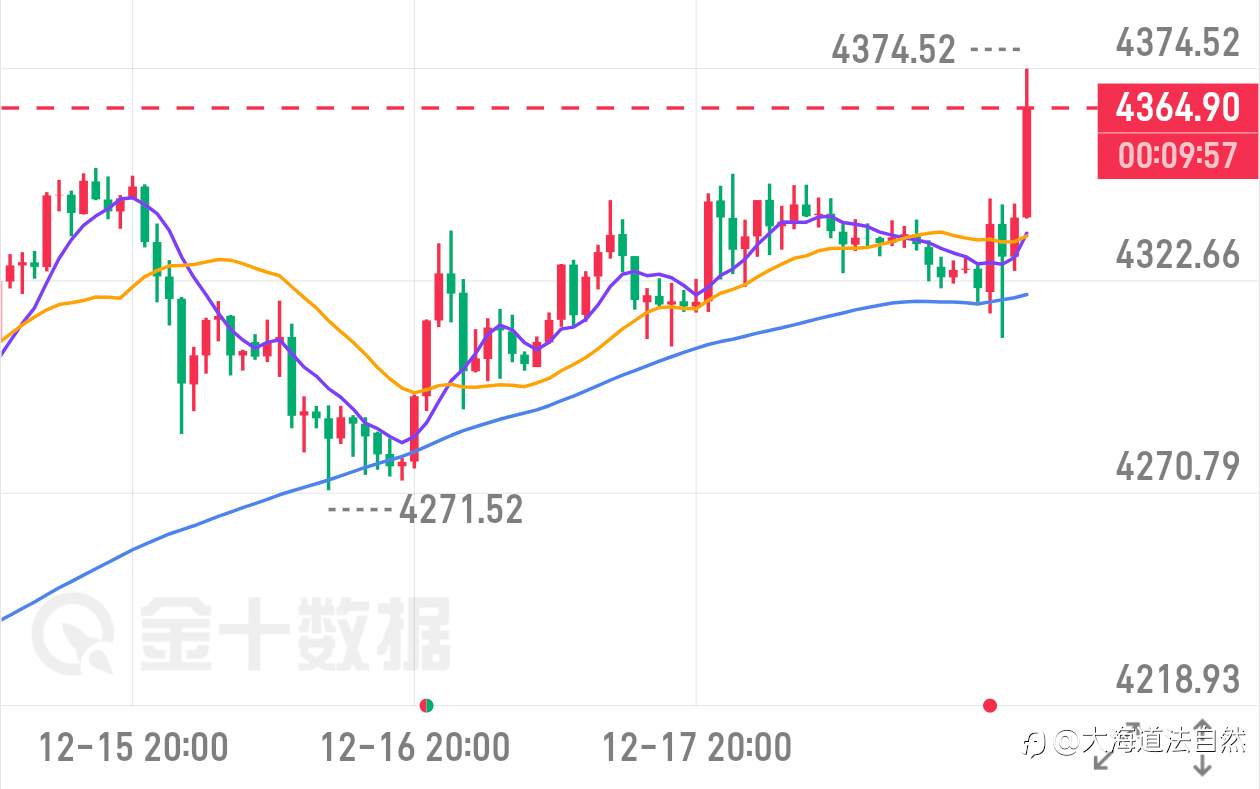

美盘CPI数据利多黄金,行情却走出了一波“先诱空再拉升”的精彩戏码——先是短暂冲高后快速下杀洗盘,把跟风多头洗出局,随后迅速探底回升,这波操作的目的再明确不过:清理浮筹后,为后续上涨扫清障碍。

背后的核心逻辑很清晰:一方面,美国劳动力市场持续疲软,直接压制了美元指数的上行空间;另一方面,市场早有CPI降温预期,数据公布后完全契合预期,进一步强化了美元的弱势格局,这两点共同为金价上涨提供了核心动力。

而从金价洗盘后迅速回升、波动幅度持续扩张的表现来看,11月CPI数据无疑给多头注入了强劲信心——通胀降温意味着美联储加息周期彻底落幕,甚至明年降息预期升温,这对无息资产黄金来说是重大利好。种种信号叠加,黄金突破历史新高的脚步,已经越来越近了。

Disclaimer: The views expressed are solely those of the author and do not represent the official position of Followme. Followme does not take responsibility for the accuracy, completeness, or reliability of the information provided and is not liable for any actions taken based on the content, unless explicitly stated in writing.

Like this article? Show your appreciation by sending a tip to the author.

Leave Your Message Now