US jobs figures show the economy is bouncing back

US stock futures jumped, and European equity indices pushed to highs of the day after a stand-out jobs report. Today's US jobs figures show the economy is bouncing back, but there is a still a long way to go to replace all the millions of jobs lost due to the pandemic. Permanent destruction of demand and productivity will take years to claw back.

US employers added 4.8m jobs in June, which smashed the consensus expectations of around 3m. The unemployment rate declined more than expected to 11.1%. Revisions to Apr and May left employment 90k better than previously thought. Labour force participation improved to 61.5%. Wages are up 5% year-on-year.

But, a couple of things we should say about this to take the shine off the report. First, weekly continuing jobless claims were a little worse than expected at 19.3m – this was a little better than last week but the number ought to be improving at a faster rate. Second, the total gains in employment over the last two months total 7.5m - but this is still dwarfed by the –20.8m recorded in April.

Three, the BLS notes that employment in leisure and hospitality increased by 2.1 million, accounting for about two-fifths of the gain in total nonfarm employment. Meanwhile, employment in retail rose by 740,000, so about 2.8m of the 4.8m was in sectors that are highly exposed to fresh lockdowns and the slowing of reopening, which has been the result of the recent spike in cases. So we cannot expect the same contribution from these sectors over the summer if states are in a stop-start reopening scenario.

Four, while the number of unemployed classed as being on temporary layoff decreased by 4.8m in June to 10.6m, following a decline of 2.7m in May, the number of permanent job losers continued to rise, increasing by 588,000 to 2.9m in June.

Risk assets rose on the report as it was overall bullish. US futures jumped, with the S&P 500 heading above 3150, taking it some or 150 points, or around 5%, above last week's lows. The Dow is up 1000 points from last week's lows. European indices rose the risk rally higher too.

Elsewhere, we saw limited reaction in the dollar, but GBPUSD shot lower shortly after the release on a separate report saying that a meeting between the UK and EU chief negotiators that had been scheduled for Friday had been cancelled.

Gold slipped lower, making a fresh low under $1760 and a possible breakout of the bearish flag signalled this morning, potentially calling for a retreat to around the $1750-$1747 area.

Meanwhile Tesla shares just keep on going and are set to gap up $100 after the company said it delivered 90,650 vehicles in the second quarter, well ahead of both what the company had guided and the Street expectation for 83k vehicles. The company has successfully ramped production at its Fremont site and the Shanghai plant also came back online after being forced to shutter in the first quarter due to Covid. China sales are picking up with Tesla selling almost 12,000 Model 3s in May. The stock also got a lift after Wedbush Securities increased its price target on the stock to $1,250 from $1,000, whilst the bull scenario got a PT of $2,000. Chinese rival Nio delivered 3,740 vehicles during June and beat forecasts with second-quarter deliveries of 10,331 vehicles.

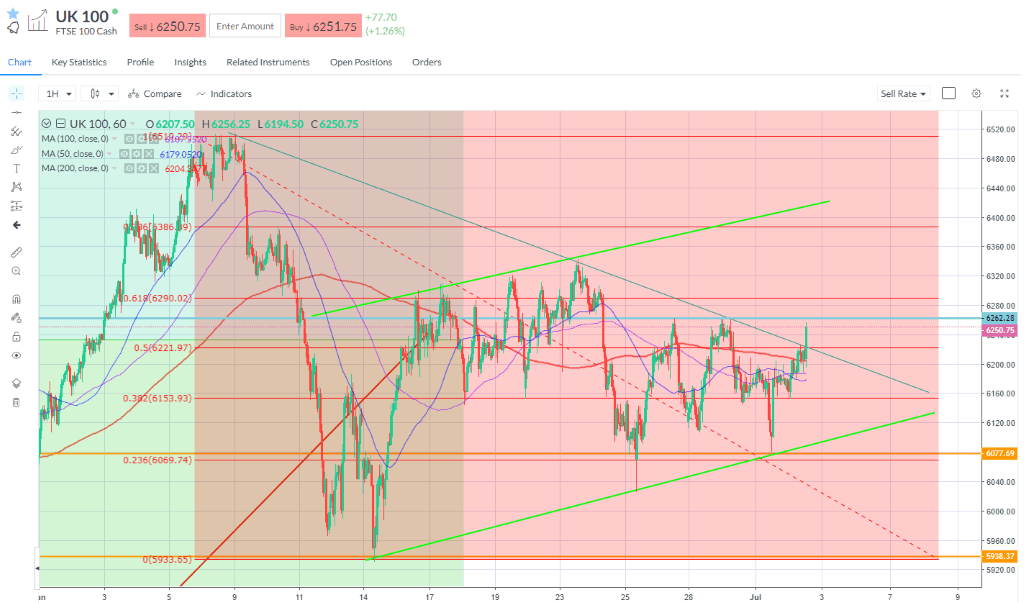

The FTSE 100 was well poised for a move and duly broke out of the descending trend line from the June peak, fresh horizontal resistance seen around 6260.

Reprinted from FXStreet,the copyright all reserved by the original author.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.