The yield spread between Germany 2-year bond yields and United States equivalent has been widening in favor of the dollar for the last two trading days. Historically the yield spread leads or moves in tandem with exchange rates. Europe is more exposed to global recession due to its economy being more reliant on trade. As market participants price in more recession fears yields on Germany bonds will fall further and dollar will more likely get a boost from haven trades.

Leveraged funds have turned bearish on the euro according to CFTC data on non-commercial net positions on futures and options.

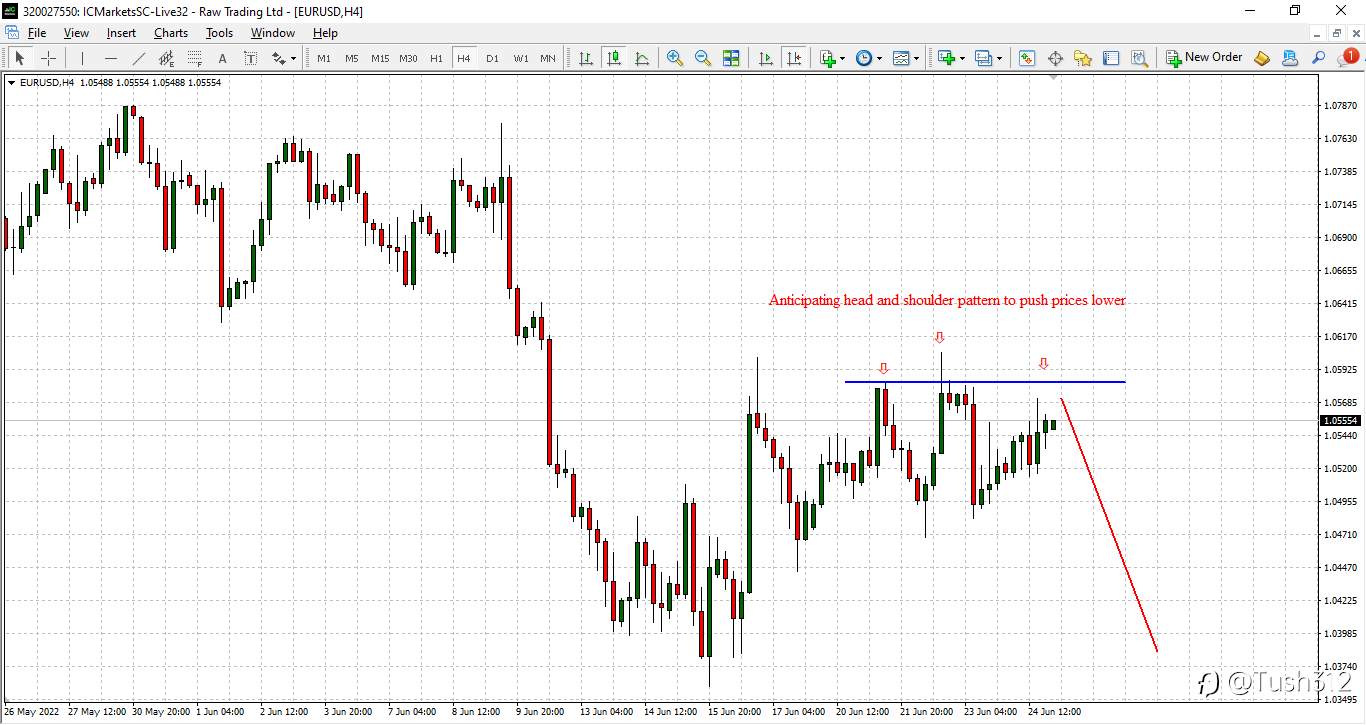

Price action from the charts show euro losing momentum to the upside and its more likely to form the famous head and shoulders price pattern suggesting further move to the downside.

Disclaimer: The views expressed are solely those of the author and do not represent the official position of Followme. Followme does not take responsibility for the accuracy, completeness, or reliability of the information provided and is not liable for any actions taken based on the content, unless explicitly stated in writing.

Leave Your Message Now