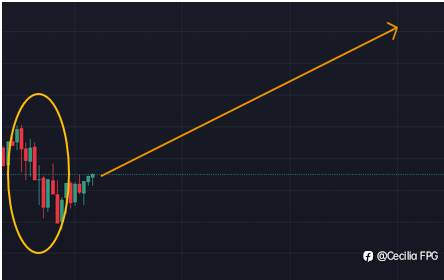

In the history of the S&P 500, there have been a total of 7 instances where it experienced a decline of over 20% or more. After the decline halted, it subsequently saw a sustained upward trend lasting at least 1 year, with a promising trajectory. In 2022, the S&P 500 experienced a decline of over 25% within a year. If historical patterns are any indication, it suggests that the S&P 500 is likely to undergo a prolonged period of growth in the near future.

[The following charts are all S&P 500 1-month (1M) trend charts.]#ForexForecast#

- In 1962, there was a decline of over 20%.

- In 1970, there was a decline of over 20%.

- In 1973, there was a decline of over 50%.

- In 1987, there was a decline of over 30%.

- In 2002, there was a decline of over 20%.

- In 2008, there was a decline of over 30%.

- In 2020, there was a decline of over 20%.

- In 2022, there was a decline of over 20%.

Why there is an upward trend after a significant decline:

1. Market Oversold Correction:

When the stock market experiences a sharp decline, investor sentiment is often negatively affected, leading to panic selling. In such cases, the market may become oversold, reaching excessively pessimistic levels and resulting in undervalued stock prices. Over time, as emotions stabilize, investors reassess the market and seek attractive investment opportunities, which can drive the stock market higher.

2. Government Intervention and Monetary Policy:

When the economy faces significant downside risks, governments and central banks typically take measures to stimulate economic growth and market recovery. These measures may include lowering interest rates, providing economic stimulus packages, increasing government spending, and more. These policy actions can improve market confidence, encourage capital inflows back into the stock market, and drive stock prices higher.

3. Economic Recovery:

The performance of the stock market is often closely related to the economic situation. When the economy is in recession or on the verge of one, the stock market may come under pressure and decline. However, as signs of economic recovery emerge, such as improvements in the job market and corporate profit growth, investors become more optimistic about future prospects. This optimism may prompt them to re-enter the stock market, driving stock prices higher.

4. Long-term Investment Trend:

Despite market fluctuations, the stock market tends to exhibit an upward trend over the long term. This is because the profits and value of businesses typically grow over time, and investors are willing to hold stocks for long-term returns. Therefore, even during temporary downturns, long-term investors often recognize the opportunity and increase their positions in undervalued stocks, eventually leading to a recovery in stock prices.

When is a suitable time to buy?

Fundamental Analysis:

While there is a high possibility of an upward trend in the long term for the S&P 500, the current fundamental signals suggest that the Federal Reserve will pause interest rate hikes this year. However, based on historical patterns, the first rate cut typically occurs around 6-8 months after multiple rate hikes. Therefore, it is possible to experience further decline in the S&P 500 index due to economic slowdown before the first rate cut, which may occur towards the end of the year or early next year.

Technical Analysis:

From the 4-hour chart, it can be observed that the S&P 500 price is consolidating within the range of 4058-4181. Currently, there is an attempt to test the resistance level around 4181, with the price at 4198. Key indicators indicate that there is still upward momentum in the market, possibly due to improved market sentiment and the strong performance of the technology sector in the past two months.

However, as the enthusiasm for technology stocks cools down and other fundamental factors in the market come into play, the price may return to a range of 3856-4000 and consolidate there. Therefore, it may be suitable to initiate buying positions within that range. If the index continues to decline to 3800 or below, further buying can be done in batches.

Of course, if investors are considering holding for at least one year or more without frequent trading, they may consider investing in the index through regular investments without being concerned about the impact of interim index declines. However, given the current overall trend of economic decline, regular investments still carry a certain level of risk.

Disclaimer: The views expressed are solely those of the author and do not represent the official position of Followme. Followme does not take responsibility for the accuracy, completeness, or reliability of the information provided and is not liable for any actions taken based on the content, unless explicitly stated in writing.

Leave Your Message Now