Keywords: NVIDIA Stock, NVDA Earnings, Q3 Report, US Tech Stocks, AI Chips, Jensen Huang, Blackwell, Nasdaq Analysis

The Market Held Its Breath, and Nvidia Delivered

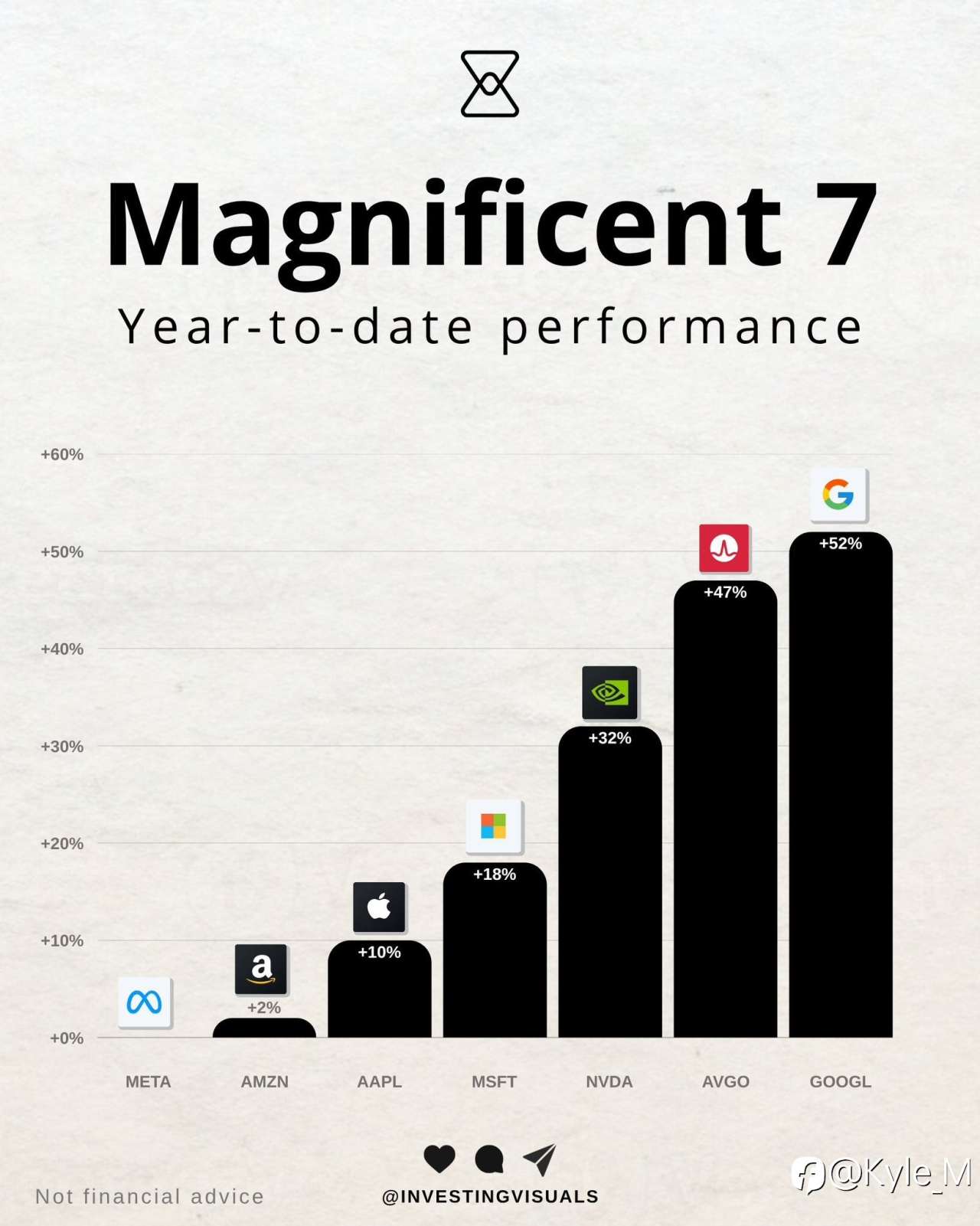

Entering this earnings season, the mood on Wall Street was tense. With macroeconomic uncertainty lingering and the "Trump Trade" shifting capital flows, the Nasdaq needed a hero. The question wasn't just about whether NVIDIA (NVDA) would beat estimates—that is almost expected now—but whether the AI growth story still had enough momentum to justify the massive valuations across the "Magnificent Seven."

This morning, Jensen Huang answered with a resounding "Yes."

By delivering another quarter of explosive growth and offering robust guidance, Nvidia didn’t just boost its own stock; it effectively put a floor under the entire US technology sector, proving once again that the AI revolution is a structural shift, not a fleeting bubble.

1. The Numbers: Crushing the "Whisper Numbers"

In the high-stakes world of AI infrastructure, "good" is not enough; results must be spectacular. Nvidia’s Q3 report ticked every box that matters to institutional investors:

- Revenue Surge: Top-line growth continues to defy the law of large numbers, driven by insatiable demand for H100 and H200 GPUs.

- Data Center Dominance: The Data Center segment remains the company's crown jewel. Revenue here hit record highs, confirming that Hyperscalers (Microsoft, Google, Meta, Amazon) are not slowing down their CapEx spending.

- Profitability: Despite concerns about supply chain costs, margins remained enviable, showcasing Nvidia's unparalleled pricing power in the semiconductor space.

Key Takeaway: The fear of an "AI air pocket"—a pause in spending by big tech—has been proven wrong. The infrastructure build-out is still in full swing.

2. The "Atlas" Effect: Why Nvidia Matters to the Whole Market

Why does a single chip company determine the direction of the S&P 500? Because Nvidia is currently the proxy for the entire AI economy.

The logic supporting the US tech rally today is simple:

- Validation of ROI: Nvidia's earnings prove that downstream companies are buying hardware.

- Sector Contagion: When Nvidia rallies, it pulls up the entire semiconductor supply chain (TSMC, Broadcom, AMD) and server manufacturers (Dell, Super Micro).

- Sentiment Anchor: In a market jittery about interest rates and inflation, Nvidia provides a rare asset: guaranteed, high-velocity growth.

By beating expectations, Nvidia has effectively removed the biggest tail risk for the market for the rest of the year. It has signaled that the "AI Supercycle" is healthy, keeping the bull market narrative intact.

3. The Blackwell Era: Demand Outstrips Supply

The most critical part of the earnings call focused on the next generation of AI chips: Blackwell.

Investors were looking for reassurance regarding production timelines and potential overheating issues previously rumored in the media. Management provided clear visibility, noting that demand for Blackwell is "incredible" and supply will likely be constrained well into next year.

For investors, supply constraints are actually good news—they imply a long runway of pent-up demand that secures revenue visibility for the next 4-6 quarters.

4. What This Means for Your Portfolio

The "NVDA Trade" has evolved. It is no longer a speculative bet; it is a fundamental holding for exposure to the digital economy.

- For Tech Bulls: The green light remains on. The fundamental drivers for the Nasdaq are secure.

- For Skeptics: Betting against Nvidia right now is effectively betting against the capex plans of the world's richest companies.

- The Risk: Volatility remains high. As the stock hovers near all-time highs, any minor macroeconomic shock can cause sharp pullbacks, even if the company's fundamentals are perfect.

Conclusion: The King Stays on the Throne

Nvidia’s Q3 performance was a masterclass in execution. By smashing expectations, they haven't just rewarded their shareholders; they have provided the psychological and fundamental support the broader US stock market desperately needed. The AI trade is not over—it is evolving, and Nvidia remains its undisputed engine.

Disclaimer: The views expressed are solely those of the author and do not represent the official position of Followme. Followme does not take responsibility for the accuracy, completeness, or reliability of the information provided and is not liable for any actions taken based on the content, unless explicitly stated in writing.

Leave Your Message Now