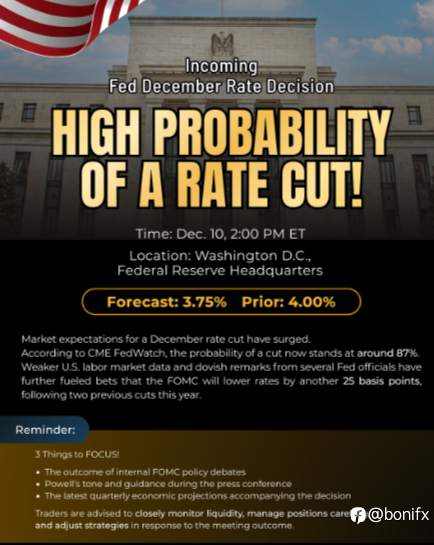

- Date: December 9–10, 2025

- Backdrop: The Fed faces a delicate balancing act. Inflation remains stubbornly above the 2% target, while the labor market shows signs of weakening.

- Complication: A recent U.S. government shutdown delayed key economic data, leaving policymakers with less clarity than usual.

- Division within the Fed: Some officials lean toward maintaining higher rates to fight inflation, while others worry about recession risks from tightening too much.

🔑 Possible Outcomes

- Rate Hold (Status Quo)Fed keeps rates unchanged.

- USD likely stabilizes but volatility spikes around the statement and press conference.

- Traders should focus on forward guidance and the “dot plot” for 2026 projections.

- Rate Cut (Dovish Shift)

- Fed lowers rates to support slowing growth.

- USD weakens across major pairs (EUR/USD, GBP/USD, AUD/USD).

- Risk-sensitive currencies (AUD, NZD, emerging markets) may rally.

- Hawkish Hold (No Cut, Strong Inflation Warning)

- Fed holds rates but signals concern about persistent inflation.

- USD strengthens, especially against JPY and EM currencies.

- Safe-haven flows into USD increase, pressuring risk assets.

- Surprise Hike (Unlikely but Possible)

- Fed raises rates unexpectedly to counter inflation.

- USD surges sharply, especially vs EUR and GBP.

- Could trigger risk-off sentiment globally, hurting equities and commodities.

- Neutral/Dovish Language with Hold

- Rates unchanged, but Fed hints at cuts in early 2026.

- USD softens gradually, markets price in easing cycle.

- Traders should watch for positioning shifts in USD/JPY and EUR/USD.

💡 Key Signals for Forex Traders

- Dot Plot & Forward Guidance: Traders should scrutinize the Fed’s projections for 2026. Even if rates are held, dovish language could trigger USD selling.

- USD/JPY Sensitivity: The yen has been particularly reactive to Fed policy shifts. A dovish Fed could accelerate yen strength, especially if the Bank of Japan maintains its cautious stance.

- EUR/USD Reaction: The euro may benefit from any Fed dovishness, but traders must weigh this against the ECB’s own policy trajectory.

- Risk Sentiment: A cut could boost equities and risk currencies (AUD, NZD), while a hawkish hold may strengthen safe-haven flows into USD.

⚠️ Risks and Trade-Offs

- Data Uncertainty: With delayed government statistics, the Fed’s decision may rely more on partial or lagging indicators, increasing unpredictability.

- Market Overreaction: Thin December liquidity can amplify moves, meaning even small surprises in Fed language could cause outsized volatility.

- Global Spillovers: Emerging market currencies are especially vulnerable to USD swings. Traders should monitor capital flow risks.

🎯 Actionable Guidance for Traders

- Prepare for Volatility: Expect sharp moves around the announcement and press conference.

- Focus on Language: Beyond the rate decision itself, Fed commentary on inflation and employment will drive forex sentiment.

- Risk Management: Use tighter stops and smaller position sizes to navigate potential whipsaws.

- Cross-Currency Strategy: Consider relative central bank stances (Fed vs ECB, Fed vs BoJ) when positioning.

The Fed’s December 2025 decision is not just about whether rates move—it’s about the tone of the guidance. Forex traders should be ready for volatility in USD pairs, with special attention to EUR/USD and USD/JPY, and manage risk carefully in thin year-end markets.

Edited 10 Dec 2025, 17:53

Disclaimer: The views expressed are solely those of the author and do not represent the official position of Followme. Followme does not take responsibility for the accuracy, completeness, or reliability of the information provided and is not liable for any actions taken based on the content, unless explicitly stated in writing.

-THE END-