Gold Price Forecast: Bulls still hopeful amid escalating US-China row

- Escalating US-China row to limit the losses in gold.

- Market-driven sentiment and USD dynamic to remain in play.

- Gold looks buy on dips from a technical perspective.

Despite the jittery market mood so far this Wednesday, Gold (XAU/USD) remains on the back foot, as the US dollar bulls are back on the bids amid renewed US-China escalation over the Hong Kong (HK) Issue. Beijing vowed retaliatory sanctions against the US after President Donald Trump signed an order end to HK’s special status under US law to punish China.

In the overnight trades, the risk appetite was boosted by Moderna Inc’s experimental vaccine success for COVID-19, which downed the US dollar to fresh multi-week lows across its main competitors and lifted the bright metal back above $1810 level.

In the day ahead, gold prices are likely to remain at the mercy of the market sentiment and US dollar dynamics amid incoming COVID-19 updates, US-China headlines and US macro/ earnings news. The gold buyers, however, may remain hopeful amid looming coronavirus risks and could resort to dip-buying, in an effort to retest the multi-year highs.

Short-term technical outlook

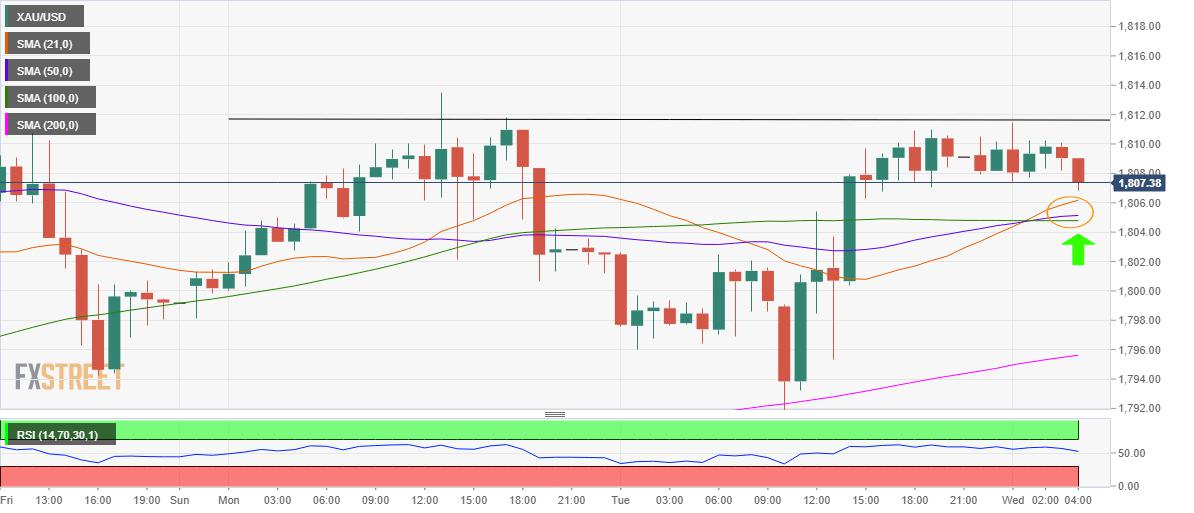

Gold: One-hour chart

On the one-hour chart, the price is flirting with the upward sloping 21-hourly Simple Moving Average (HMA) support at $1806.13 while the Relative Strength Index (RSI) has turned south at 50.35.

Therefore, the bears look to extend control, with the next support seen around $1805, the confluence of the 50 and 100-HMAs. Should the bulls fail to defend that level, a sharp drop towards the downside target of $1796 cannot be ruled out, where the bullish 200-HMA lies.

The spot has managed to hold above the 200-HMA since mid-June and hence it will act as powerful support, where the buyers can look for fresh entries.

Alternatively, only a decisive break above the $1812/13 barrier will revive the bullish momentum in the near-term. The bulls will then aim for the multi-year highs of $1818.17

Gold: Additional levels to consider

Reprinted from FXStreet,the copyright all reserved by the original author.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

-THE END-