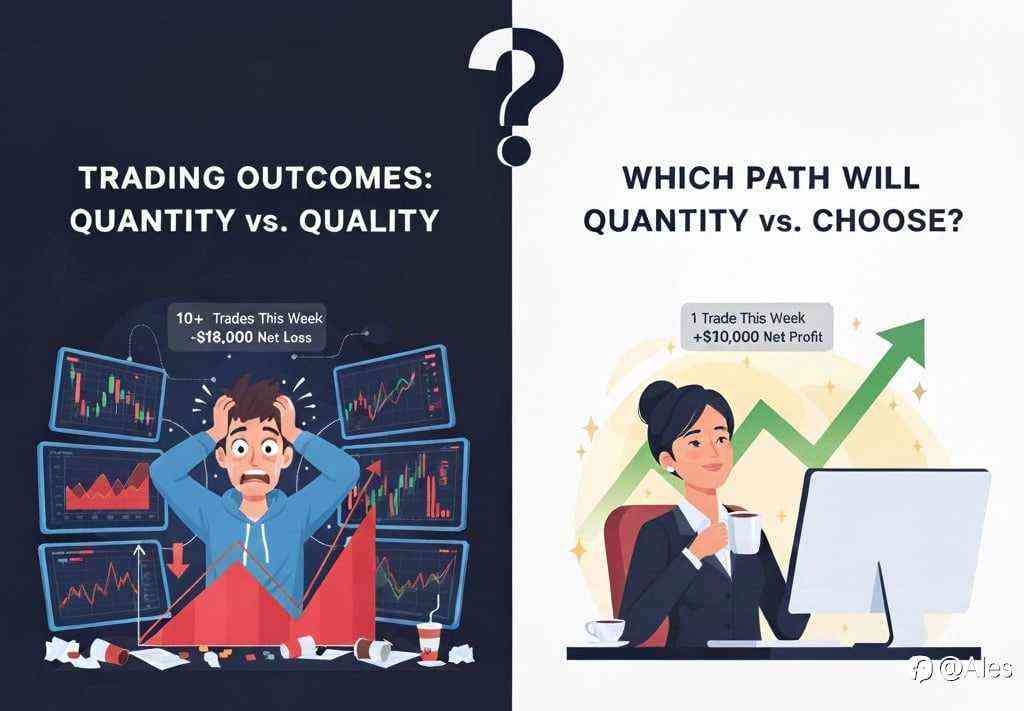

A paradox often occurs in trading: the more you trade, the less you earn. Beginners frequently confuse trading with a regular job, where income is directly tied to hours worked or tasks completed. In the market, it’s the opposite.

"The fastest one in trading is the one who is the slowest."

This phrase is the foundation of professional trading. What matters isn't how fast you click buttons, but your ability to wait for your specific setup and execute the trade according to your plan without hesitation.

A pro might sit in front of the monitor for 8 hours a day and not open a single position if the market is "unclear." This isn't a waste of time - it is the preservation of capital, both mental and financial.

Why does "Quantity" not equal "Wealth"?

- Mathematical Expectation: Every extra trade is a risk. The more trades you make, the higher the probability of making an error or hitting a losing streak.

- Emotional Resources: Trading means working in a zone of constant uncertainty and high emotional tension. Your brain is like a battery. By the 10th trade of the day, it runs out of juice, and you start making "stupid" mistakes.

How to find your "norm"?

Adopt the "One-Trade Rule" based on your system.

- If the system gives no signal - no position is opened.

- Once one trade is made (regardless of whether it’s a profit or a loss) - the trading day is over, and you move on to analyzing the position.

- If you feel discomfort after hitting a Stop Loss, take a break and perform your analysis afterward.

This approach builds systematic habits and discipline.

Trading is hunting, not assembly-line work. A hunter can sit in ambush for days just for one precise shot. Be the hunter, not the target.

The Bottom Line: Remember, profit is not proportional to the number of mouse clicks. The biggest money is made during 10% of the price movement.

Edited 19 Dec 2025, 21:40

Disclaimer: The views expressed are solely those of the author and do not represent the official position of Followme. Followme does not take responsibility for the accuracy, completeness, or reliability of the information provided and is not liable for any actions taken based on the content, unless explicitly stated in writing.

Leave Your Message Now