US stocks continued to rally om Friday as investors are more confident about a soft landing scenario. A deepening conflict in the Middle East could prompt fund allocation out of Europe and into the US.

Morgan Stanley raised the view on so-called cyclical stocks relative to safer defensive peers, noting Friday’s blowout payrolls data and expectations of more interest-rate cuts from the Fed.

Goldman Sachs boosted expectations for S&P 500 earnings growth next year as a solid macro outlook drives margins. The bank’s strategist upgraded his 12-month target for the benchmark to 6,300 points from 6,000.

Companies in the S&P 500 are expected to report a 4.7% increase in Q3 from a year ago, according to data compiled by Bloomberg Intelligence. A low bar leaves companies more room to beat forecast.

Since 1971, the S&P 500 has posted an annualized return of 15% during periods in which the central bank cut rates. Those gains have been even stronger when rate-cutting cycles hit in non-recessionary periods.

On the flip side, CTAs are expected to sell US stocks even if the market stays flat in the next month, according to data from Goldman Sachs. And volatility control funds no longer have room to add exposure.

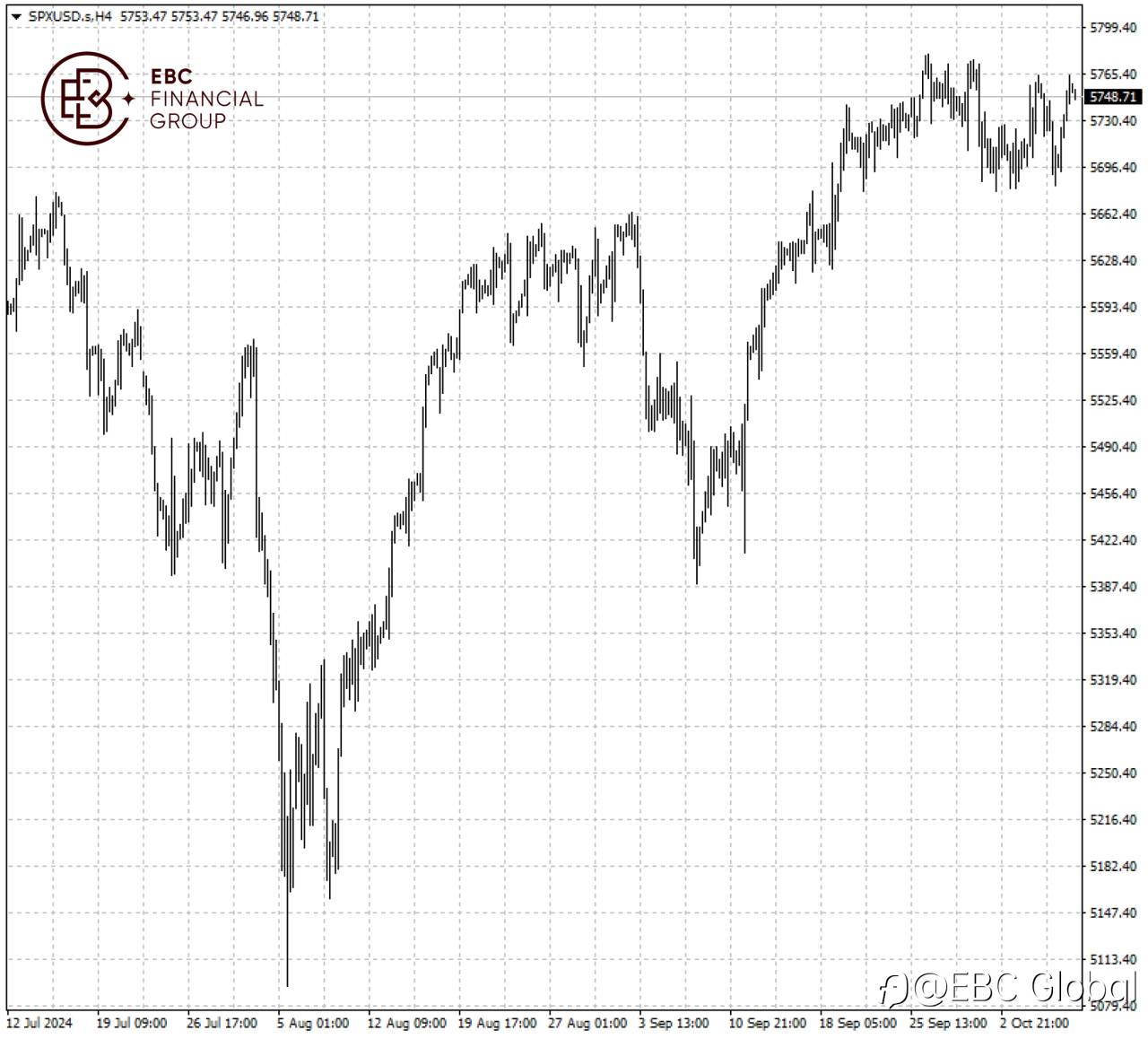

The S&P 500 traded close to its record high but the double top pattern suggests it will more likely move sideways in the near term. The support lies around 5,680.

EBC Institute Perspectives Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC International Business Expansion or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

风险提示:以上内容仅代表作者或嘉宾的观点,不代表 FOLLOWME 的任何观点及立场,且不代表 FOLLOWME 同意其说法或描述,也不构成任何投资建议。对于访问者根据 FOLLOWME 社区提供的信息所做出的一切行为,除非另有明确的书面承诺文件,否则本社区不承担任何形式的责任。

FOLLOWME 交易社区网址: www.followme.com

加载失败()