Last week, I watched a dark horse film from the Cannes Film Festival called "The Lighthouse." It's a classical, black-and-white, retro-style film that is not your typical fast-paced movie. Instead, it's a thrilling film that allows for multiple perspectives and deep contemplation.

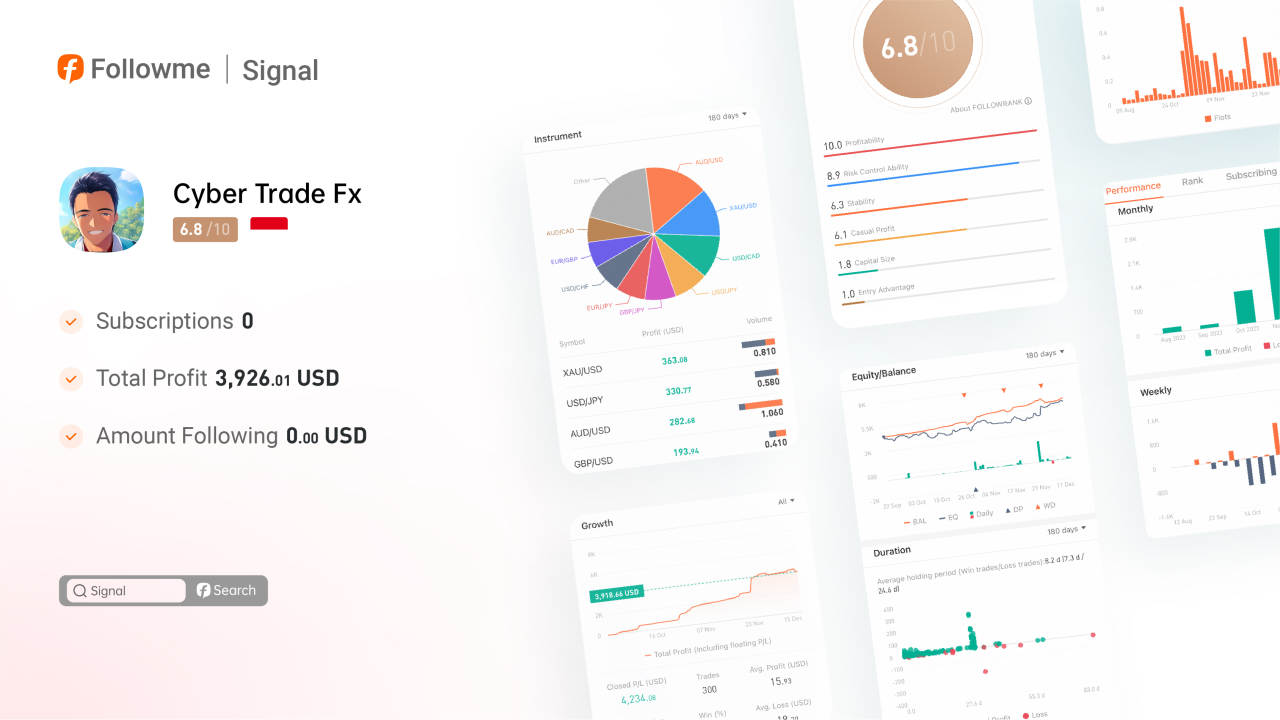

The fear portrayed in the movie is well-constructed, starting with guilt, numbness, loneliness, and desire, and eventually escalating to madness. In trading, anxiety often replaces fear, and mishandling it can lead to a chain of mistakes. Even if you have trading skills, these factors can still easily trigger anxiety. Today, we will discuss the signal @Cyber Trade Fx #8, which is related to the anxiety associated with holding positions.

Anxiety 1:Entry Mistakes and Salvaging Positions

Although this trading signal has a win rate of 94.36%, the average holding time for profitable trades is 7.2 days compared to 24.6 days for losing trades. Additionally, the equity curve consistently remains more than 10% below the balance curve. It seems that instead of immediately withdrawing from a losing position, the approach is to wait. Sometimes, "waiting" can become the sword of Damocles.

Anxiety 2: Insufficient Opportunities, Compensated by Different Instruments

There are a total of 13 trading instruments, with over 30% of the trading volume coming from XAU/USD, followed by Australian currency pairs at around 25%. XAU presents more opportunities while the Australian currency pairs offer higher efficiency in terms of returns. However, this also means that the position size may be higher. Historical data shows that on November 2nd, the position size approached 1 lot, which is relatively high for an account with a balance of $5,000.

In Summary

With an annualized return of 172% and one-third of the time spent in floating losses, it may not be stable enough to be considered a subscription strategy. However, as an annualized product, there may still be some hope.

Disclaimer: The views expressed are solely those of the author and do not represent the official position of Followme. Followme does not take responsibility for the accuracy, completeness, or reliability of the information provided and is not liable for any actions taken based on the content, unless explicitly stated in writing.

Leave Your Message Now