- An ugly start to 2022

- Volatility is the hallmark of the asset class

- Inflation is not going away anytime soon and will continue to erode fiat currency values

- Fintech and inflation - Cryptos provide an alternative

- Bitcoin and Ethereum will find bottoms - The bull market is not over

The US Federal Reserve abandoned the characterization of rising IInflation as “transitory” at the December FOMC Meeting. After President Biden nominated Chairman Powell for a second term, and in the aftermath of the latest consumer price index data, the Fed accelerated tapering quantitative easing, setting the stage for liftoff from a zero percent Fed Funds rate as early as the March 2022 FOMC meeting.

In the early days of 2022, the central bank has gone back and forth about reducing its balance sheet. Still, the December FOMC minutes reflected that moving from quantitative easing to quantitative tightening is possible over the coming months.

Inflation weighs on fiat currency values as it erodes purchasing power. The declines in the dollar, euro, pound, yen, and other fiat currencies that derive their value from the full faith and credit in the governments that issue legal tender is not readily apparent when measuring one foreign exchange instrument versus another. However, the fiats have lost value when measured against stocks, commodities, real estate, and cryptocurrencies in 2021.

Cryptocurrencies are an alternative to other means of exchange that reflect a libertarian economic ideology. While central banks, treasuries, monetary authorities, and governments can expand and tighten monetary policy to impact the money supply, cryptocurrencies are different. Crypto values depend on supply and demand established by market participants without government interference. Therefore, inflationary pressures likely caused the over 180% rise in the asset class’s market cap in 2021.

Bull markets rarely move in a straight line, and corrections can be swift and brutal. In a volatile asset class like cryptos, the price action has been nothing short of head-spinning, and the cryptocurrency asset class has started 2022 on a bearish note.

An ugly start to 2022

The leading cryptocurrencies and the asset class’s market cap began falling on Nov. 10 and continued to move lower so far in 2022.

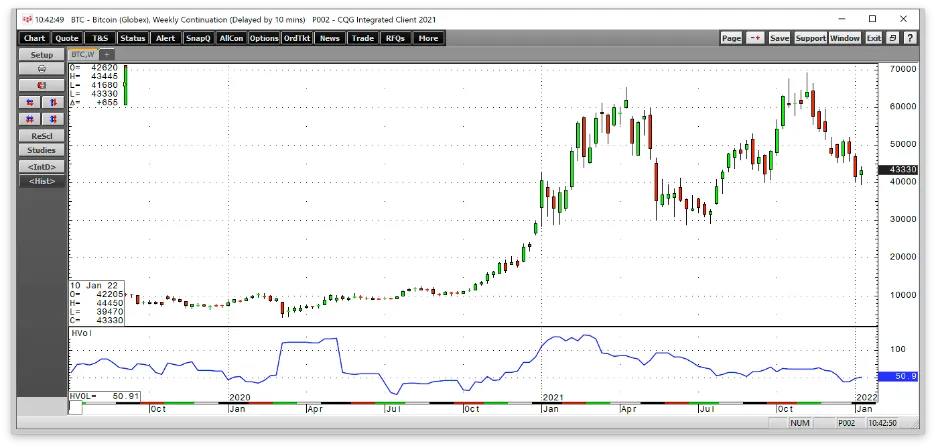

As the chart illustrates, January Bitcoin futures put in a bearish key reversal trading pattern on Nov. 10 when the price reached a high of $69,820 and closed below the previous day’s low. On Dec. 31, 2021, the futures closed at $46,275, and at the end of last week, the leading cryptocurrency was at the $43,330 level, 37.9% below the Nov. 10 high.

January Ethereum futures reached a high of $4,972.75 on Nov. 10, put in the same bearish pattern, and closed 2021 at the $3,685 level. At $3,340 on Jan. 14, Ethereum was 32.8% below its mid-November record peak.

Meanwhile, the cryptocurrency asset class’s market cap was $2.166 trillion on Dec. 31 and stood at $2.091 trillion on Jan. 17, a 3.5% decline so far in 2022. Bitcoin and Ethereum are 6.4% and 9.4% lower, respectively, in 2022. The leading cryptos have underperformed the asset class so far this year as other tokens have done better than the two dominant cryptocurrencies.

Volatility is the hallmark of the asset class

Market participants are accustomed to wild price swings in the cryptocurrency asset class, with token prices routinely doubling, tripling, and more than halving in value.

The weekly Bitcoin futures chart shows that weekly historical volatility traded between 42.57% and 128.50% in 2021. At the 50.9% level on Jan. 14, the price variance metric was closer to the low than the high since the beginning of 2021.

Ethereum futures began trading in February 2021. Weekly historical volatility traded from a low of 38.92% to a high of 149.95% from February through December 2021. At the 49.7% level on Jan. 14, weekly Ethereum volatility was also near the low.

The decline in price variance shows that the leading cryptos are consolidating after the moves from the Nov. 10 high. While both made lower lows in early 2022, the price action has calmed, with Bitcoin and Ethereum prices recovering from the recent bottoms.

Edited 18 Jan 2022, 03:21

Disclaimer: The views expressed are solely those of the author and do not represent the official position of Followme. Followme does not take responsibility for the accuracy, completeness, or reliability of the information provided and is not liable for any actions taken based on the content, unless explicitly stated in writing.

Leave Your Message Now