For this Tickmill review, we opened a live account and deposited over US$ 8,000.

We traded the popular instrument in each market to identify the average spread and placed 12 trades in total.

We contacted the broker’s customer support to resolve the challenges we faced.

Finally, we withdrew all our funds to discover if there are any issues with withdrawals.

What is Tickmill

Tickmill is a global Forex and CFDs broker, founded in 2014.

The broker is headquartered in London but is licensed by regulators in the UK, Cyprus, South Africa, Seychelles, and Labuan (Malaysia).

Tickmill has offices in each of the countries where it is regulated.

Some of Tickmill’s key features are listed below:

Licenses and Regulations

Tickmill is licensed by 5 global regulators including the top-tier UK’s FCA, the CySEC, FSCA, Labuan FSA & South Africa’s FSA.

Here’s a full list of the licenses, which are held by Tickmill’s subsidiaries:

Is Tickmill Safe

Yes, Tickmill is safe to trade. Tickmill’s regulation by the FCA and CySEC means that traders registered under the two entities are entitled to deposit compensation schemes of up to £85,000 and €20,000 respectively.

We did not encounter any major issues when trading and making withdrawals with Tickmill.

For this review, we opened an account under Tickmill UK Ltd which is regulated by Financial Conduct Authority (FCA) for our tests where we deposited money, placed trades, and withdrew our funds.

We recommend that you register your account with the UK entity, if it’s available to you, as we consider FCA regulation as the best since it provides compensation of up to £85,000 if the broker goes bankrupt.

Fees and Commissions

Tickmill charges low fees for stock index trades, while forex and commodities fees are average to high.

Spread Charged in our Trades

In our tests, we chose the popular instrument in each market. We placed 3 trades for each instrument to get a complete picture of the average spread. We tested the Classic Account which only charges a spread without commissions. Overall, the spread is stable as shown in the table below.

We traded through MT4 on our iPhone which we video recorded the trades. You see this them here.

Comparing the spreads charged in our trades to industry benchmarks, we found the spread on stock indices to be quite low, but the spreads on Forex and commodities were in-line with industry averages or higher.

Other fees

Tickmill does not charge non-trading fees such as account inactivity fees as well as deposit & withdrawal fees.

Tickmill Account types

Tickmill offers 3 account types, that is, the Pro, Classic, and VIP accounts. See the differences below:

Tickmill also offers swap-free forex accounts. The main difference with Islamic accounts is that instead of daily swap rates, there is an administration fee charged if you hold for more than 3 nights.

For our tests, we chose to open a Classic Account.

Account Opening

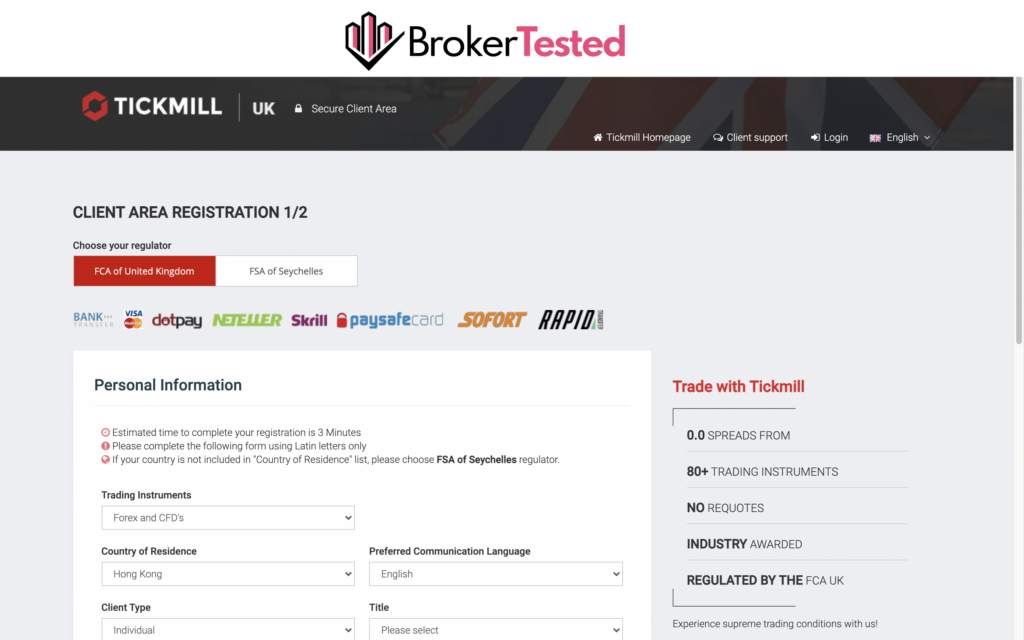

Tickmill account opening is fast and straightforward. We opened an account to test the entire process, which was fully digital.

Here are the 5 steps to opening a Tickmill account:

- Enter your country of residence, preferred communication language, client type, your name, email, and phone number.

- Enter your address including country of residence, state, city, street name, house number and ZIP code.

- Answer a few questions about your nationality employment and financial status

- Choose and confirm your password.

- Verify your ID and residency using either a National ID or Passport and a bank statement.

The registration process took about 20 minutes and our account was approved in 1 day, which was impressive.

We registered our account on 29 January 2022 and it was verified on 30 January 2022. Our account was approved the next day after submitting all the necessary documents.

Unlike other brokers, Tickmill allows you to choose the entity under which you want to open an account giving you the option to choose the UK entity, which we did.

We video recorded our account opening process. See the video below

Tickmill account opening

Deposit and Withdrawal

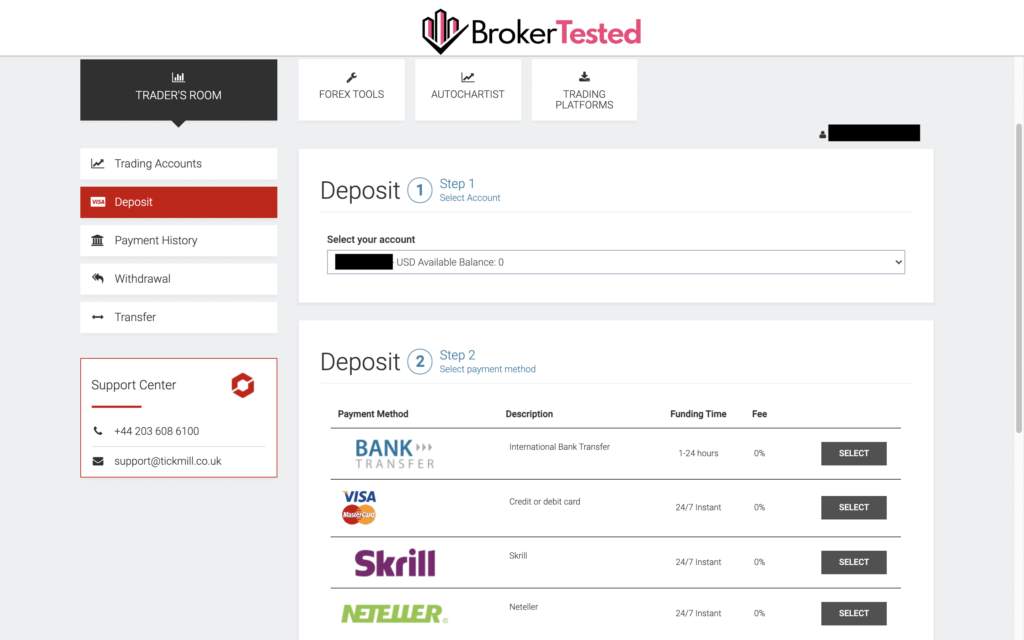

Tickmill offers free and fast deposits and withdrawals. There are various options for funding your account, including bank wires, credit and debit cards, and e-wallets such as Skrill and Neteller.

Minimum Deposit

Tickmill’s minimum deposit is $100 for bank transfers, credit/debit cards, Skrill and Neteller. However, the VIP account has a $50,000 minimum deposit.

Deposit

Tickmill clients can deposit funds into their trading accounts using debit/credit cards, bank transfers, and e-wallets such as Skrill, and Neteller.

The table below shows the details of our deposits:

All the deposit methods offered by Tickmill are instant and free, except for bank transfers, which take 1 working day and usually incur a $25 fee charged by the bank.

Withdrawal

Tickmill processes client withdrawals quite fast with zero charges on each withdrawal.

We withdrew our funds via the four payment methods we used to make our initial deposits to test all the available withdrawal options.

Tickmill allows you to withdraw your funds using any of the payment methods used to deposit funds without following a particular order. We made our first deposit using Skrill yet our first withdrawal was to our credit card.

Markets and Products

At Tickmill, you can trade CFDs on Forex, stock indices, commodities, and German government bonds.

Popular asset classes, such as stocks, ETFs, mutual funds, bonds and options are missing.

Here’s the complete list of Tickmill’s product offerings:

Trading Conditions

The trading conditions at Tickmill are good. You can run most types of trading strategies as the broker allows high-risk strategies such as hedging and scalping.

There are no time limitations for keeping your hedging positions open. Tickmill also allows the use of Expert Advisors (EAs).

Leverage

Tickmill offers different leverage levels to its clients depending on the entity under which they registered their account:

The table below outlines the various leverage levels available to clients:

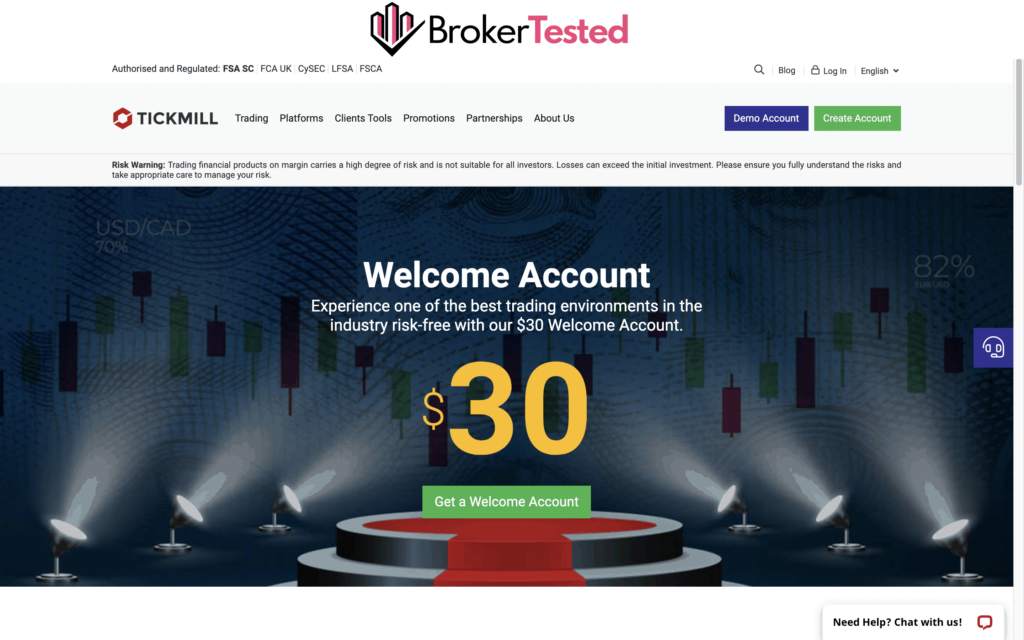

Tickmill Bonus

Tickmill offers a no-deposit bonus worth $30 to its new clients.

However, the bonus is only provided by Tickmill Ltd and does not apply to clients from certain countries.

Here are the full details of the bonus scheme:

Trading Platform

Tickmill’s trading platform is based on the popular MetaTrader 4 platform (MT4). The broker does not offer any other trading platform making it ideal for MT4 lovers.

WebTrader

Tickmill MT4

The MT4 platform is decent enough and can be customized to a high degree. However, the design is getting old, and we would have loved to see the broker offer the MetaTrader 5 platform (MT5), which is the newer version of the platform.

In our test, we placed all our trade through the MT4 app on our iPhone.

Research and Tools

Tickmill provides user-friendly research tools including

- Autochartist

- Myfxbook Copy Trading

- Economic Calendar

- Forex Calculators

- Tickmill VPS

- One-Click Trading

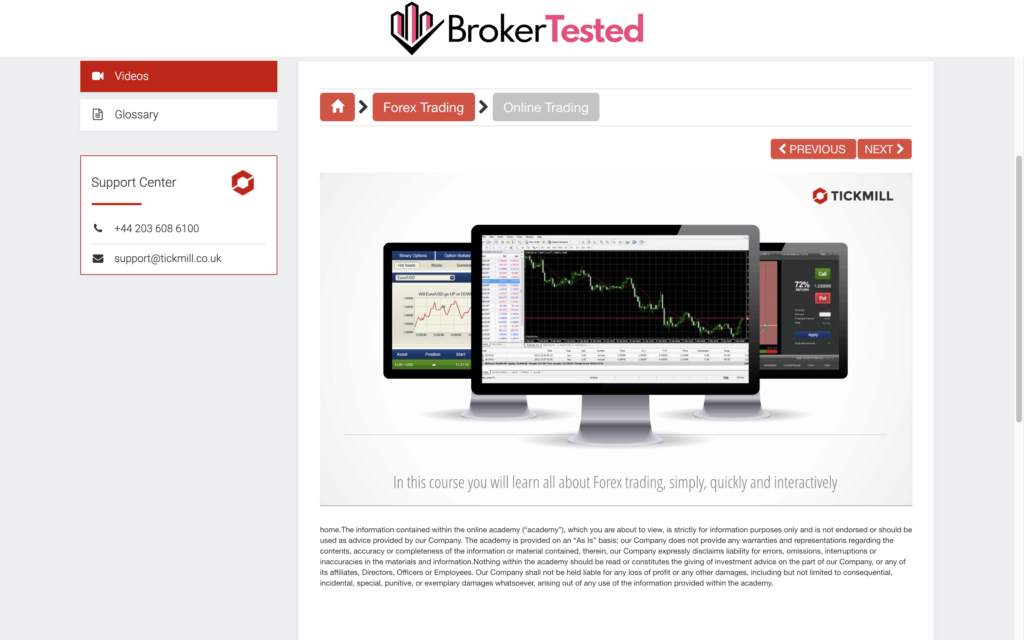

Education

Tickmill does a good job in education. They offer

- Webinars

- Seminars

- Ebooks

- Video Tutorials

- Infographics

- Forex Glossary

- Fundamental Analysis

- Technical Analysis

- Market Insights

Customer Service

Tickmill’s customer support team was helpful and provided relevant answers to our questions.

You can contact Tickmill via Email, and Phone calls. However, we could not reach anyone by phone as our calls went unanswered.

We were disappointed to find out that the broker does not have a Live Chat function, which is a crucial support channel offered by most brokers.

See the results of our test below:

We did note that the account opening and verification process was smooth and we did not encounter any issues during the process.

Tickmill Customer service channels:

Conclusion

Our overall experience was smooth. Tickmill allows traders to trade with almost any trading strategy including scalping, which is great for day trading and EA trading. Tickmill also allows traders to change their leverage levels and…

As compared to other brokers. Tickmill offers a limited number of markets and instruments, and we hope that they will add shares CFDs, cryptocurrencies, and ETFs in the future.

We recommend Tickmill for traders who run EAs, scalping and prefer the MT4 platform, as well as those interested in trading with FCA-regulated brokers.

We recommend Tickmill for traders who are

- Experienced traders

- Beginners

- Run Scalping

- Hedging

- EAs trading

- Trading through MT4

Tickmill might not be a fit if you are

- Real Stock / Futures Trading

- Commission based trading

- Prefer other platforms rather than MT4

Disclaimer: The views expressed are solely those of the author and do not represent the official position of Followme. Followme does not take responsibility for the accuracy, completeness, or reliability of the information provided and is not liable for any actions taken based on the content, unless explicitly stated in writing.

Leave Your Message Now