Stop Chasing Leaderboards: How to Spot Signal Providers That Pass the Reality Check

A good signal provider is not the one with the biggest return. It is the one you can still trust when the market turns ugly. In copy trading, flashy performance is easy to market, but repeatable execution is rare. The goal of Followme and this article is simple: Help you spot signal providers that look strong on the surface, then verify them with a practical checklist before you follow.

What makes a good signal provider on Followme:

The best providers usually share a few fingerprints that show up directly on the signal card and inside the strategy page. Time in market matters first, because a strategy that survives 30 to 60 weeks or more has been tested across different volatility regimes, not just one lucky month. Next is return and risk together, because high return with high drawdown is often borrowed time.

Then comes the equity curve, where smooth growth or a staircase pattern is usually healthier than vertical spikes and deep V shaped recoveries.

Finally, social proof needs context, meaning followers and copied capital should grow alongside stable performance and consistent risk behavior.

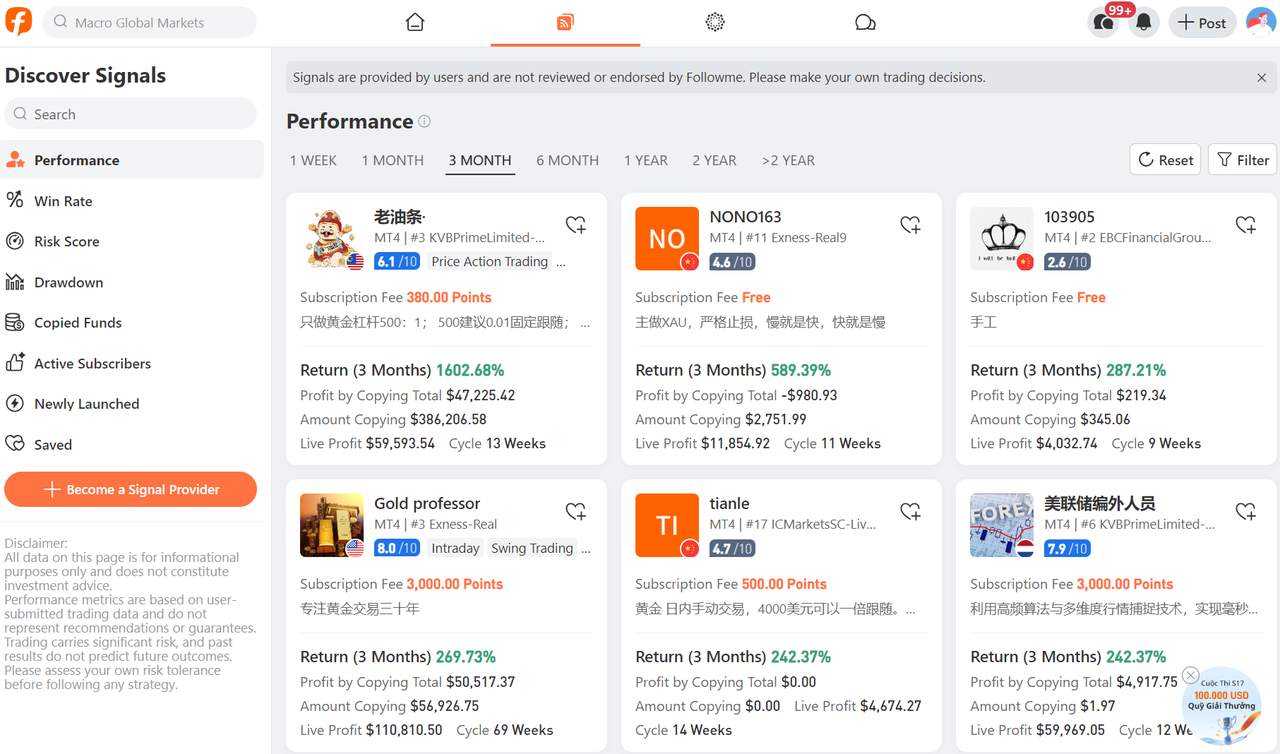

Followme's Signal Providers recommendation: When the number doesn't lie

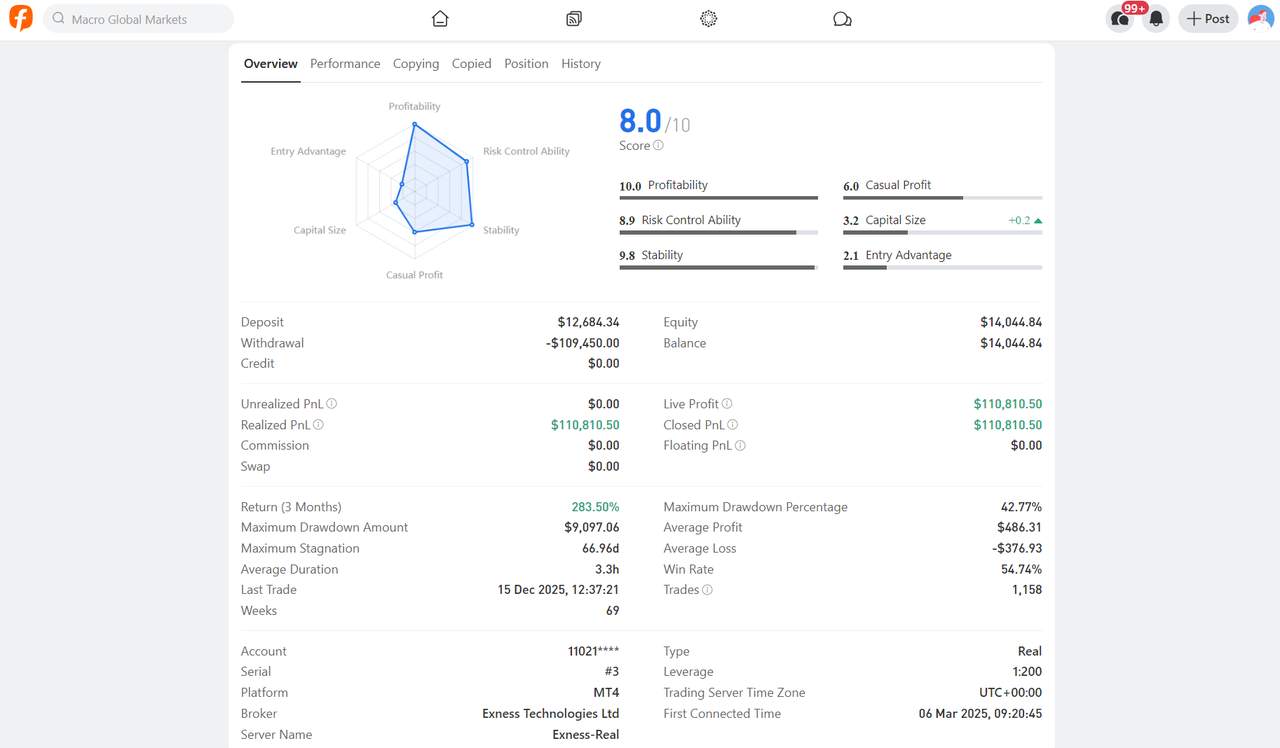

Signal Spotlight #1: Gold professor (69 weeks live):

If you are looking for a performance plus track record combination instead of a short-term spike, Gold professor is one of the cleanest profiles on the Performance board. On the 3-month view, it shows Return (3 Months) 269.73%, Followme score 8.0/10, and Cycle 69 Weeks. That cycle length matters because time in market is the first filter that separates repeatable execution from lucky volatility.

Quick Facts: Gold professor (what the card tells you at a glance):

Platform: MT4 (Exness real)

Score: 8.0/10

Subscription fee: 3,000 Points

Return (3 Months): 269.73%

Profit by Copying Total: $50,517.37

Amount Copying: $56,902.60

Live Profit: $110,810.50

Cycle: 69 Weeks

Why Gold professor is interesting for copiers:

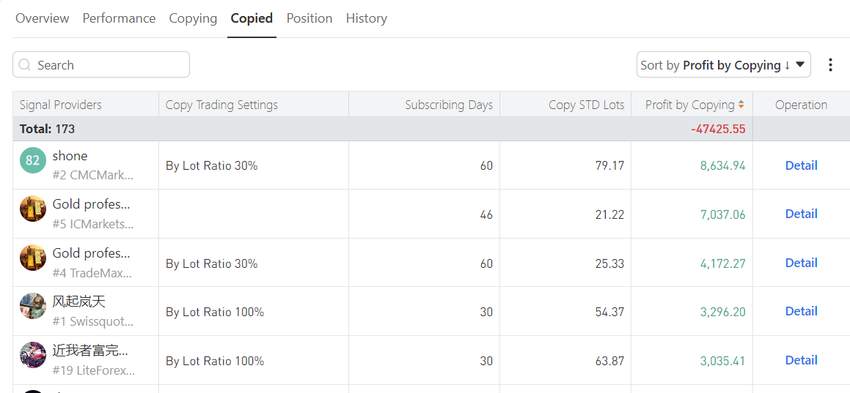

A 3 month return number is a headline, not the full story. What makes Gold professor more copy trader friendly is the combination of a stronger overall score, meaningful copied capital, and a long live cycle. In copy trading, this is close to social proof with context, because people did not just follow, it stayed live long enough for the crowd to test it under different market moods.

Copy Gold professor's Signal

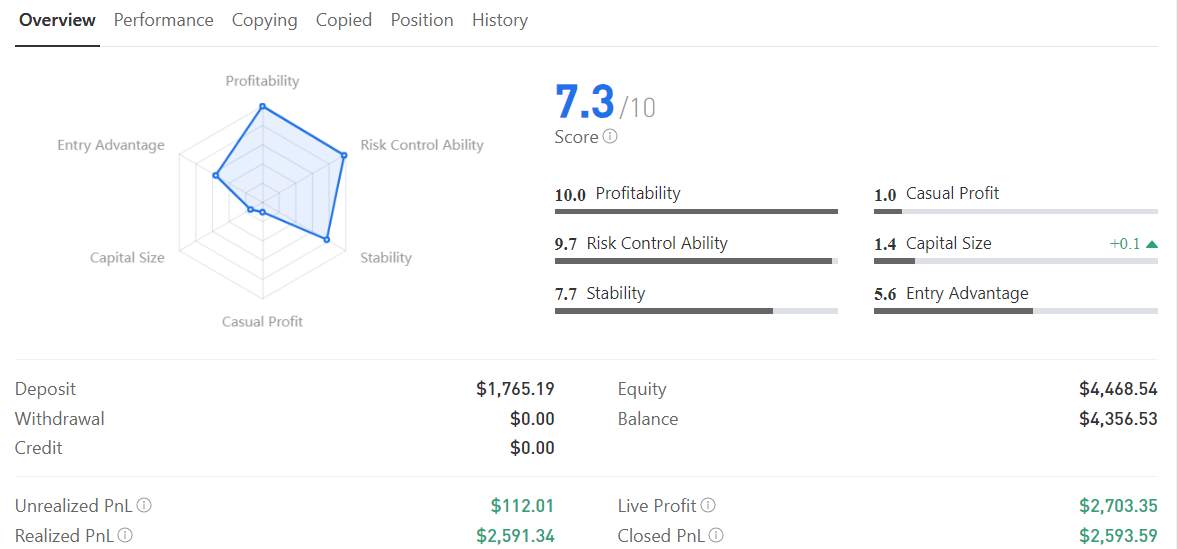

Watchlist Pick #2: freedom5200 (29 weeks live, lower subscription barrier):Not everyone wants a high fee signal, especially if you are still building confidence with position sizing. freedom5200 is a more accessible profile on the same board with Return (3 Months) 140.70%, score 7.3/10, Cycle 29 Weeks, and Subscription fee 100 Points. The Amount Copying is smaller than the top names, but it still shows real activity, which can be a healthy middle ground for learners who want participation plus data without paying premium points.

Quick Facts: freedom5200:

Platform: MT4 (Exness real)

Score: 7.3/10

Subscription fee: 100 Points

Return (3 Months): 140.70%

Profit by Copying Total: $1,144.43

Amount Copying: $6,360.41

Live Profit: $2,709.27

Cycle: 29 Weeks

Copy freedom5200's Signal

Watchlist Pick #3: 黄金大鲨鱼 (66 weeks live, free subscription):

If your priority is longevity plus low friction, 黄金大鲨鱼 stands out for one simple reason: it is free to subscribe, and it has Cycle 66 Weeks. That kind of history is rare compared to many hot signals that only have a few weeks of performance. Its Return (3 Months) 80.24% is lower than the aggressive leaders, but the Live Profit displayed is substantial, which can signal an account that has been active long enough to build meaningful P and L.

Quick Facts: 黄金大鲨鱼:

Platform: MT4 (STARTRADER live)

Score: 6.6/10

Subscription fee: Free

Return (3 Months): 80.24%

Profit by Copying Total: $479.30

Live Profit: $123,709.25

Cycle: 66 Weeks

Copy 黄金大鲨鱼's Signal

To keep this practical, use a simple flow: Quick Facts, Interpretation, Fit. The goal is to confirm whether the signal is copy friendly, not just high performing on paper.

1. Weeks live first, returns second: A 13 to 20 week strategy with extreme returns is very different from a 60 plus week strategy that survived multiple market regimes.

2. Cross check Profit by Copying vs signal profit: If followers consistently cannot capture the performance, execution, slippage, or timing differences may be at play.

3. Score plus copied funds together: A higher score is helpful, but it is stronger when paired with meaningful Amount Copying.

4. Open the signal page and read the equity curve: Smooth growth with controlled pullbacks usually beats near vertical spikes.

5. Red flags to avoid: Too new plus too explosive, rapidly changing behavior, or performance that looks good only on a short slice of time.

A note on expectations (copy trading is not autopilot):

Even the best looking card is still just an entry point. Copy trading means you are mirroring real trades, so your results can differ due to timing, spreads, and risk settings. The safest approach is to size conservatively, treat performance as information not a promise, and follow strategies that behave consistently when conditions get messy.

Why Followme?

What makes Followme powerful is that we do not force you to copy based on hype or screenshots. The app provides a structured way to validate a signal provider using real, trackable data.

That workflow is the real advantage to help you compare signal providers with the same yardstick and avoid blindly chasing high returns.

-

Open Followme, go to Discover Signals, then Performance, then choose "3 Month"

-

Search these three names and study each profile

-

Review equity curve and risk stats. Follow the signals you like and keep comparing week by week, because consistency is the real edge

👉 Follow Followme for the latest market updates and more powerful tools for your trade!

Disclaimer: The views expressed are solely those of the author and do not represent the official position of Followme. Followme does not take responsibility for the accuracy, completeness, or reliability of the information provided and is not liable for any actions taken based on the content, unless explicitly stated in writing.

Leave Your Message Now