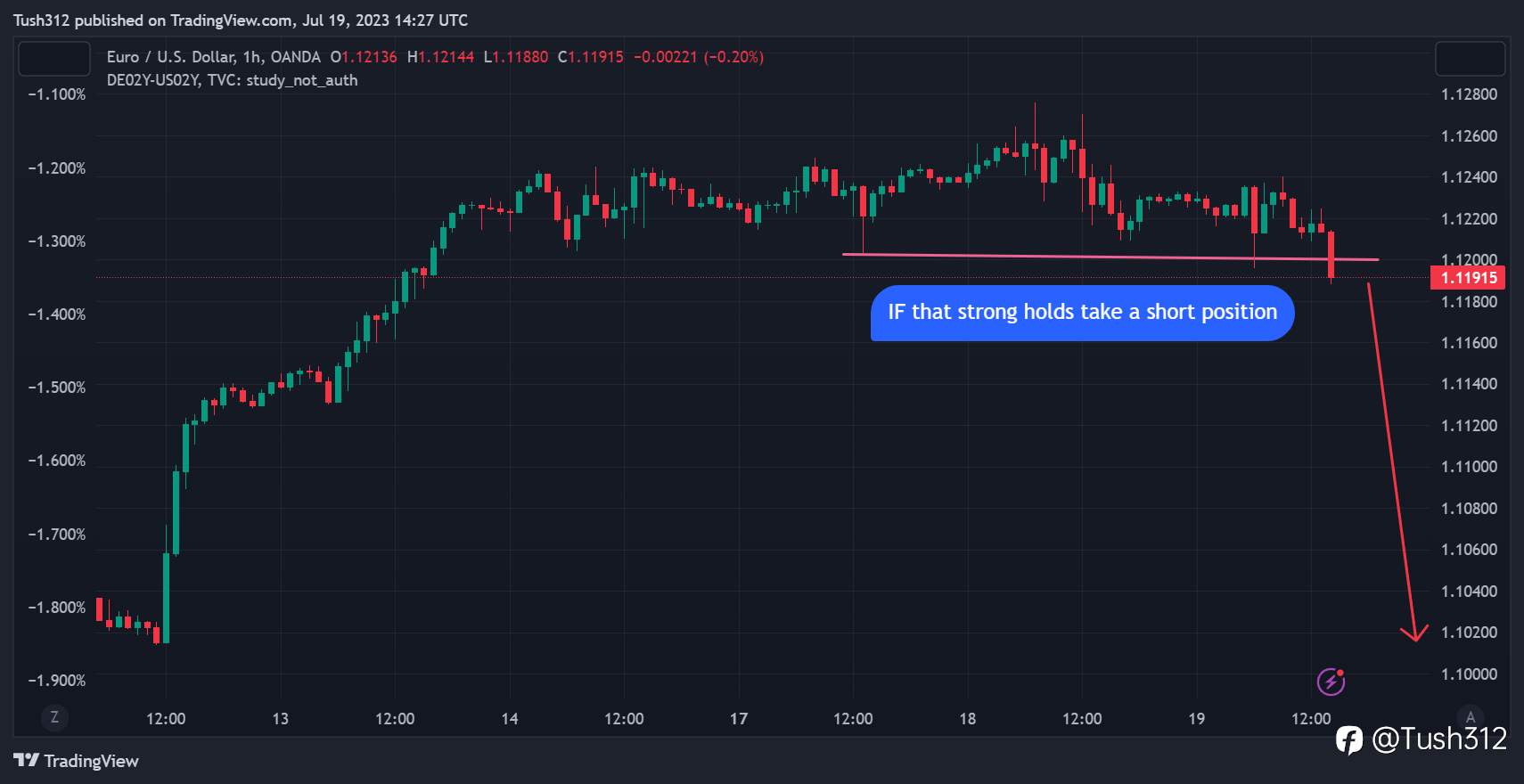

Price actions

EURUSD has been on the sideways channel for the better part of the week a significant drop below 1.1195 will be a good signal to enter a short position targeting 1.1.

Disclaimer: The views expressed are solely those of the author and do not represent the official position of Followme. Followme does not take responsibility for the accuracy, completeness, or reliability of the information provided and is not liable for any actions taken based on the content, unless explicitly stated in writing.

Leave Your Message Now