Global equity markets closed the week with steep losses as traders shifted their money out of risk assets, worried by economic concerns and inflation-focused central banks that appear ready to continue tackling high prices even if it induces recessions. US stocks opened higher on Friday after the US non-farm payrolls report crossed the wires, which showed a gain of 315,000 jobs in August. That was slightly above the 315k Bloomberg consensus forecast, although wages didn’t rise as much as expected. The wage data was encouraging for the US inflation outlook, which weighed on gold-friendly breakeven rates. XAU/USD rose on Friday, but the yellow metal traded almost 1.5% lower throughout the week.

The cooling wage growth helped ease the Fed’s perceived rate path. Traders appeared wary of holding risk over the long US holiday weekend. Yields across the Euro Area rocketed higher as bond traders ditched European debt. The European Central Bank is expected to deliver a 75-basis point rate hike at next Thursday’s policy meeting, with overnight index swaps (OIS) showing a 62.8% chance for the jumbo hike.

Dutch European natural gas prices plummeted on Friday, bringing the total weekly loss to nearly 40% as supply fears eased. According to GIE’s AGSI data, the European Union’s gas storage rose to over 80% as of August 31, putting the 27-member bloc on pace to hit its storage targets before the winter, when energy demand will increase. The ECB’s incoming rate hike is seen as tempering demand.

Risks remain. Russia’s Gazprom, on Friday, said it would not resume operations of the Nord Stream 1 Pipeline, a critical artery for Europe’s energy. The Russian state-backed energy company cited technical issues in extending the outage that started on Wednesday. Those issues may slow Europe’s progress on increasing storage, especially if flows don’t restart, which is a possibility that markets should consider.

The Canadian Dollar fell against the Greenback, with the Loonie weighed down by falling crude oil prices. USD/CAD was looking at its highest daily close since November 2020 during Friday trading. The Bank of Canada is seen raising its benchmark lending rate to 3.25%, according to cash market pricing. That would bring the BoC’s rate above what BoC Governor Tiff Macklem sees as the neutral rate (2%-3%). That said, Canada’s economy is likely to suffer, given the rate would be above neutral assuming a 75-bps hike does occur. The Canadian Dollar is likely primed for further losses outside of a large recovery in oil prices.

Elsewhere, the Reserve Bank of Australia (RBA) is set to deliver an interest rate decision on September 6. The Australian Dollar fell around 1% last week as iron ore prices in China fell almost 10%, bringing the metal ore to its lowest level since November 2021. Rate traders have eased bets for continued aggression from the Australian central bank beyond next week’s meeting, which is expected to see a 50-bps hike. However, with the country’s inflation rate still well above target at 6.1%, the RBA may have to deliver an increase in its pace of tightening. China remains a massive headwind for Australia and the broader APAC region. Several cities locked down last week as Covid-19 cases increased.

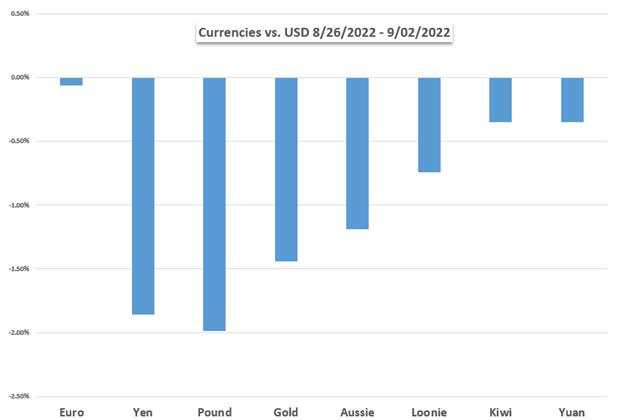

US DOLLAR PERFORMANCE VS. CURRENCIES AND GOLD

Fundamental Forecasts:

Gold Prices Set to Move Higher in the Week Ahead After NFP Data Cools FOMC Bets

Gold prices fell last week but managed to trim losses on Friday after the US jobs report cooled FOMC rate hike bets, pushing Treasury yields lower. A light economic docket may extend XAU’s Friday gains.

Australian Dollar Outlook: Data is Mixed but Lead Looks Ominous

The Australian Dollar has tanked in the aftermath of a hawkish Federal Reserve and Chinese growth concerns ahead of the RBA meeting. Will higher interest rates boost AUD/USD?

USD Weekly Forecast: Solid Jobs Report Supportive of U.S. Dollar and 75bps Rate Hike

USD enters the week on a firm footing as the US Dollar Index (DXY) anticipates the ECB interest decision on Thursday.

Euro ( EUR) Forecast – The ECB Needs to Ramp Up Interest Rates and Fast

The European Central Bank needs to hike interest rates by 75 basis points at next week’s meeting and confirm that it will continue to tighten monetary policy to throttle back runaway inflation.

British Pound (GBP) Forecast: Sterling's Slide May Continue as New Prime Minister Faces Immediate Tests

Sterling remains under severe pressure due to a combination of factors that may be compounded by a new Prime Minister.

Bitcoin & Ethereum Forecast for the Week Ahead

Bitcoin struggles to gain topside traction. Ethereum is vulnerable to a Merge buy the rumour, sell the fact

S&P 500, Nasdaq 100 Forecast for Week Ahead: Path Higher Difficult but Possible

The S&P 500 and Nasdaq 100 may find some support in the fact that the US economy remains resilient and that inflationary pressures are beginning to ease more quickly than initially expected.

USD/CAD Rate Outlook Hinges on BoC Interest Rate Decision

The Bank of Canada (BoC) interest rate decision may keep USD/CAD afloat as the central bank is expected to adjust its approach in combating inflation.

Technical Forecasts:

Pound Weekly Forecast: Cable Eyes Pandemic Low, EURGBP at Resistance

Pound selling has only gained momentum and looks to continue into next week. Cable slumps towards levels not seen in 37 years while EUR/GBP flatters a beleaguered euro

US Dollar Technical Forecast: USD Rips Towards Uptrend Resistance

US Dollar rallied 0.7% for a third weekly advance with DXY approaching uptrend resistance early in the month. The levels that matter on the weekly technical chart.

Canadian Dollar Forecast: Tactical Opportunities Aplenty Despite Robust USD Strength

Multiple Canadian Dollar crosses are approaching key technical areas as sentiment and USD strength weigh heavily. These are the levels to watch.

Gold Price Forecast: Gold Holds Support as Silver Slides to Two-Year Lows

Gold and Silver have suffered big blows throughout the year as USD strength continues to run. In Gold, the $1700 level came in as key support this week – but can it hold for long?

Japanese Technical Outlook: USD/JPY, EUR/JPY, AUD/JPY, CAD/JPY Prepare for More Gains?

The Japanese Yen is under pressure with pairs like USD/JPY, EUR/JPY, AUD/JPY and CAD/JPY either pushing past or pressuring resistance. Is more pain in store for the Yen ahead?

S&P 500, Nasdaq 100, Dow Jones Forecast for the Week Ahead

It was a brutal week for stocks with a glimmer of hope from Thursday evaporating on Friday. With a hawkish Fed in focus, equities remain in a vulnerable state.

Leave Your Message Now