This week’s ECB monetary policy meeting highlighted the economic calendar along with rising CPI data out of the US and the passing of a new $1.9 trillion stimulus bill in Congress.

ECB prescribes a higher dose of “monetary medication”

The ECB kept its interest rate policy unchanged, as expected. Its benchmark rate remains at zero, with a deposit rate of -0.5%.

What’s notable is the ECB president’s statement that the central bank will use its PEPP purchases more generously in the coming months. Moreover, ECB staff inflation forecasts have been adjusted significantly higher. They now expect that 2021 inflation will rise to 1.5% compared to previous projections of 1.0%.

Christine Lagarde said the central bank expects its PEPP purchases will be conducted at a “significantly higher pace than during the first months of this year.” She failed to put a number on the increase but did mention that the goal is to contain the recent rise in government bond yields. Madame Lagarde also asserted that the ECB is “not doing yield curve control” - not targeting any specific maturity on the yield curve with its purchases.

PEPP

A brief refresher - “PEPP” stands for Pandemic Emergency Purchase Programme. It’s the ECB’s current version of what’s known as quantitative easing (QE) in the US and elsewhere. The size of the ECB’s program is slightly under $2 trillion.

The increased pace of PEPP purchases comes as many economists have been warning of a double-dip recession in the Eurozone. First-quarter EU 2021 GDP may end up being negative, following the contraction of over 6% last year.

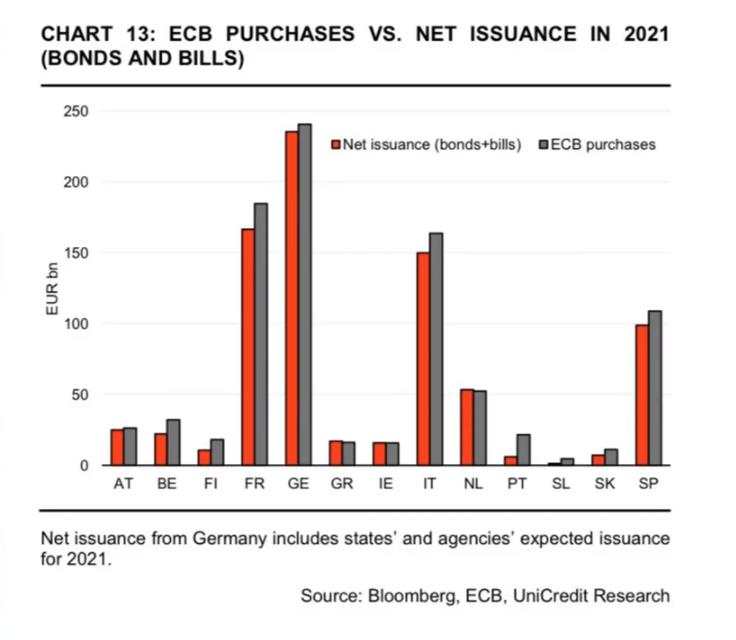

Interestingly enough, the ECB’s purchases of EU sovereign bonds is already outpacing net issuance by European governments this year:

Encouraging the addiction to low rates

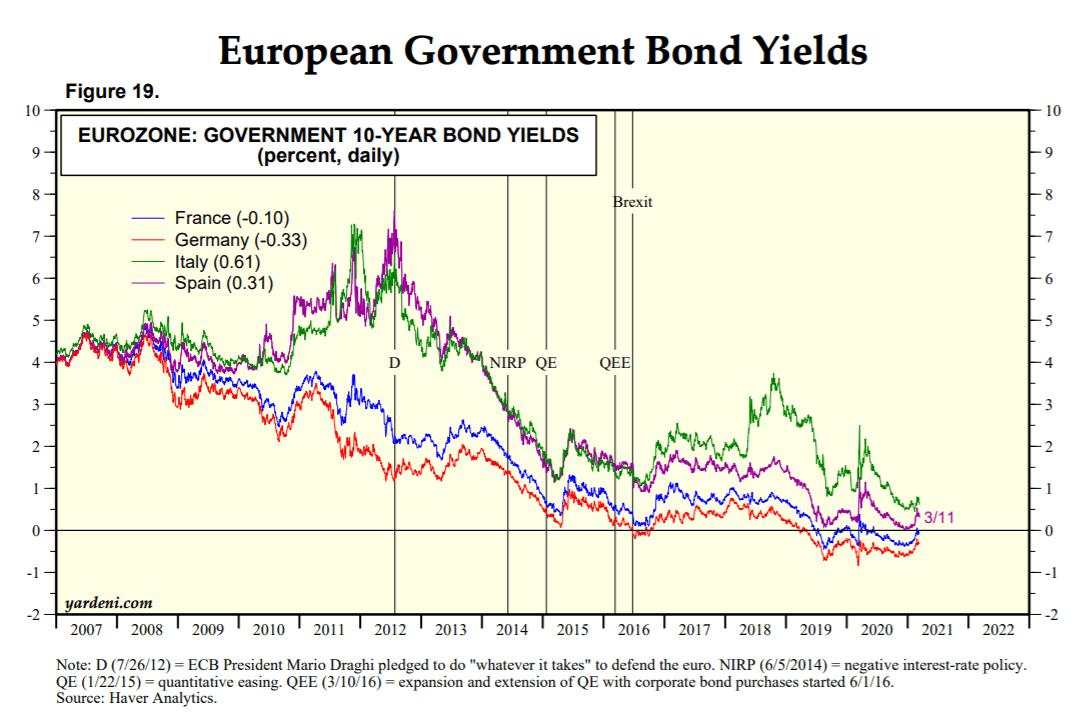

How high have bond yields risen in the EU to warrant the ECB’s response? The chart below from Yardeni Research gives us some perspective:

Comparing the 10-year government bond yields of the four major European economic powers, we can see yields are still extremely low from a historical perspective.

Thought experiment: Imagine telling a banker back in the 1980s, 90s, or even early 2000s, that the future ECB would be “concerned” and even forced into a policy reaction based on a situation where 10-year yields increased by, say, 40 basis points (remaining negative in real terms)! They would laugh incredulously!

Indeed, these are unprecedented times…

Central banks and the financial markets and governments they support are now more sensitive than ever to even the slighten rise in rates. It’s a phenomenon the ECB and other central banks created themselves and one they will also continue to exacerbate. It’s beginning to seem as though the ECB will never be able to raise rates again.

Now that the ECB has delivered on what markets had been wishing for, attention will turn to the US Federal Reserve and its upcoming monetary policy meeting.

Recall, during an interview one week prior to Thursday’s ECB announcement, Fed Chair Powell failed to deliver a similar commitment to either increase the pace of QE or address the rise in Treasury yields with Fed policy. As a result, the US 10-year yield has remained above 1.5% since, weighing heavily on equity markets and risk assets broadly.

FOMC in focus next week

Markets will be watching closely next Wednesday to see if the Fed’s monetary policy meeting will result in a policy manoeuvre to put a ceiling on 10 and 30-year US Treasury yields.

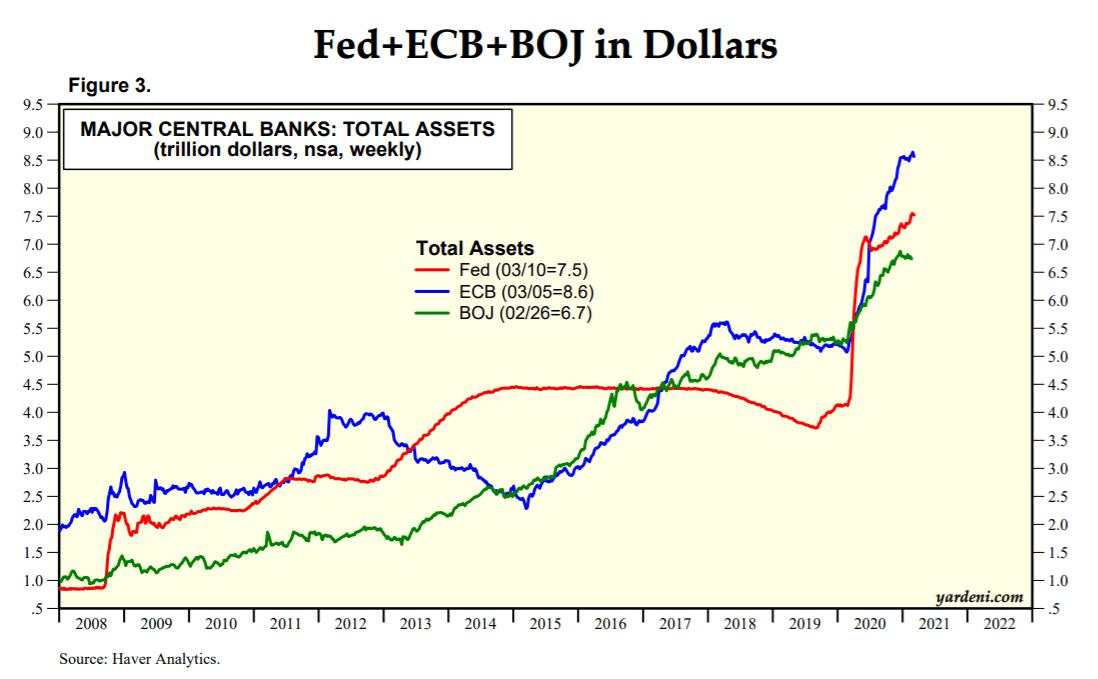

For context, here’s an update on where the balance sheets of the world’s three largest central banks stand heading into next week: (Chart from Yardeni Research)

Note, the size of the ECB’s balance sheet has taken a substantive lead over the Federal Reserve’s since last summer. So, what will the Fed do next?

This Wednesday, economists and Fed-watchers anticipate that the US central bank is likely to announce either a higher volume of QE (not necessarily targeted at the long-end of the yield curve) or a new version of the old “operation twist.” Recall in late 2011 when Ben Bernanke’s Fed implemented the original operation twist - they sold some of their holdings of short-dated Treasuries in order to buy more on the long end of the curve. An operation twist would not speed up the Fed’s balance sheet expansion - it would just alter the duration of the Treasuries owned by the Fed.

The Fed currently has about $330 billion in short-duration T-bills that can be used as ammo for an operation twist. It would aim to directly mitigate the situation of rising yields on the long-end of the yield curve, compared to simply announcing a greater volume of QE.

The other option for the Fed (less likely) would be to implement an official yield curve control policy (YCC). This would directly target rates on the long-end while expanding the Fed’s balance sheet. However, this is not something the Fed will likely want to implement until the situation becomes dire.

FOMC outcomes

This brings us to the two principal outcomes we can expect from next week’s Fed meeting. The first (more likely) is that a “minor” policy adjustment is made to halt rising long-end yields. An operation twist or higher volume of QE would be an admission that the financial economy and government’s fiscal situation are much weaker than in the past and incapable of handling rising rates and the growing inflation expectations. It would, however, be reasonable to expect yields on the 10-year and 30-year Treasuries to fall, as institutions react by front-running the Fed’s purchases.

The second outcome would be for the Fed to refrain from any action. This would likely come as a surprise to markets and would risk yields running even higher on the long end- perhaps quickly! Such an outcome would be likely to weigh heavily on financial markets.

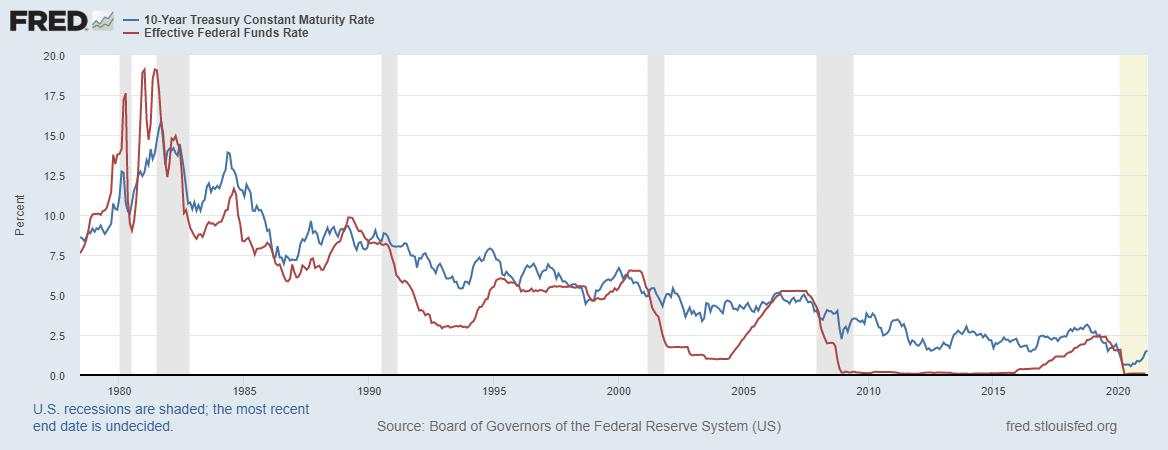

As we can see in the chart below, the 10-year US Treasury yield remains quite low from a historical perspective - like the situation in the EU:

During the recovery period following the 2008 recession, the 10-year yield reached 3% while the official Fed Funds Rate was held down at the zero bound. This time around, financial markets and the US government are clearly incapable of taking on the same burden without having a adverse impact on asset prices.

The Fed’s worst nightmare would be having to announce one of the two most likely policy interventions outlined above next week, and still see rising yields in response. That would be a sign that the huge fiscal deficits and monetary policy interventions have revived the bond market vigilantes. This would likely force the Fed into yield curve control, making it almost impossible for rates to rise again, even in the long-term.

What this means for investors

If the Fed does nothing and the 10-year yield remains above 1.5% - perhaps even chasing the 2% level, growth stocks and risk assets are likely to remain under serious pressure. Risk-off would be the most likely sentiment reaction for the broad markets.

A successful policy move like an operation twist would likely provide an opportunity to buy long-end Treasury bonds and front-run the Fed. It would also support further upside in risk assets including the tech names which have been trading with extremely high multiples as of late.

If the 10-year yield makes a firm top, it will likely mean gold has also found its bottom.

Take a look below, the correlation between the 10-year yield and gold is clear:

The 10-year yield & gold correlation:

2016: The 10-year yield’s bottom = gold’s top.

2018: The 10-year yield’s top = gold’s bottom.

2020: the 10-year yield’s bottom = gold’s top.

Unless the correlation were to break, it’s highly likely that whenever the 10-year yield’s rise ends, gold will have a runway to move higher.

With the US government deficit set to remain extremely high into the foreseeable future, inflation expectations will logically remain formidable even once a reversal in the 10-year yield takes place. This would be very bullish for inflation-hedge assets and it would follow that negative real rates will remain in place in order to inflate the government’s debt away. As a result, tangible assets like gold, silver, commodities, land, and equipment will be poised for a leg higher.

Reprinted from FXStreet,the copyright all reserved by the original author.

Disclaimer: The views expressed are solely those of the author and do not represent the official position of Followme. Followme does not take responsibility for the accuracy, completeness, or reliability of the information provided and is not liable for any actions taken based on the content, unless explicitly stated in writing.

Leave Your Message Now