In the early phase of QE, financial markets perceive central bank forward guidance on asset purchases and on policy rates to be closely linked. This generates a mutual reinforcement of both instruments. At a later stage, there may be mounting concern that the signalling works in the other direction as well. Scaling back asset purchases could be interpreted as a signal that a rate hike will follow soon once the net purchases have ended. In the US, Jerome Powell has been very clear that tapering would not signal a change in the outlook for the federal funds rate. In the Eurozone, both types of guidance are explicitly linked. This may complicate the scaling back of asset purchases in view of the impact on rate expectations. On the occasion of the decision on the PEPP, it might be worth to consider revisiting the link between APP guidance and rate guidance.

Quantitative easing may influence inflation via different transmission channels: better anchored inflation expectations, market liquidity, wealth effects, the exchange rate, commercial banks’ excess reserves at the central bank which may entice them to increase their loan volume, portfolio rebalancing, a signalling effect with respect to official interest rates. The last two are considered to be particularly important. The introduction of an asset purchase program sends a signal that the central bank has no intention whatsoever to hike its policy rate. Consequently, policy rate expectations decline, which lowers bond yields. Portfolio rebalancing refers to the changing asset allocation of investors that have sold their bonds to the central bank. The latter has extracted duration from the market, thereby forcing investors to look for riskier instruments -" corporate bonds, equities, real estate, etc.- to generate a sufficient return. The portfolio channel compresses risk premiums, thereby lowering the financing cost for companies. It can also generate wealth effects due to the rising asset prices.

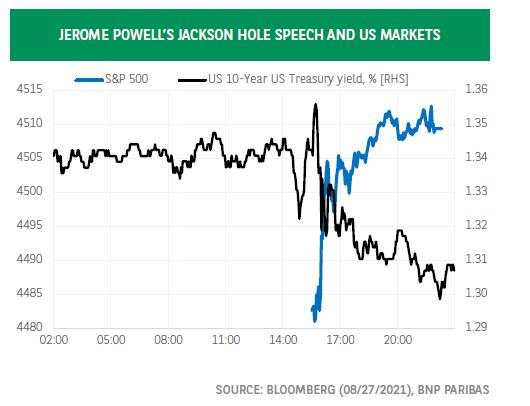

In the early phase of QE, central bank forward guidance on asset purchases and on policy rates are closely linked, either explicitly or implicitly, in the perception of financial markets. It generates a mutual reinforcement of both instruments. At a later stage, there may be mounting concern that the signalling works in the other direction as well. Scaling back the monthly bond purchases could be interpreted that a rate hike will follow soon once the net purchases have ended. In the US, the minutes of the July FOMC meeting report the concern of several members in this respect. In his speech at the annual Jackson Hole symposium of the Federal Reserve Bank of Kansas City, Jerome Powell has been very clear that tapering would not signal a change in the outlook for the federal funds rate1. Bonds and equities rallied, reflecting that investors welcomed the clear separation between forward guidance in terms of QE and that which concerns the policy rate.

In the Eurozone, both types of guidance are explicitly linked. The Governing Council expects the net asset purchases under its asset purchase program (APP) “to end shortly before it starts raising the key ECB interest rates”. This implies that, quite likely, any communication about reducing the monthly purchases under the APP, would influence policy rate expectations. One could argue that this risk is well under control given the strict conditions for a rate hike that have been set in the recently updated interest rate guidance. Moreover, it looks premature to be concerned about such an outcome. The Governing Council first needs to decide on the pandemic emergency purchase.

Download The Full Eco Flash

Reprinted from FXStreet,the copyright all reserved by the original author.

Disclaimer: The views expressed are solely those of the author and do not represent the official position of Followme. Followme does not take responsibility for the accuracy, completeness, or reliability of the information provided and is not liable for any actions taken based on the content, unless explicitly stated in writing.

Leave Your Message Now