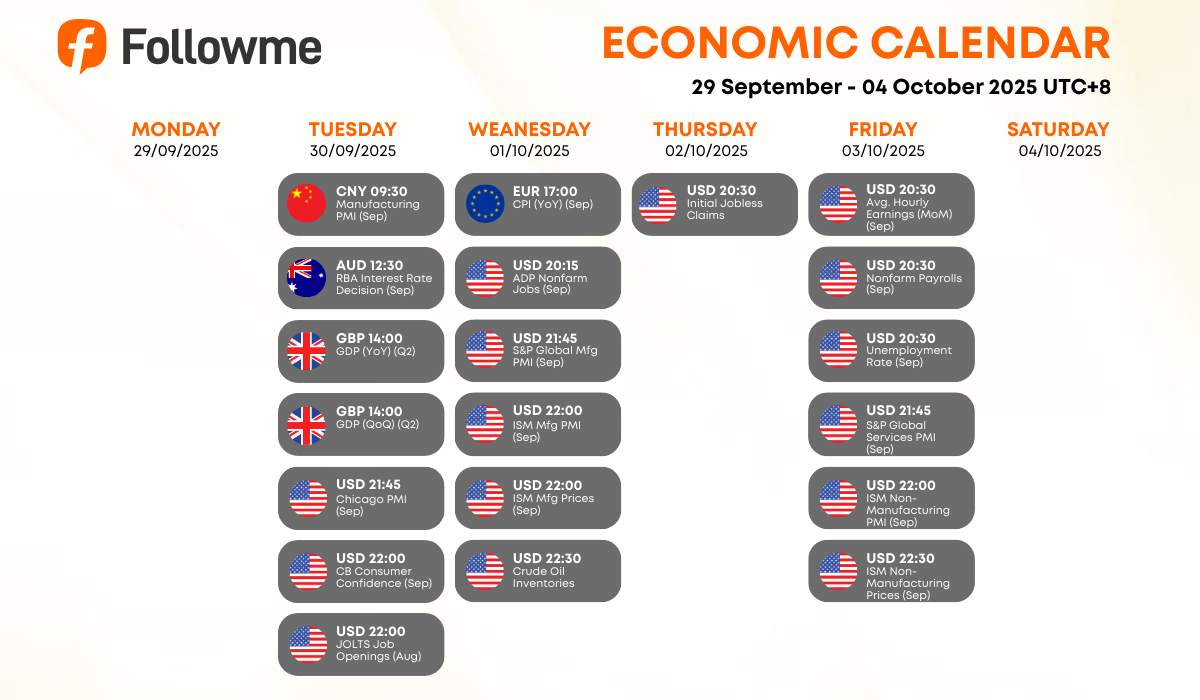

Weekly Economic Calendar: Week of September 29 - October 4, 2025 (GMT+8)

This week's macro calendar is loaded with U.S. events that will guide market sentiment. Key highlights include September PMI data, Q2 GDP results from the UK, Eurozone CPI, U.S. labor market updates, and energy inventories. Investors will be watching closely for clues on growth resilience and Fed policy direction.| Time | Cur. | Events | Fcst | Prev |

|

Thursday, September 30, 2025

|

||||

| 09:30 | CNY |

Manufacturing PMI (Sep)

|

49.6 | 49.4 |

| 12:30 | AUD |

RBA Interest Rate Decision (Sep)

|

3.60% | 3.60% |

| 14:00 | GBP |

GDP (YoY) (Q2)

|

1.20% | 1.30% |

| 14:00 | GBP |

GDP (QoQ) (Q2)

|

0.30% | 0.70% |

| 21:45 | USD |

Chicago PMI (Sep)

|

43.2 | 41.5 |

| 22:00 | USD |

CB Consumer Confidence (Sep)

|

95.3 | 97.4 |

| 22:00 | USD |

JOLTS Job Openings (Aug)

|

7.150M | 7.181M |

|

Wednesday, October 1, 2025

|

||||

| 17:00 | EUR | CPI (YoY) (Sep) | 2.20% | 2.00% |

| 20:15 | USD | ADP Nonfarm Employment Change (Sep) | 53K | 54K |

| 21:45 | USD | S&P Global Manufacturing PMI (Sep) | 52.0 | 52.0 |

| 22:00 | USD | ISM Manufacturing PMI (Sep) | 49.1 | 48.7 |

| 22:00 | USD | ISM Manufacturing Prices (Sep) | 64.5 | 63.7 |

| 22:30 | USD | Crude Oil Inventories | -0.607M | |

| Thursday, October 2, 2025 | ||||

| 20:30 | USD | Initial Jobless Claims | 229K | 218K |

| Friday, October 2, 2025 | ||||

| 20:30 | USD | Average Hourly Earnings (MoM) (Sep) | 0.30% | 0.30% |

| 20:30 | USD | Nonfarm Payrolls (Sep) | 51K | 22K |

| 20:30 | USD | Unemployment Rate (Sep) | 4.30% | 4.30% |

| 21:45 | USD | S&P Global Services PMI (Sep) | 53.9 | 54.5 |

| 22:00 | USD | ISM Non-Manufacturing PMI (Sep) | 52.0 | 52.0 |

| 22:00 | USD | ISM Non-Manufacturing Prices (Sep) | 69.2 | |

| Key highlights: |

🇦🇺 RBA Rate Decision (Tue) – The Reserve Bank of Australia kept interest rates unchanged at 3.60%, aligning with market expectations.

🇬🇧 UK GDP (Tue) – Growth slowed in Q2, with YoY at 1.20% (vs. 1.30% prior) and QoQ at 0.30% (vs. 0.70%), suggesting softer momentum.

🇺🇸 U.S. Consumer & Jobs (Tue) – CB Consumer Confidence came at 97.4, while JOLTS Job Openings stood at 7.18M, showing easing labor demand.

🇪🇺 Eurozone CPI (Wed) – September YoY inflation at 2.00% keeps ECB policy in focus.

🇺🇸 U.S. PMI (Wed) – S&P Global Manufacturing PMI forecast at 52 (vs. 53 prior), ISM Manufacturing PMI expected at 48.7, and ISM Prices at 63.7, highlighting inflation persistence in input costs.

🇺🇸 Crude Oil Inventories (Wed) – Prior drawdown of -0.607M, with traders monitoring supply tightness.

🇺🇸 Initial Jobless Claims (Thu) – Previous at 218K, a key labor health metric before Friday’s NFP release.

🇺🇸 Labor Market Focus (Fri) – Nonfarm Payrolls forecast at 22K, Unemployment Rate steady at 4.30%, and Hourly Earnings at 0.30%. These figures will heavily shape expectations for the Fed’s next move.

🇺🇸 Services PMI (Fri) – S&P Global Services PMI at 53.9 (vs. 54.5 prior) and ISM Non-Manufacturing PMI at 52, while ISM Prices jumped to 69.2, pointing to sticky inflationary pressures.

Macro Analysis

🇺🇸 U.S. Economy & Fed Outlook

- Labor Market: Jobless claims steady near 218K and subdued payroll growth highlight a cooling but resilient job market.

- PMI Signals: Services remain in expansion, but manufacturing lags, showing a two-speed economy.

- Inflation Pressures: ISM Prices suggest cost pressures are not easing, complicating Fed’s inflation fight.

- Global Outlook: Weak UK GDP and soft Eurozone inflation suggest diverging paths vs. U.S. resilience.

🟢 Bullish USD Scenario

- Resilient labor market and strong services PMI support USD strength.

- Sticky inflation through ISM Prices reinforces hawkish Fed bias. Trade Ideas: Long USD/JPY, short EUR/USD.

- Weak manufacturing PMI and soft payroll growth limit USD upside.

- If inflation eases faster than expected, Fed could turn less hawkish. Trade Ideas: Long EUR/USD, long gold.

- A surprise jump in Jobless Claims (well above 218K) could spark downside in USD.

- Unexpected CPI or wage growth shifts may trigger high volatility in USD pairs.

Watch full calendar at Followme Economic Calendar Tool

🔔Don’t forget to follow Followme and stay in sync with the latest updates.

Disclaimer: The views expressed are solely those of the author and do not represent the official position of Followme. Followme does not take responsibility for the accuracy, completeness, or reliability of the information provided and is not liable for any actions taken based on the content, unless explicitly stated in writing.

Like this article? Show your appreciation by sending a tip to the author.

-THE END-