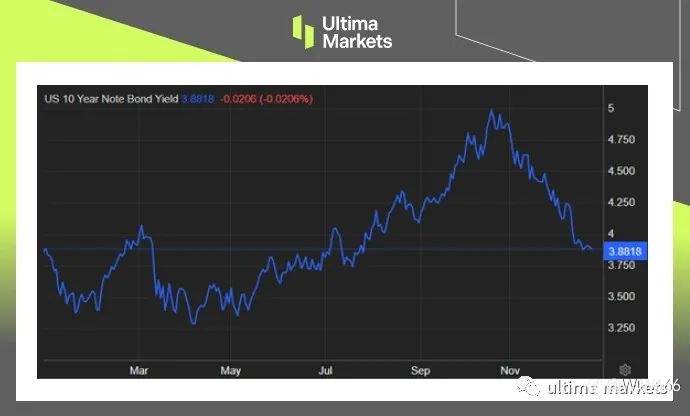

圣诞节假期结束恢复交易后,美国10年期公债利率下滑至3.88%,仍然接近7月底以来的最低水平。此降幅归因于美国公布通胀淡化数据,推升来年更早、更大幅度的降息预期。

上周五的最新数据显示,11月美国PCE物价指数下降0.1%,这是自2022年2月以来首见下滑,超出华尔街持平的预测。

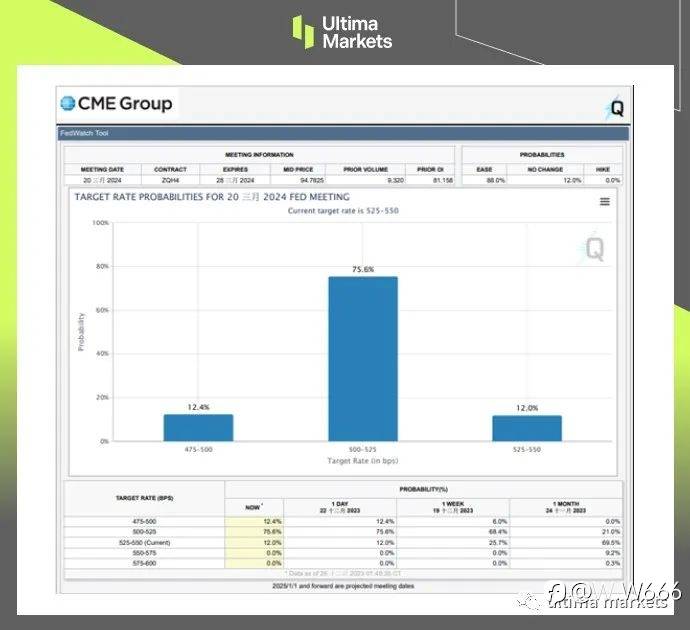

目前,市场押注联准会于3月例会降息25个基点的可能性为75%。依CME FedWatch 工具显示,明年总共降息预计将超过150个基点。

(美国十年期公债利率)

(2024三月美联储利率预测,CME FedWatch Tool)

Disclaimer: The views expressed are solely those of the author and do not represent the official position of Followme. Followme does not take responsibility for the accuracy, completeness, or reliability of the information provided and is not liable for any actions taken based on the content, unless explicitly stated in writing.

Like this article? Show your appreciation by sending a tip to the author.

Leave Your Message Now