The dollar was steady on Wednesday after a partial government shutdown swiftly. Meanwhile, the yuan hovered around its highest level in more than 2 years amid signs of a thaw in China-Europe relation.

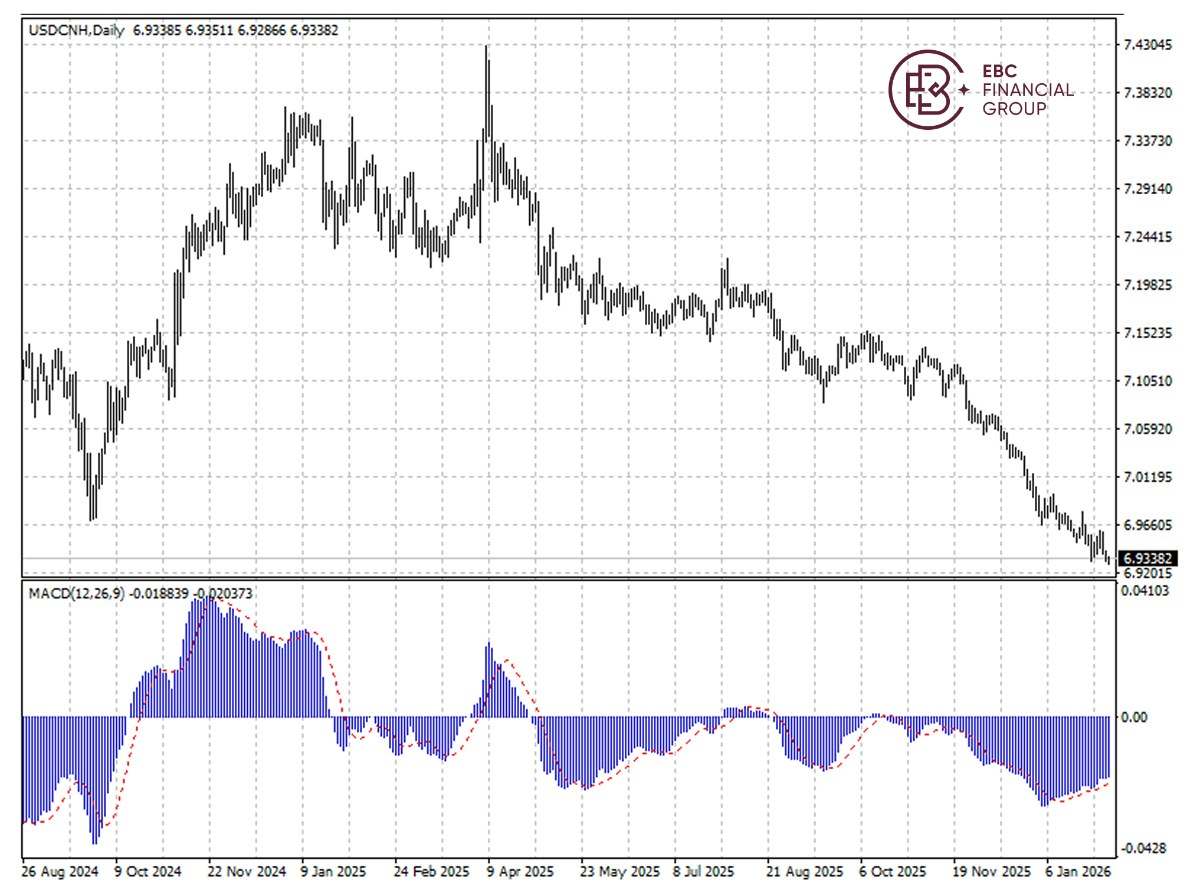

An average of 13 forecasts from global investment banks has the currency at 6.92 per dollar by year's end, while market pricing points to around 6.8 per dollar in the derivatives market.

A stronger yuan erodes a competitive advantage for exporters, so analysts believe a runaway rally is unlikely. The PBOC midpoint has been weaker than market estimates since November.

Goldman Sachs raised its 12-month yuan forecast to 6.7 per dollar as the uptrend may prompt more exporters to convert to yuan. China saw a record trade surplus of $1.2 trillion in 2025.

However, Beijing could be considering to ramp up policy support in coming weeks as strong exports failed to offset weak domestic demand. The latest PMI for consumer goods eased to 48.3 from 50.4.

A majority of economists expect central bank to cut the RRR in Q1, according to a Bloomberg survey last month. They also project a reduction to the main policy rate in Q4.

Yuan has trended higher consistently for month, with bearish MACD divergence increasingly apparent. As such we see the momentum ease and a pullback towards 0.96 per dollar in the short run.

Asset recap

As of market close on 3 February, among EBC products, precious metals led gains. JPMorgan still expects gold to rise to between $6,000 and $6,300 a troy ounce by the end of the year despite Warsh's nomination.

PayPal replaced its CEO Alex Chriss, who was brought in to steer the payments firm through slowing growth and heightened competition, and simultaneously issued a lacklustre profit forecast for 2026

PepsiCo reported quarterly earnings and revenue that topped analysts' expectations, fuelled by improving organic sales across its business, though demand for its snacks was sluggish.

EBC Financial Group Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Global Financial Collaboration or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

Disclaimer: The views expressed are solely those of the author and do not represent the official position of Followme. Followme does not take responsibility for the accuracy, completeness, or reliability of the information provided and is not liable for any actions taken based on the content, unless explicitly stated in writing.

Leave Your Message Now