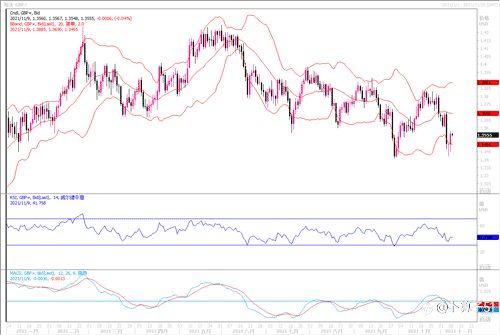

上周的三大央行利率决议,画风直转,给早前市场堆积起来的对全球央行激进加息的预期泼了一瓢凉水。澳储行取消了国债收益率目标,但认为加息条件可能需要一段时间才能到达;美联储如期Taper,却表示对加息要有耐心;英央行不仅没有如期加息,还把首次加息预期推迟到数月之后。澳元和英镑几乎是应声直线下跌,英镑因为加息预期落空跌势更为凌厉,成为当周表现最差的主要货币。4小时图的英镑走势当中,基本上算是无力反弹,上方顶底转换点的压制点1.360都给不到,RSI指标更是在20%的超卖反弹之后,目前再次拐头向下,间接性说明英镑短期,还存在着一个低点,下方支撑将继续关注1.340一线,反弹也只需要关注1.3600短期压力。本周若是美联储一众官员在对待通胀和加息的态度上偏鹰派的话,英镑则恐要继续遭受抛盘的压力。

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.