FP Markets Review 2022

For this FP Markets review, we have opened an account with the broker and deposited over €6,000.

We traded the popular instrument in each market to get the real spreads and placed a total of 12 trades.

We also reached out to customer support to solve the issues we faced.

Finally, we withdrew our funds to see if there are any issues with the withdrawal process.

Why FP Markets?

First Prudential Markets, popularly known by its tradename FP Markets, is an Australia-headquartered forex broker and was founded in 2005.

This broker offers a range of investment instruments with forex, stocks, indices, commodities, and cryptocurrencies. It is best known for offering forex ECN pricing.

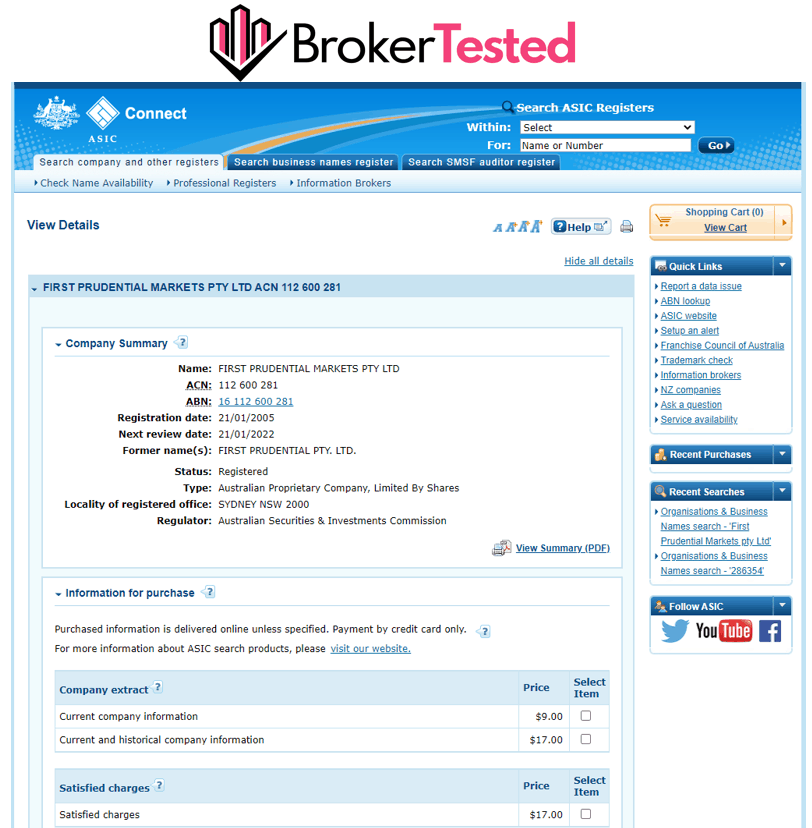

FP Markets is licensed and regulated in multiple jurisdictions, including the United Kingdom, Australia, Cyprus, and Saint Vincent and the Grenadines.

Some of the highlights of FP Markets are:

Licenses and Regulations

FP Markets holds 3 regulatory licenses. One of the licenses is from Australia’s ASIC, which is regarded as a top regulator. The other two from Cyprus Securities and Exchange Commission (CySEC) and Saint Vincent & The Grenadines Financial Services Authority (SVGFSA).

The full list of all FP Markets licenses is below:

Is FP Markets Safe?

Yes, FP Markets is safe to trade.

The broker is licensed by two reputed regulators, the UK’s FCA and Australia’s ASIC. Additionally, the UK and European clients’ funds are also protected under the compensation schemes of £85,000 and €20,000 under the FCA and CySEC, respectively.

For this FPMarkets Review, we opened a standard account with First Prudential Markets Ltd, which is regulated by CySEC in Cyprus. We deposited money, placed trades, and withdrew deposits for our tests.

We recommend you register your account under the regulation of the United Kingdom or Australian regulators if they are available in your jurisdiction.

FP Markets Fees and Commissions

Trading fees charged by FP-Markets depend on the account type.

For standard account type, all fees are built into the spreads. For the raw accounts, forex and metal trading fees are fixed, but for other commodities, they are built into the spreads.

Spreads for our trades with the standard account were lower than the industry average for forex and indices, but it was on the higher side for other asset classes.

Spread Charged in Our Trades

For our tests, we have chosen popular instruments in each market. We placed 3 trades for each instrument to get a picture of the average spread.

Our test is based on the FP Markets Standard MetaTrader account, which charges a spread across all tradable instruments. The spreads for each instrument were consistent, except for commodities.

Details of our trades are shown below the table.

Our testing finds that FP Markets standard account spreads for forex and indices are lower than the industry average. Spreads on stocks, commodities, and cryptocurrencies, however, are on the average benchmark.

Other Fees

FP Markets does not charge any prominent non-trading fees.

There is no deposit fee on FP Markets, along with zero inactivity and account maintenance fees. Though FP Markets does not charge for credit/debit cards and domestic Australian bank transfers, it charges a fee for other withdrawal methods.

There is an AU$55 monthly fee for traders using IRESS Trader/ViewPoint. This fee can be waived by generating a monthly commission of AU$200 or by holding an IRESS Premier account.

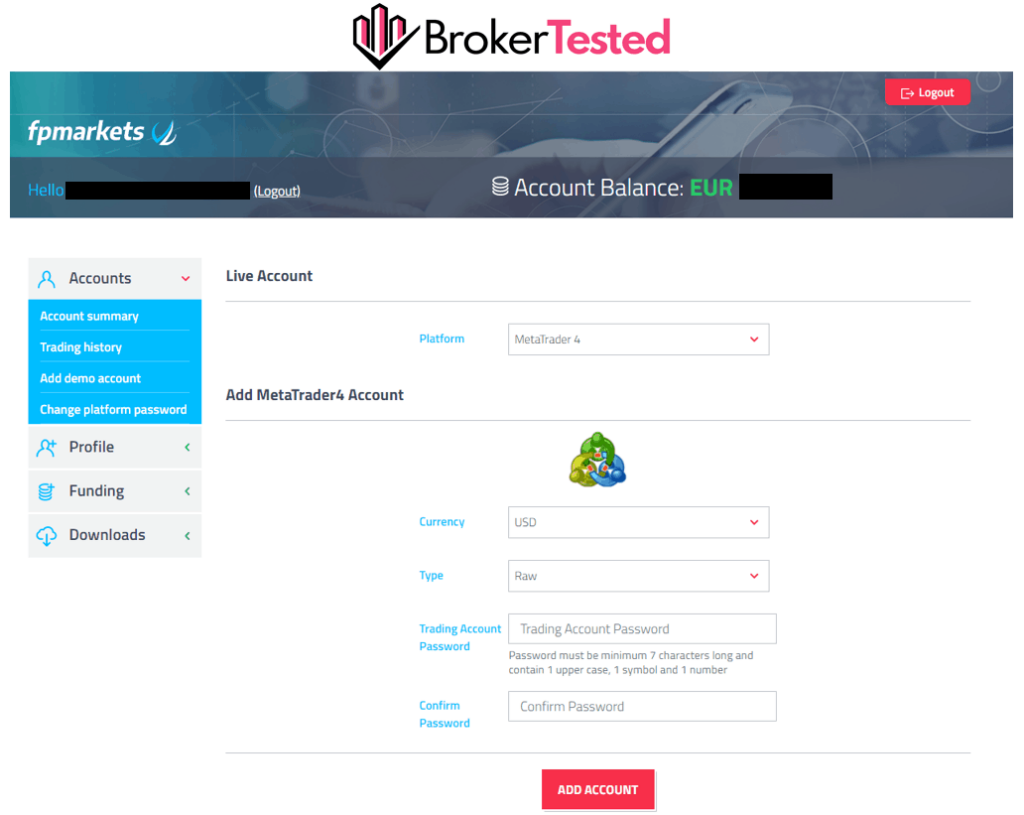

Account Types

FP Markets offers multiple accounts based on the trading platforms, MetaTrader and IRESS, available on FP Markets Demo Account. Forex trading is only based on MetaTrader accounts.

MetaTrader Accounts: Standard account, and Raw account.

IRESS Accounts: Standard account, Platinum account, and Premier account.

The minimum deposits are higher in IRESS accounts.

Details of MetaTrader accounts are below:

Details of IRESS accounts are below:

FP Markets also offers Standard and Raw Islamic forex trading accounts.

FP Markets started to offer a Pro account for ASIC-regulated traders, which will bypass the recently impose regulatory restrictions on retail trading leverages. Pro Account will offer leverage up to 1:500.

Traders have to prove their financial and trading eligibility to open an FP Markets Pro account.

Account Opening

Opening a new account with FP Markets is quick and smooth.

We opened MetaTrader4 and MetaTrader5 Standard accounts for our tests.

Registration of a new FP Markets account:

- Enter your email, first name, last name, account type (individual or corporate), country of residence, and phone number (New traders can also register using existing Google or Facebook account)

- Enter your date of birth, address, employment type, occupation, dual citizenship status, level of education, tax-paying country, tax ID number, and if politically exposed.

- You have to choose your account configuration: The trading platform and the base currency

We submitted the following documents to verify our FP Markets account:

- Copy of national identification (both front and back)

- Copy of utility bill as address proof

The registration process took around 20 minutes. Our account was verified in 1 working day.

Our account was registered on January 11, 2022, and verified on January 12, 2022.

Our overall account opening experience was smooth and without any issues from registration to verification.

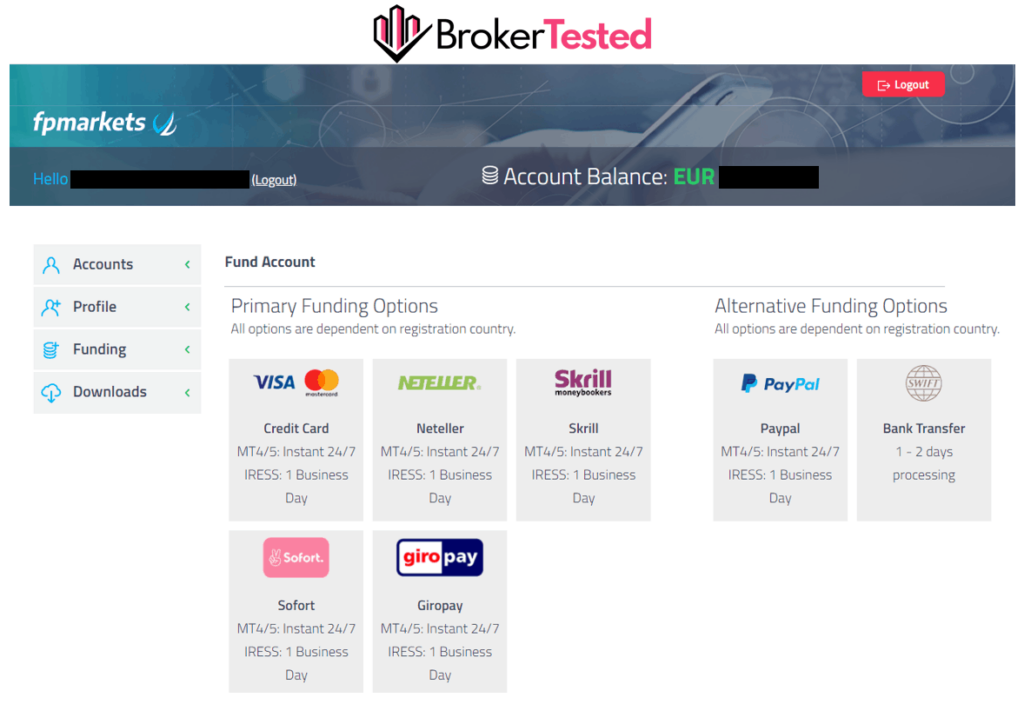

Deposit and Withdrawal

Both deposits and withdrawals on FP Markets are easy and without any fees. All our funding and withdrawal requests were completed without any issues.

FP Markets Minimum Deposit

MetaTrader accounts of FP Markets require a minimum deposit of $50 or equivalent. The minimum deposits to be maintained on IRESS accounts are higher.

Traders only need to maintain the minimum deposit balance in their accounts.

Deposit

FP Markets supports a wide range of deposit methods, including credit and debit cards, bank transfers, and online wallets like BPay, Poli, PayPal, Neteller.

FP Markets also supports Broker-to-Broker transfer, meaning traders can transfer their funds held with another broker to their FP Markets accounts.

We tested the deposit process on FP Markets using multiple payment modes.

There was no deposit fee and most of the fundings was made in 5 minuites.

Details of our fund deposits are shown in the below table.

We have transferred funds from our one FP Markets account to another, which went smoothly.

Withdrawal

FP Markets allows withdrawals via credit/debit cards, bank transfers, PayPal, Skrill, and several other methods.

The broker does not charge any fees for withdrawal into credit/debit cards, PayPal, or Australian domestic bank wire transfers. However, for the rest of the methods, it charges a fee to process each withdrawal request.

Overall, our experience with FP Markets’ withdrawal process was positive. The requests were smooth and fulfilled within the promised time.

Details of our withdrawal requests are in the table below.

FP Markets ask the traders to provide income proof before proceeding with the first withdrawal request. Traders can submit any of the four accepted documents:

- Annual Bank Statement

- Employment Agreement

- Investment Account(s) Report

- Another official duly certified document showing the origin of the money deposited

We have submitted statements from Skrill, Neteller, and the bank as proofs, and our fund was released on the same day.

Markets and Products

FP Markets offers CFDs trading services in many popular markets, including forex, indices, commodities, stocks, and cryptocurrencies.

Stock CFDs are available on both MetaTrader and IRESS accounts, but only IRESS accounts (available only under the ASIC-regulated entity) have direct market access.

The complete list of FP Markets offerings are:

Trading Conditions

FP Markets offers excellent trading conditions. It allows both hedging and scalping strategies.

Leverage

Leverages offered by FP Markets on various asset class are standard, as per the regulatory requirements, and are detailed below:

Trading Platform

FP Markets offers trading services on MetaTrader and IRESS platforms. IRESS is popular for offering stock CFDs and is only available to traders on the ASIC-regulator entity.

All trading platforms offered by FP Markets are:

- MetaTrader 4

- MetaTrader 5

- IRESS

All these trading platforms offer trading services on desktop, web, and mobile.

IRESS Platform

FP Markets offers IRESS trading platform only to the traders under its Australia-registered entity. It is a third-party trading platform developed by a publicly-listed company of the same name.

IRESS offers four trading platforms:

- IRESS ViewPoint (Web-based platform)

- IRESS Trader (Desktop-based platform)

- IRESS ViewPoint Essential (Web-based platform)

- IRESS Mobile (Mobile-based platform)

Only IRESS Traders supports direct market access (DMA) data and comes with a monthly fee of AU$55.

Copy-Trading

FP Markets is also a copy trading platform as allows traders to mirror the trading strategies of expert traders. This service, however, is not available to ASIC-regulated clients.

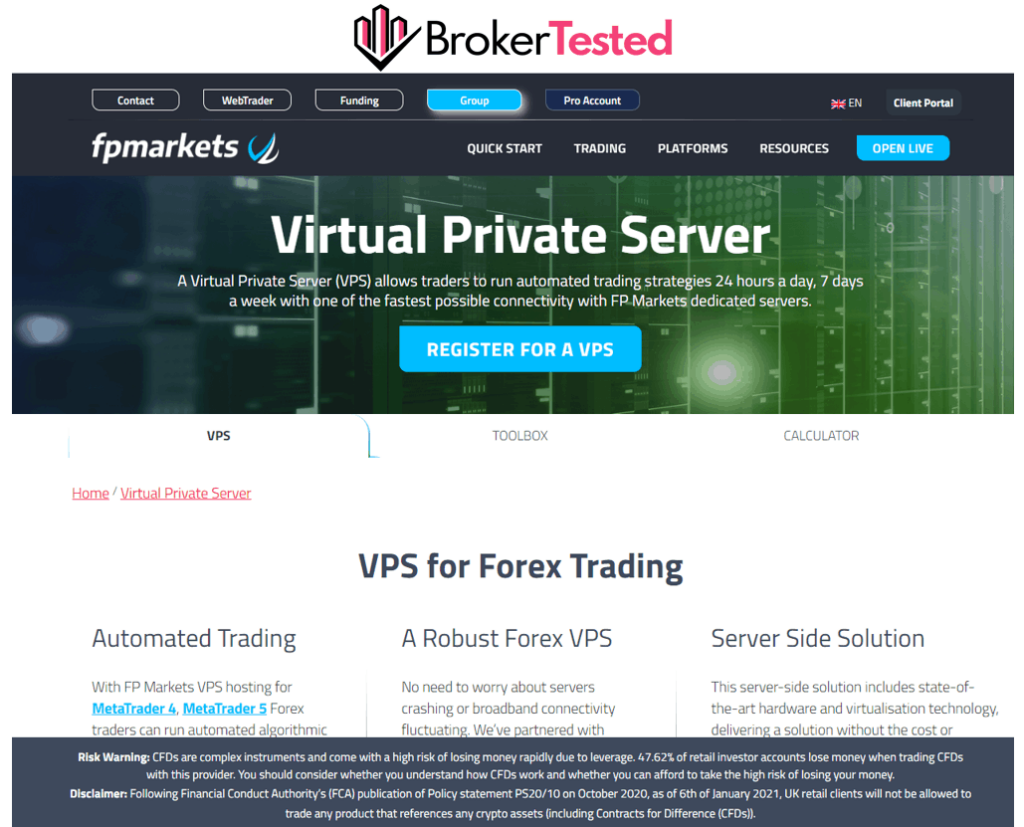

Research and Tools

FP Markets offers some good market research and analysis tools. The charting tools are decent.

Some of the tools offered by the broker are:

- VPS for forex trading

- Economic calendar

- Trading indicators and charting tools

- Forex signals through Autochrist

- Decent news feed

The broker does not offer fundamental market data.

Education

FP Markets offers some good quality educational resources to rookie traders.

The educational materials offered by the brokers are:

- Webinars

- ebooks

- Video tutorials

- Trading glossary

- Newsletter with critical market information

Customer Service

FP Markets has good customer support.

Traders can contact the broker via:

- Live chat

- Phone

Our experience with FP Markets customer support was mixed. Though the broker representatives were quick to answer, the responses were inaccurate multiple times.

The broker also has a detailed FAQ section for frequently faced issues.

Conclusion

Our overall experience with FP Markets was positive.

All the processes, from account opening to deposits and trading, went smooth. Though the withdrawal process takes two days, it is consistent.

The most impressive part with this broker is the ECN pricing and low spreads for forex and indices. The availability of many stock CFDs on IRESS is also a positive feature for traders.

However, we were disappointed with the multiple inaccurate answers by the FP Markets customer support executives.

We recommend FP Markets for traders who are

- Forex traders

- FP markets is excellent for Australia-based stock CFDs traders

- Beginners in trading

- Experienced traders

- ECN traders

- Scalping or hedging traders

- EA trader

FP Markets might not be a fit for

- Trading Futures, Real Stocks or Index

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

-THE END-