Current trend

Shares of Alcoa Corp., one of the largest aluminum producers, are adjusting at 29.00.

Yesterday, management announced that the acquisition of alumina producer Alumina Ltd.'s assets had been fully completed and was conducted through Alcoa Corp.'s subsidiary, AAC Investments Australia 2 Rty Ltd. Within its framework, investors will receive 0.02854 dollars per #AWC paper, which, based on the price at the time of the conversion on July 26, amounted to 2.8 billion dollars. As part of the agreement, Alcoa Corp. gained full control over the Alcoa World Alumina and Chemicals (AWAC) joint venture, which it previously owned only by 60.0%. It was also decided to issue convertible preferred shares of Series A on August 1, for which dividends of 0.10 dollars per paper will be paid on August 29.

Against this background, analysts at Citibank and Morgan Stanley confirmed the rating of the emitter's shares at the "Buy" and "Overweight" levels, respectively, with a target price of 50.0 dollars. The improvement in estimates was due to the positive performance of Alcoa Corp. for the second quarter: revenue amounted to 2.6 billion dollars, above the previously forecast 2.52 billion dollars.

Support and resistance

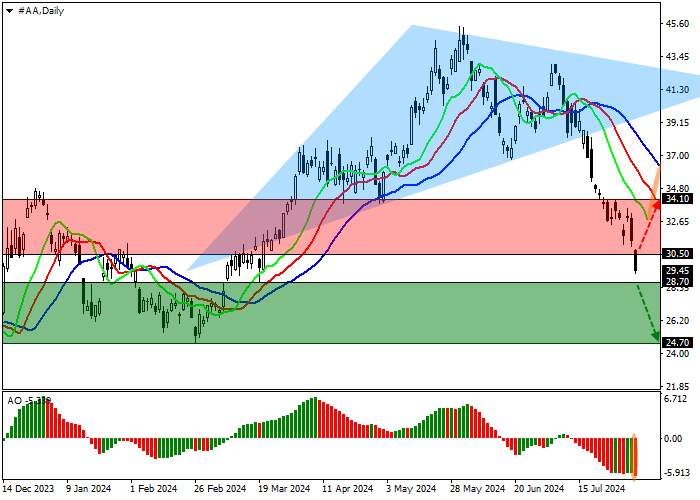

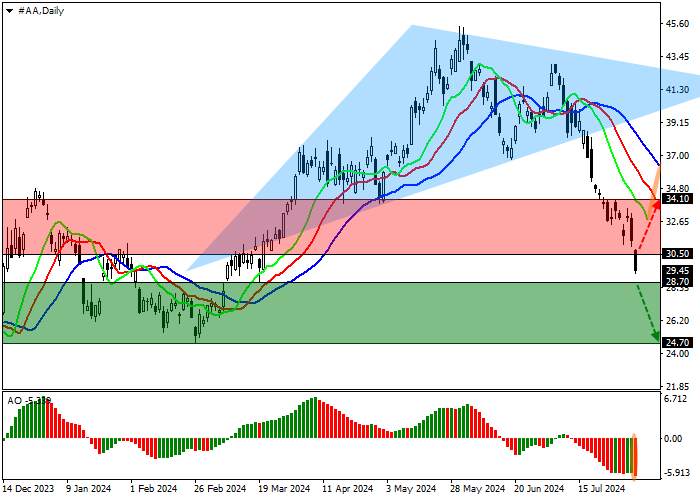

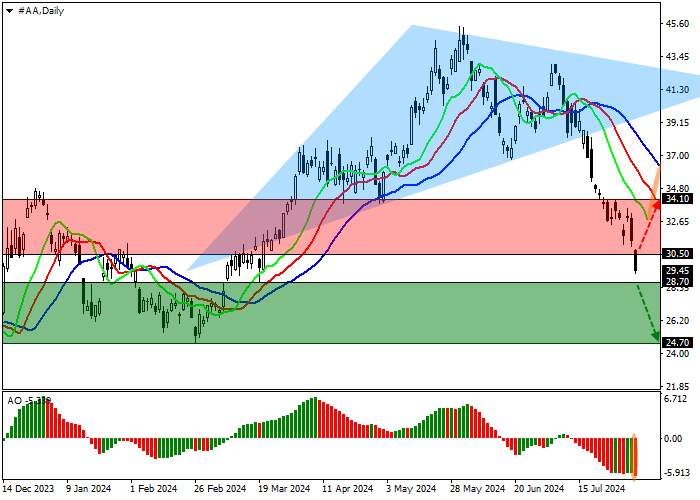

On the D1 chart, the company's quotes have reversed again and continue to work out a downward signal from the "head and shoulders" pattern, approaching a year low of 24.70.

Technical indicators have long reversed and issued a sell signal: the range of EMAs fluctuations on the Alligator indicator is expanding in the direction of decline, and the AO histogram forms new correction bars, being below the transition level.

Support levels: 28.70, 24.70.

Resistance levels: 30.50, 34.10.

Trading tips

If the asset continues to decline and consolidates below the support level of 28.70, one can open short positions with the target of 24.70 and stop-loss of 30.00. Implementation period: 7 days and more.

In case of a reversal and continued growth of the asset, as well as price consolidation above the resistance level of 30.50, one may open long positions with the target of 34.10 and stop-loss of 29.00.

Load Fail()