On December 10, 2025, the Federal Reserve delivered its anticipated holiday gift to markets—a 25 basis point rate cut, trimming the federal funds target to 3.50%-3.75%. This marks the third consecutive easing move in 2025, signaling confidence in cooling inflation but wariness over persistent pressures. The decision, passed 9-3, highlighted internal rifts: Fed Governor Miran pushed for a bolder 50 bp slash, while Chicago's Goolsbee and Dallas' Schmid voted to hold steady, citing sticky job growth.

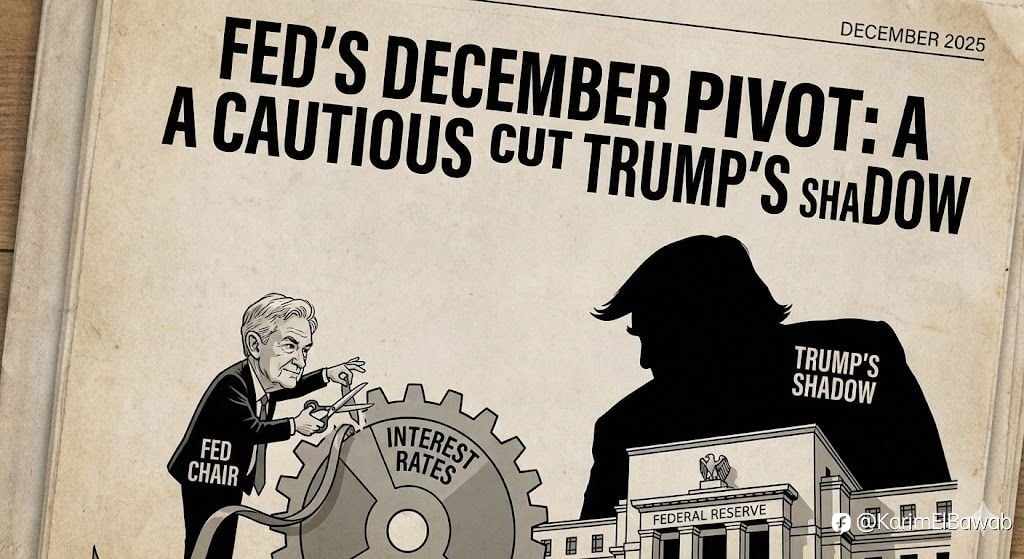

Jerome Powell's presser painted a nuanced picture of "progress on dual mandate" while dodging direct jabs at President Trump's vocal demands for deeper cuts. "We're not rushing; data dictates," Powell quipped, emphasizing balanced risks between recession and reacceleration. He nodded to Trump's fiscal plans—tariffs and tax extensions—as potential inflationary wildcards, hinting at a "higher for longer" path into 2026.

- Market Jitters: Equities dipped modestly (S&P 500 -0.5%), but bonds sold off sharply—10-year Treasury yields spiked to 4.21%, a three-month peak, as traders bet on fewer future easings.

- Crypto Crossfire: Bitcoin tumbled 1.4% to $92K on the "hawkish cut" vibe, while Ethereum eked out a 0.6% gain, buoyed by ETF inflow hopes.

- Global Echoes: The dollar strengthened 0.8% versus majors, pressuring emerging markets and yen carry trades.

Powell's composed tone masked the Fed's tightrope: easing without igniting Trump's ire or derailing the soft landing. With just two meetings left in 2026 before potential leadership shakeups, this cut feels like a bridge to uncertain waters.

Takeaway: The Fed's measured step buys time, but Trump's megaphone looms large—watch yields for the real policy tell. What's your bet on the next cut: January or bust?

Disclaimer: The views expressed are solely those of the author and do not represent the official position of Followme. Followme does not take responsibility for the accuracy, completeness, or reliability of the information provided and is not liable for any actions taken based on the content, unless explicitly stated in writing.

Leave Your Message Now