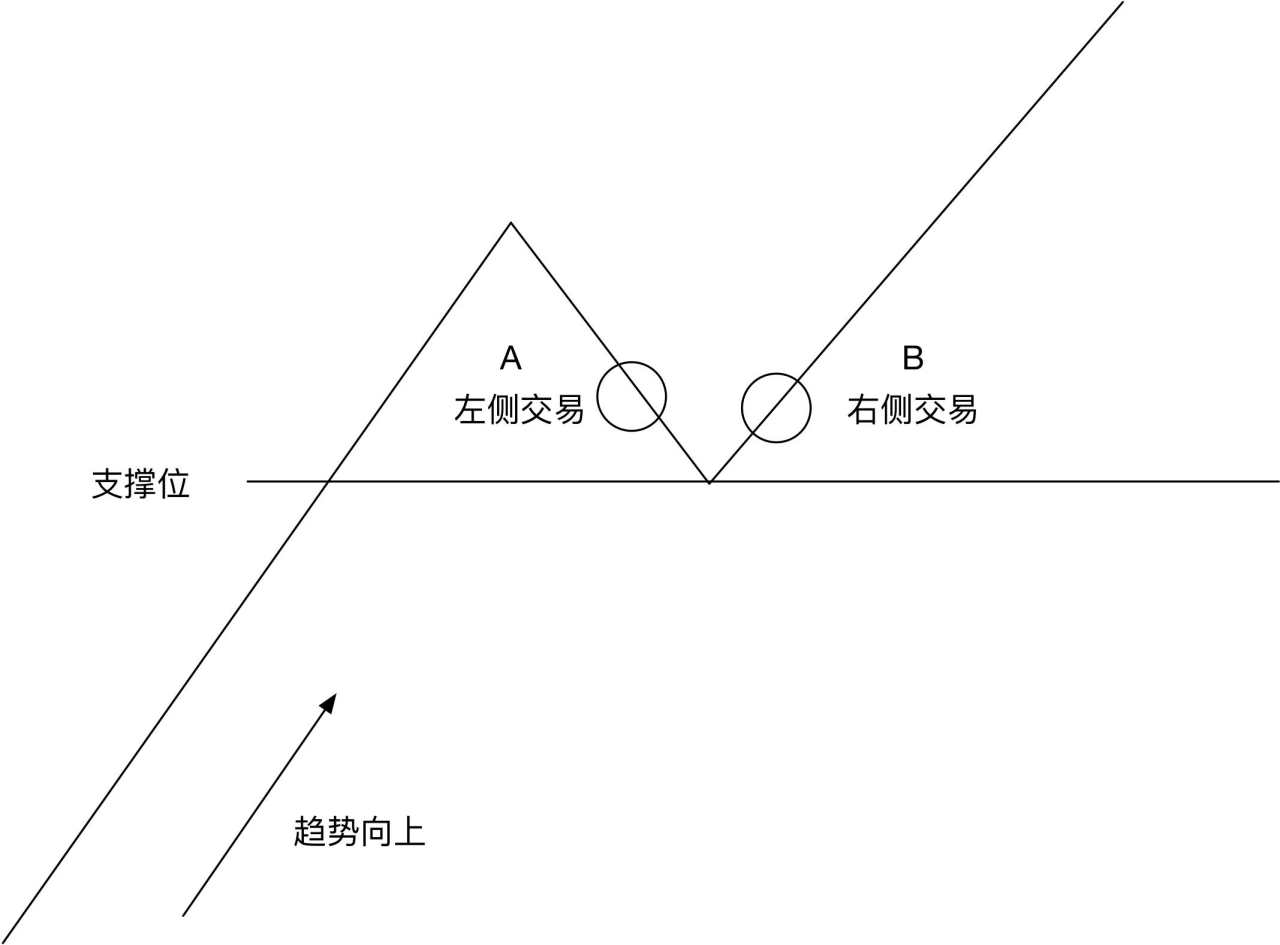

题主自己也说了,左侧交易是个坏习惯,我们先来看一下左侧交易为什么是个坏习惯,如下图所示,我们以做多为例。

背景:主要趋势向上,市场处于向下的回调时期

当价格尚未完全到达支撑位前或者刚刚到达支撑位,我们就进入做多,这个就是左侧交易,逆市顺势交易。

而当价格从支撑位有了一定反弹确认后,我们再进入做多,这个就是右侧交易,顺市顺势交易。

可以看到,右侧交易多了一步价格对支撑和阻力的确认,因为支撑位和阻力位并不是价格总是会支撑和反弹,只是有这样的倾向而已,所以右侧交易更加符合交易现实,不仅顺市而且顺势,而且有更加高的胜算率。

一般我们使用中长实体阳线来确认支撑位的有效性,以及使用中长阴线来确认阻力位的有效性。

Reprinted from 知乎,the copyright all reserved by the original author.

Disclaimer: The views expressed are solely those of the author and do not represent the official position of Followme. Followme does not take responsibility for the accuracy, completeness, or reliability of the information provided and is not liable for any actions taken based on the content, unless explicitly stated in writing.

Like this article? Show your appreciation by sending a tip to the author.

Leave Your Message Now