Yields on long maturity bonds are driven by future growth and inflation expectations. When bond yields of different maturities are plotted on a curve they depict term structure of interests rates.

Investors fear a behind the curve FED will tighten policy aggressively causing a recession. Fed funds futures expiring Dec 2022 is pricing in more than 200(2 percent) points rate increases by year end.

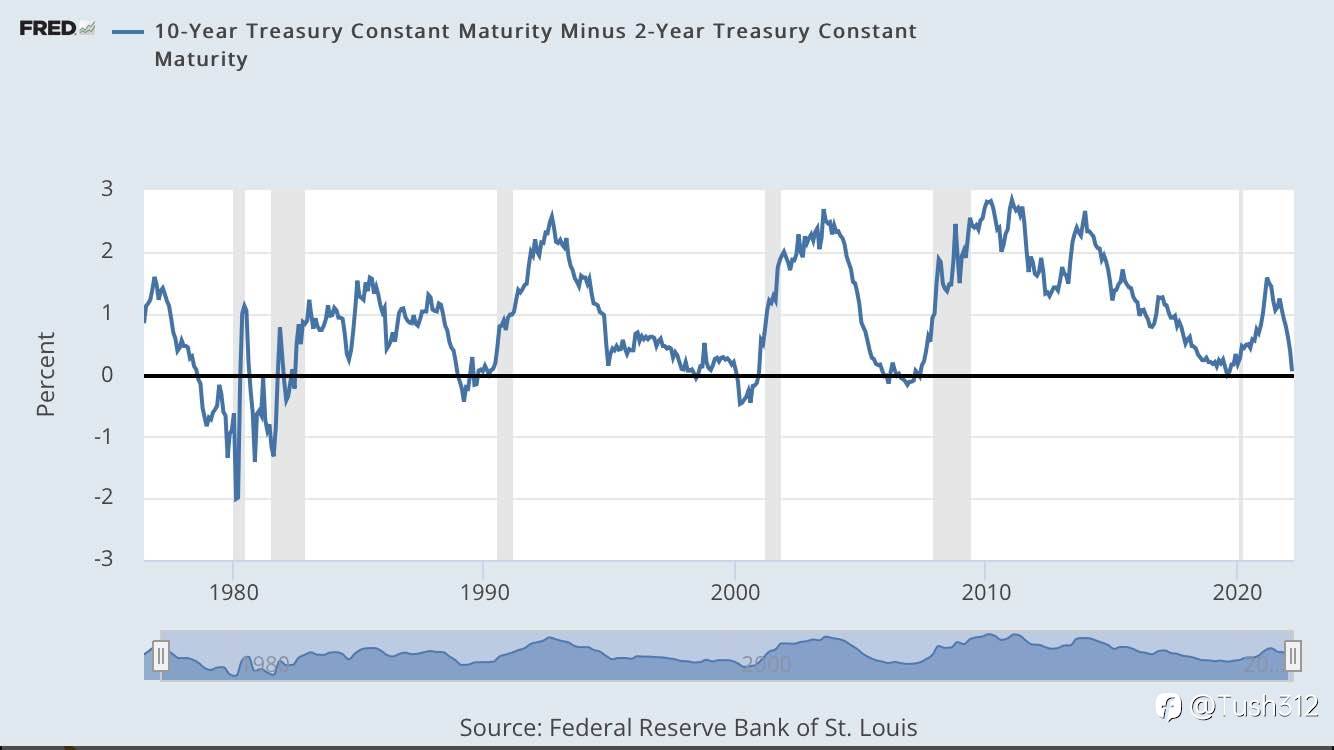

When the curve inverts it’s a signal of a recession. 2/10 year yield curve has successfully predicted the past USA recession. The recession occurs 18-24 months after the curve inverts.

The curve inverts when short maturity bond yields rise faster than long maturity bonds. In a matter of months we will have a recession and stock and commodities will peak.

Hold defensive sectors stocks like consumer staples, Healthcare and utility. Especially those with solid balance sheets and solid earnings per share growth rates.

Disclaimer: The views expressed are solely those of the author and do not represent the official position of Followme. Followme does not take responsibility for the accuracy, completeness, or reliability of the information provided and is not liable for any actions taken based on the content, unless explicitly stated in writing.

Leave Your Message Now