US stock indexes turned lower last week, with losses accelerating into the weekend as the US Dollar surged. Federal Reserve rate hike bets firmed up a bit after hawkish rhetoric from James Bullard and Esther George, two FOMC voters. The Dow Jones Industrial Average fell 0.86% on Friday, trimming earlier gains and ending the week negative. The high-beta Nasdaq-100 Index (NDX) broke its four-week win streak, closing 2.38% lower.

Traders will receive an inflation update for July via the US PCE price index. Analysts expect a 4.7% annual increase for core prices, the Fed’s preferred metric. That would be down from 4.8% in June. A miss may help revive Fed pivot bets, but rate traders are keen to hear what Fed Chair Jerome Powell says at the Jackson Hole Economic Symposium on August 26. Mr. Powell is scheduled to speak Friday at 14:00 GMT.

Equity traders appear ready to abandon the US stock rally. According to the CFTC’s Commitments of Traders (COT) report, released Friday, short positioning among S&P 500 speculators rose by 44k as of August 16. Equity markets in Asia also ended lower, with the S&P Asia 50 Index falling by 1.2% through the week. Chinese stocks fell amid a blistering heatwave that is forcing factories to close. China’s tech giant Tencent reported its first drop in quarterly revenue, which weighed on Chinese tech stocks. Hong Kong saw a rise in Covid cases, prompting officials to reopen an isolation site.

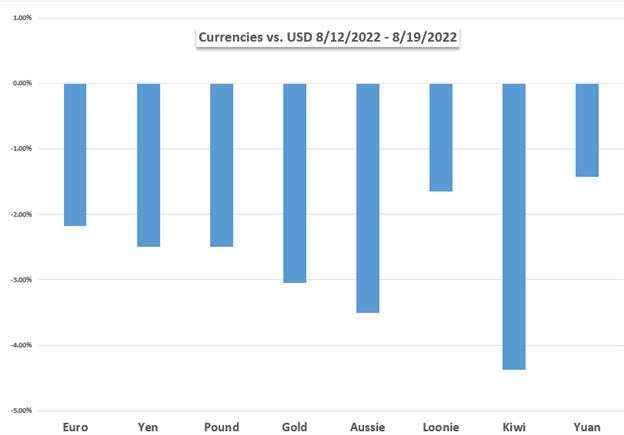

The China-sensitive Australian Dollar fell over 3% against the US Dollar. Iron ore prices in China fell nearly 4%, adding a headwind to the Aussie Dollar. A disappointing Australian jobs report boosted selling, although rate markets still see a 50 basis-point increase at the Reserve Bank of Australia’s September policy meeting. Crude oil prices ended lower last week as tightening Fed bets and China’s economic woes outweighed a big draw in US oil stocks.

European natural gas prices settled at a record high. Europe’s dry conditions and heat have squeezed hydroelectricity capacity. On Friday, Russia’s state-controlled Gazprom said it would suspend its Nord Stream pipeline to Germany later this month. Europe has made progress on filling its gas storage ahead of the winter, but the upcoming pipeline shutdown puts another question mark over its energy situation. According to AGSI data, EU gas storage is nearly 76% full.

The Euro and British Pound fell over 2% versus the USD. Europe and the United Kingdom face high odds of recession partly due to the soaring energy prices across Europe. Elsewhere, Bitcoin prices fell over 10% as risk aversion accelerated. Gold traders sold the precious metal against hawkish Fed bets. Besides Jackson Hole and US inflation data, the economic event docket is sparse, leaving prevailing risk trends at the helm.

US DOLLAR PERFORMANCE VS. CURRENCIES AND GOLD

Fundamental Forecasts:

S&P 500, FTSE 100 Week Ahead: Jackson Hole Symposium in Focus

S&P 500 posts first weekly drop in a month. FTSE 100 defying gravity

Euro Forecast – EUR/USD Plunging Into Parity as US Dollar Bulls Run Amok

The Euro, along with a range of other majors, is looking fairly helpless in the face of a rampant US dollar with parity – EUR/USD 1.000 - unlikely to hold the latest sell-off.

Gold Price Forecast: Bullion to Find Relief on Slowing US Inflation

The update to the US Personal Consumption Expenditure (PCE) Price Index may curb the weakness in the price of gold as the report is anticipated to show a slowdown in inflation.

British Pound (GBP) Weekly Forecast: Red-Hot Inflation Rekindles Stagflation Fears

Bearish Sterling momentum builds on red-hot inflation print and rising rate hike expectations.

Canadian Dollar Weekly Forecast: USD/CAD Braces Ahead of Key U.S. Economic Data

USD/CAD will be subject to USD specific factors next week as the Canadian dollar remains exposed to downside risk.

Bitcoin Ethereum Outlook: BTC/USD, ETH/USD Weighed Down by the Fed

Risk assets sank this week as USD strength rattled markets. Bitcoin and Ethereum surrender August gains. US data and Jackson hole could drive prices in either direction.

Technical Forecasts:

US Dollar Technical Forecast for the Week Ahead: USD Surges to Resistance

US Dollar surged more than 2.5% off the monthly lows with a breakout of the August range eyeing a run at the highs. Key levels on the DXY weekly technical chart.

S&P 500, Nasdaq 100, Dow Jones Forecast for the Week Ahead

US equities finally found resistance this week, with the S&P 500 bumping in to the underside of the 200 day moving average. Will that resistance lead to a turn?

Japanese Yen Weekly Technical Forecast: Ranges Aplenty

USD/JPY has put in an impressive recovery since the CPI dollar sell-off and now has the yearly high in sight. AUD/JPY consolidates, presenting range trading opportunities

Gold Price & Silver Forecast – XAU/USD, XAG/USD Not Looking Too Good

Gold and silver downturns need to hold soon or else the trend off the highs is likely to continue in the days/weeks ahead towards new cycle lows.

Leave Your Message Now